Trump-EU Trade Deal Boosts Bitcoin

1. Trump-EU Trade Deal Could Spark Rally For Bitcoin And Risk Assets

Fundstrat says the new trade agreement between the U.S. and the EU may eliminate major macroeconomic fears — potentially creating bullish momentum for Bitcoin and other risk-on assets.

2. The Largest U.S.-EU Trade Deal In History

Former U.S. President Donald Trump has announced a comprehensive $1.35 trillion trade deal with the European Union, signaling a dramatic shift in global trade dynamics.

Key highlights of the deal include:

- The EU will purchase $750 billion worth of U.S. energy.

- It will invest $600 billion into the U.S. economy.

- Hundreds of billions will be spent on U.S.-made military equipment.

- A flat 15% tariff will now apply to all goods traded between the U.S. and EU — replacing previous complex tariff structures.

Trump emphasized the magnitude of the agreement:

“This is the biggest trade deal I’ve ever made. And we’re just getting started,” He stated.

3. Positive Signals For Bitcoin And Equities

Thomas Lee, Head of Research at Fundstrat Global Advisors, remarked:

“This eliminates a major tail risk — it’s bullish for equities.”

While Bitcoin has traditionally benefited from macro uncertainty as a hedge or safe haven, today’s hybrid market structure means that it is increasingly viewed as a risk-on asset by institutions. As a result, improving risk sentiment could support Bitcoin in the short term.

4. Additional Macro Factors Supporting Bitcoin

- Reduced geopolitical tension and lower trade friction typically boost appetite for risk assets like Bitcoin.

- As institutional adoption of Bitcoin grows, macro tailwinds can drive more capital into crypto.

- Global tariff realignment — including steep upcoming tariffs on Canada (35%), Mexico (30%), and Brazil (50%) — along with a 90-day extension on U.S.-China tariffs, may lead to major shifts in capital flows in the months ahead.

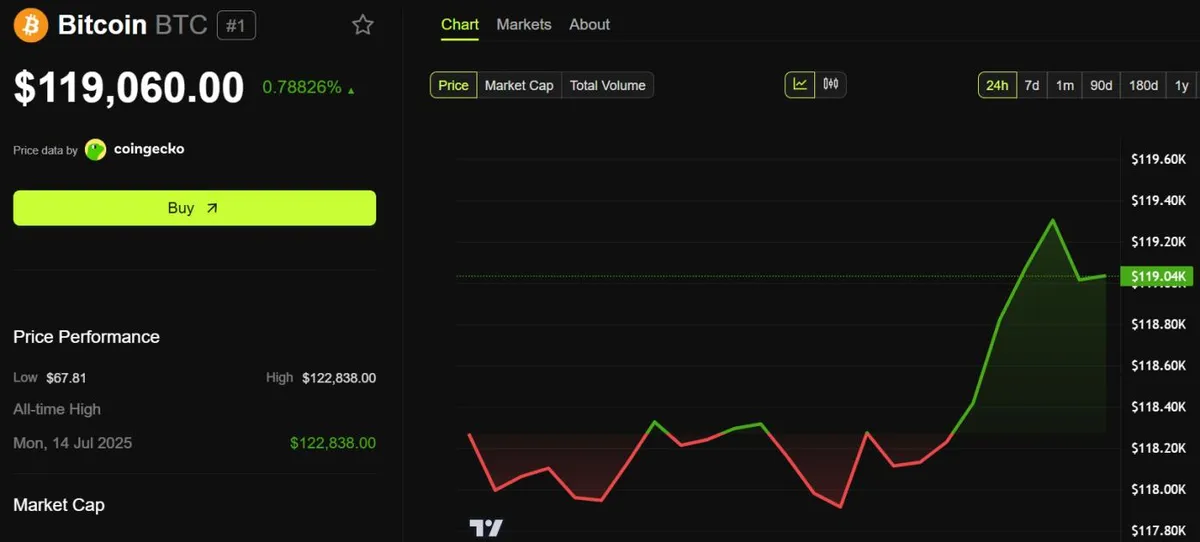

5. How Is Bitcoin Reacting?

At the time of writing, Bitcoin is trading at $119,060, showing a slight 0.78% increase over the last 24 hours. This suggests investors may be responding positively to the improved macro outlook.

Bitcoin (BTC) Price Performance. Source: BeInCrypto

6. Conclusion: A Rare Window Of Clarity For Crypto Investors?

The Trump-EU trade agreement has potentially cleared a major macro hurdle, opening the door for renewed optimism in global markets — and crypto could benefit directly.

Is this the beginning of a broader rally for Bitcoin?

Investors should stay alert — this might be a rare moment of clarity in an otherwise uncertain macro landscape.