VN-Index Surpasses 1,500 Points, Market Rises Strong

1. Stock Market Performance on July 18

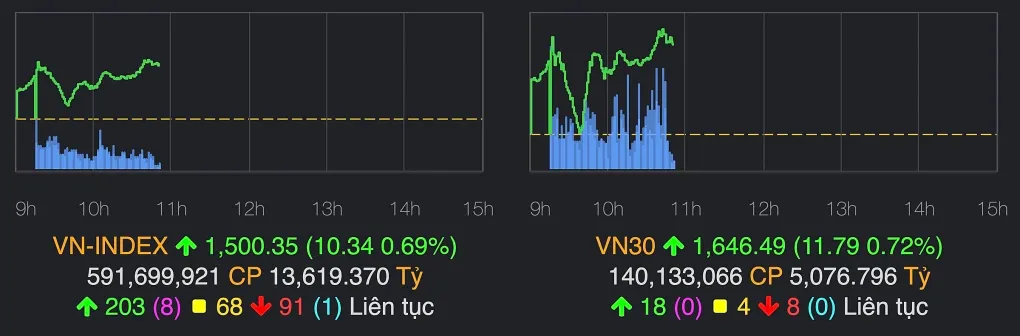

In the middle of the morning session, the VN-Index surged, reaching the 1,500-point mark thanks to the strong performance of real estate stocks. However, the index quickly faced profit-taking pressure, causing it to dip back below the reference point. Around 9:40 AM, the VN-Index dropped by just 2 points before gradually recovering and surpassing the 1,500-point level again after an hour.

A key highlight of the morning session was the contribution of major real estate stocks such as VHM, NVL, and CEO, which led the price rally. Additionally, smaller real estate stocks like HQC and QCG also saw significant gains, hitting their price ceiling.

VN-Index and VN30-Index on the morning of July 18. Photo: VNDirect

VN-Index and VN30-Index on the morning of July 18. Photo: VNDirect

2. Growth Driven By Real Estate And Securities Stocks

Securities stocks also contributed to the market’s positive momentum, with the group seeing a notable rise during the morning. Particularly, VIX hit its price ceiling, drawing attention from investors. Other stocks like VCI, HCM, EVF, and VDS also recorded increases of around 3-4% compared to the reference price, bolstering the overall market optimism.

3. Profit-Taking Pressure Towards The End Of The Morning Session

Despite the strong growth earlier in the morning, the VN-Index fell by nearly 3 points, reaching around 1,487 points just before the lunch break. On the HOSE exchange, 171 stocks were in the red, while 142 stocks remained in the green. Notably, VIC (Vingroup) and banking stocks such as CTG, BID, and VCB came under significant selling pressure, which slowed down the index's upward momentum.

4. Liquidity And Foreign Investor Activity

Liquidity on the HOSE remained quite strong, reaching over 18,200 billion VND. However, foreign investors continued to be net sellers, with a net sell-off of approximately 267 billion VND, primarily focused on stocks like FPT, STB, DXG, and GEX. On the other hand, there were positive signs as foreign investors continued to accumulate shares in certain stocks, notably MSN.

5. Stock Market Outlook: Growth and Optimism

Although the market faced some pressure during the morning session, analysts remain optimistic about the long-term trend of the VN-Index in the coming sessions. AIS Securities forecasts that the market will maintain its growth trend, driven by real estate stocks. VPBank Securities also recommends that investors hold onto stocks that show consistent growth and avoid stocks that have overheated, while looking for buying opportunities during pullbacks to the support levels.

6. Conclusion: Don't Miss Out On Real Estate Stock Investment Opportunities

With positive signals from real estate and securities stocks, along with an optimistic long-term market outlook, investors should keep an eye on leading stocks like VHM, NVL, VIC, and VIX. However, it's essential to be mindful of market corrections and select the right timing to increase positions.