US Crypto Law: "Serious Changes" Demanded

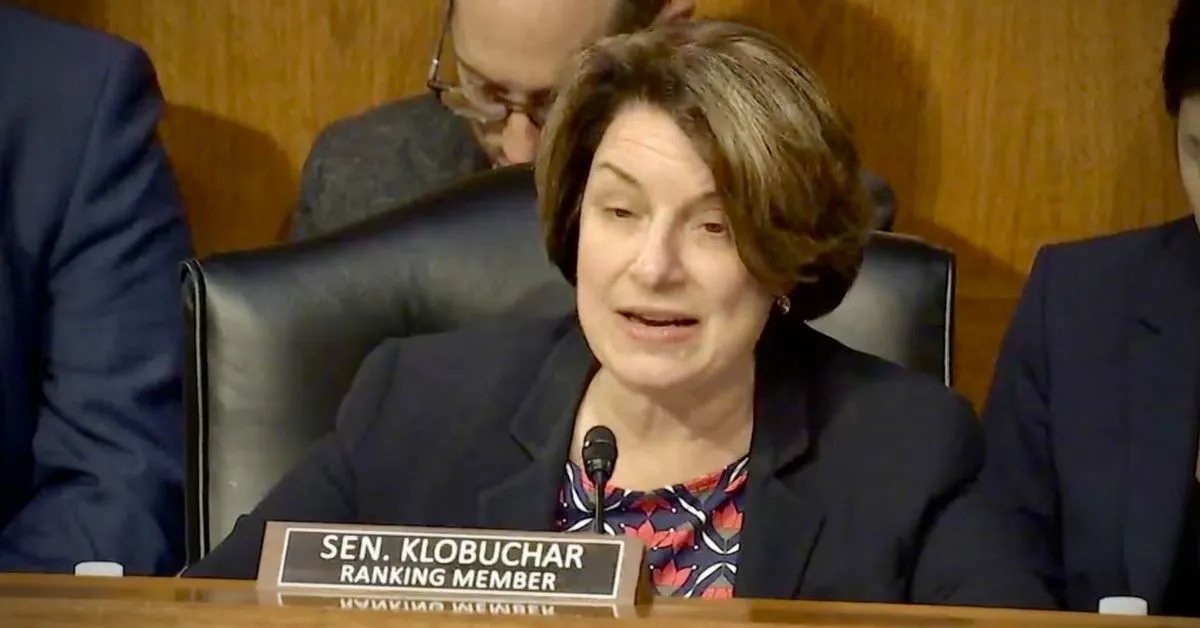

The global crypto market is closely watching legislative developments in the United States, where Senator Debbie Stabenow, the top Democrat on the Senate Agriculture Committee, has sent a clear message: any bill on cryptocurrency market structure will need "serious changes" to pass. This declaration signals a challenging road ahead for regulatory efforts and highlights differing views on how to manage the rapidly growing crypto industry.

As the House of Representatives pushes its own bills forward, Senator Stabenow's firm stance indicates that the Senate will be a key battleground where demands for consumer protection and market fairness will take precedence. This could significantly reshape the legal future for digital assets in the world's largest economy.

1. Top Priority: Protecting Crypto Consumers

At the heart of Senator Stabenow's demands is the need to establish robust consumer protection measures. During a recent Agriculture Committee hearing, she emphasized that any legal framework must have strong "guardrails" to shield retail investors from the fraud, manipulation, and intense volatility inherent in the crypto market. She expressed deep concern over the risks ordinary people face when participating in such an uncertain space.

This position is not new. It is reinforced by her past legislative efforts, particularly the "Digital Commodities Consumer Protection Act" (DCCPA). This proposed bill demonstrated her long-standing commitment to granting the Commodity Futures Trading Commission (CFTC) more authority to oversee the spot crypto market. Therefore, her demand for "serious changes" is not just an immediate reaction but a steadfast adherence to a core principle: the safety of investors must come first.

2. The Need for Fairness: A Level Playing Field for Crypto

One of the major changes Senator Stabenow is calling for is to ensure fairness by requiring crypto companies to adhere to the same standards as traditional financial institutions. She argues that there cannot be a separate playing field with looser rules for the digital asset industry. This includes strict requirements for capital, risk management, and operational transparency to prevent the kind of sudden collapses seen in the past.

Furthermore, eliminating conflicts of interest is a critical part of her vision for a fairer crypto market. Senator Stabenow and many other Democrats are concerned about business models where a single platform can operate simultaneously as a broker, a dealer, and an exchange. This "all-in-one" model can create severe conflicts of interest that disadvantage customers. Mandating the separation of these functions is seen as a necessary step for the market to mature and become more trustworthy.

3. Legal Challenges and the Future of Crypto Law

The road ahead for crypto legislation in the U.S. remains fraught with challenges, especially the ongoing debate over jurisdiction. The rivalry between the Agriculture Committee (which oversees the CFTC) and the Banking Committee (which oversees the SEC) over who will be the primary regulator remains a major obstacle. Senator Stabenow supports a significant role for the CFTC, particularly for assets deemed commodities, but also stresses the need for close coordination between the two agencies to avoid regulatory gaps.

Overall, while the House may be moving quickly on a crypto bill, the demand for "serious changes" from a powerful lawmaker like Senator Stabenow shows that the process in the Senate will be slower and more deliberate. Any final bill that hopes to gain bipartisan support will almost certainly need to incorporate stronger consumer protections and stricter operational rules, shaping a more clearly regulated future for the entire digital asset industry.