Vietnam's Financial Future: Tokenized ETFs and Blockchain

1. Dragon Capital Proposes Pilot Tokenization Of ETFs, Allowing Purchases Using Bitcoin

On July 17th, Dragon Capital announced its plan to pilot the tokenization of Exchange-Traded Funds (ETFs). The proposal was researched by the fund management company and was advised and validated by the Vietnam Blockchain Association (VBA) for expertise and information accuracy.

- Market Context: The number of digital asset accounts in Vietnam is forecasted to surpass stock accounts, reflecting a strong shift of investors towards digital products. Vietnam has also consistently ranked among the top countries in terms of digital asset adoption, with total blockchain transactions exceeding 100 billion USD in the past year.

- Project Objective: To create a financial product that combines real-world assets (RWA) with digital technology, provided by financial companies under the supervision of regulatory authorities. The aim is to attract individual investors to the mainstream capital market, offering both innovation and safety.

Investors are monitoring the movements of a traditional ETF listed on HoSE. Photo: Tat Dat

Investors are monitoring the movements of a traditional ETF listed on HoSE. Photo: Tat Dat

2. The Operation Process Of Tokenized ETFs

Asset tokenization is the process of converting the ownership or value of a physical or digital asset into tokens. These tokens represent part or the entire value of the asset and can be traded on blockchain platforms. Tokenization helps increase liquidity, reduce transaction costs, and open up investment opportunities for more people.

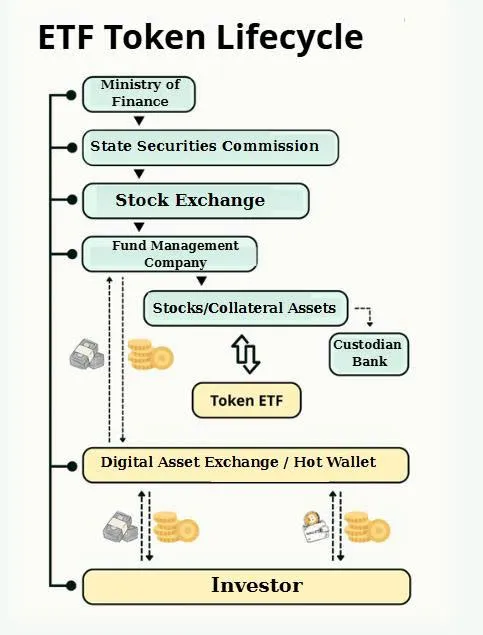

According to Dragon Capital’s proposal, the tokenization process begins with a collaboration between asset management companies and index providers, such as the Ho Chi Minh Stock Exchange (HoSE). This will result in the formation of two separate ETFs: traditional ETFs and tokenized ETFs.

To begin tokenizing ETFs, an equivalent amount of reserved shares will be stored in a custodian bank and collateralized on a 1:1 ratio with tokens. The asset management company will collaborate with technology providers and tokenization platforms to develop smart contracts and select a platform for issuance… Dragon Capital proposes using the ERC-1400 blockchain for its flexibility in recovery mechanisms and identity verification (KYC) features, as well as anti-money laundering (AML) compliance.

After creating the ETF tokens, the distribution process will require cooperation with primary digital asset market makers or authorized partners. Initially, the focus will be on centralized exchanges (CEX) operating in Vietnam and non-custodial wallets, ensuring compliance with common KYC requirements on these platforms, where over 70% of digital asset capital in Vietnam is concentrated. This approach ensures government oversight and regulatory compliance.

Subsequently, digital asset exchanges in Vietnam and non-custodial wallets will handle the distribution of tokens to investors via secondary market transactions. Payment methods may include bank transfers, e-wallets, payment cards, international payment services, or mobile digital wallets. After purchasing the tokens, investors can freely choose their preferred custody and payment methods to efficiently manage their assets within the framework of tokenized ETFs.

Brief Lifecycle of a Tokenized ETF

Brief Lifecycle of a Tokenized ETF

3. Trading And Exchanging Tokenized ETFs With Other Digital Assets, Such As Bitcoin

Dragon Capital believes that allowing the conversion of other digital assets into tokenized ETFs will attract significant capital inflows into the Vietnamese financial market. Currently, when users buy digital assets with Vietnamese Dong (VND), it typically means buying foreign assets. By allowing investors to exchange foreign digital assets for tokenized ETFs, capital can be directed back into the domestic market. "This mechanism not only helps retain capital within Vietnam but also strengthens the local financial ecosystem," the fund management company said.

Through tokenization, Dragon Capital hopes to increase individual investor participation in the financial market, protect investor rights, and strengthen the financial system with robust legal frameworks. Regulatory authorities will be able to maintain the integrity of token issuance, oversee secondary market transactions, regulate service providers, and protect individual investors' rights.

Furthermore, regulatory oversight will enable the application of appropriate taxes on digital assets and manage capital flows, thereby promoting a stable financial market and broadening market participation among various demographics. "Achieving this is key to developing a mature capital market, helping Vietnam become an international financial hub," Dragon Capital stated.