2027: CCP to Support Vietnam’s Stock Market

1. Central Counterparty Clearing Mechanism For Securities Expected To Launch in 2027

The Central Counterparty (CCP) model for securities transactions is expected to be implemented starting in 2027, aiming to enhance market liquidity and stability.

The State Securities Commission (SSC) recently announced a plan to roll out a central counterparty clearing mechanism. This is considered one of the missing elements that has prevented Vietnam’s stock market from being upgraded in international rankings.

According to the plan, in Q3 of this year, the Ministry of Finance will issue accounting guidelines for transactions arising from the new mechanism. At the same time, the SSC will approve the establishment of Vietnam Securities Clearing Company Limited (a subsidiary of the Vietnam Securities Depository and Clearing Corporation – VSD), which will take on the role of CCP.

In Q1 2026, the SSC is set to issue new regulations regarding registration, custody, and settlement of securities transactions. During this period, VSD will conduct training programs, system testing with market participants, and infrastructure readiness checks. This preparation phase may last throughout 2026.

By early 2027, the SSC plans to officially implement the CCP mechanism for the equity market.

Investors are monitoring stock market prices. Photo: An Khuong

2. What Is The CCP Mechanism And Why Does It Matter?

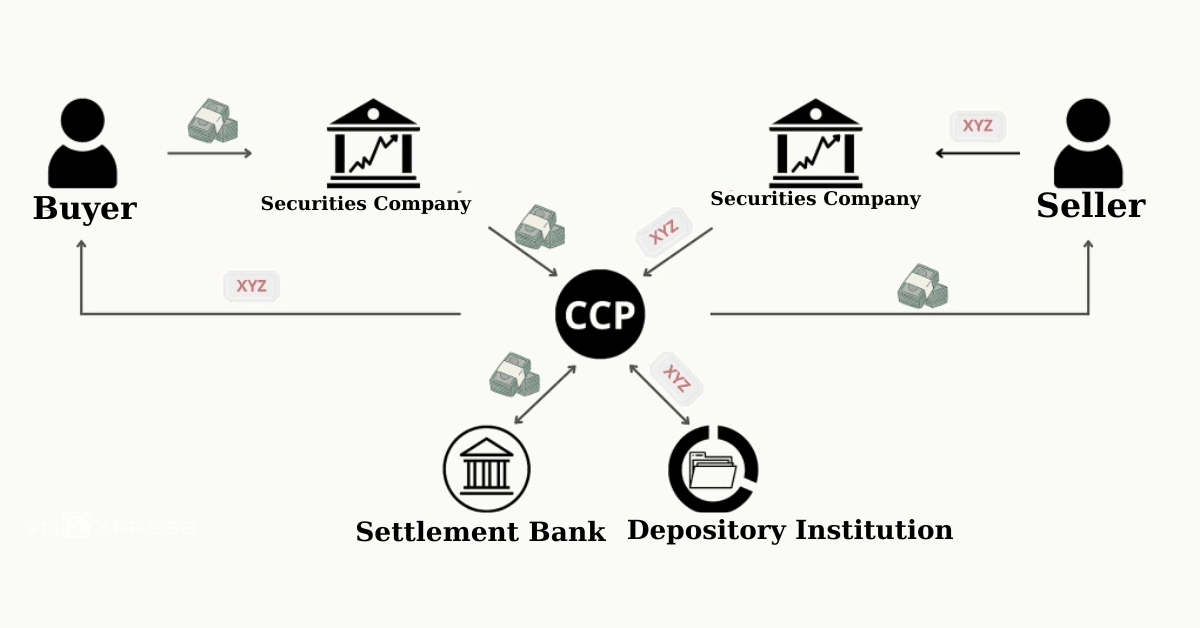

Under the CCP model, a central clearing company (in the future, the Vietnam Securities Clearing Company Limited) acts as an intermediary between the buyer and seller in a securities transaction. This means that each party only has obligations toward the CCP, rather than directly with their counterpart.

Once a trade is matched, the CCP becomes the buyer to all sellers and the seller to all buyers. It ensures delivery of securities to the buyer and payment to the seller. The mechanism also performs netting of obligations, which reduces the actual number of transactions and related costs.

One of the key advantages of CCP is risk mitigation. In cases where one party defaults, the CCP ensures the transaction is completed through guarantee funds and other safety mechanisms, thereby supporting market stability and investor confidence.

Diagram illustrating the CCP mechanism in securities trading.

Diagram illustrating the CCP mechanism in securities trading.

3. CCP And Market Upgrading Efforts

According to Circular 68 from the Ministry of Finance, foreign investors are currently allowed to place buy orders without having to pre-fund their accounts (i.e., non pre-funding). However, to effectively implement and safeguard such transactions, the CCP mechanism is considered essential. Experts see CCP as a vital component for enabling non pre-funding trading, attracting foreign capital, and meeting market upgrade criteria.

As reported by the World Bank, about 80% of global securities payment systems already use the CCP model. In Vietnam, this mechanism has been applied to the derivatives market since 2017.