SPK Surges 90% – Will It Break the All-Time High?

Spark Token (SPK) soared by more than 90% in just 24 hours, reaching a new all-time high (ATH) of $0.121 on July 23. While the Ignition airdrop continues to generate excitement, technical indicators suggest that SPK needs one more strong push to sustain its bullish momentum.

SPK just set a new ATH – but can it break higher? Dive into key technical signals and price levels to watch next.

1. Exchange Inflows: Warning Sign Of Potential Profit-Taking?

After a massive price rally, the first question is: Are investors sending tokens to exchanges to sell?

Hourly net flow data shows that SPK inflows still exceed outflows, which means more tokens are entering exchanges than leaving – a possible early sign of sell pressure building up.

If inflows keep rising while price stalls, a pullback may be imminent, even during an uptrend.

Spark Price and Positive Net Flow: Coinglass

2. Hourly RSI: Critical For Confirming A Sustainable Breakout

The Relative Strength Index (RSI) on the hourly chart is hovering near 80, but has not formed a new high – a sign of weakening momentum.

- Previously, when RSI formed higher highs alongside price, it triggered a major breakout.

- Now, RSI is flattening while price holds, hinting at divergence and potential short-term reversal.

If RSI fails to break higher with the price, a downward correction is more likely.

Spark Price and RSI: TradingView

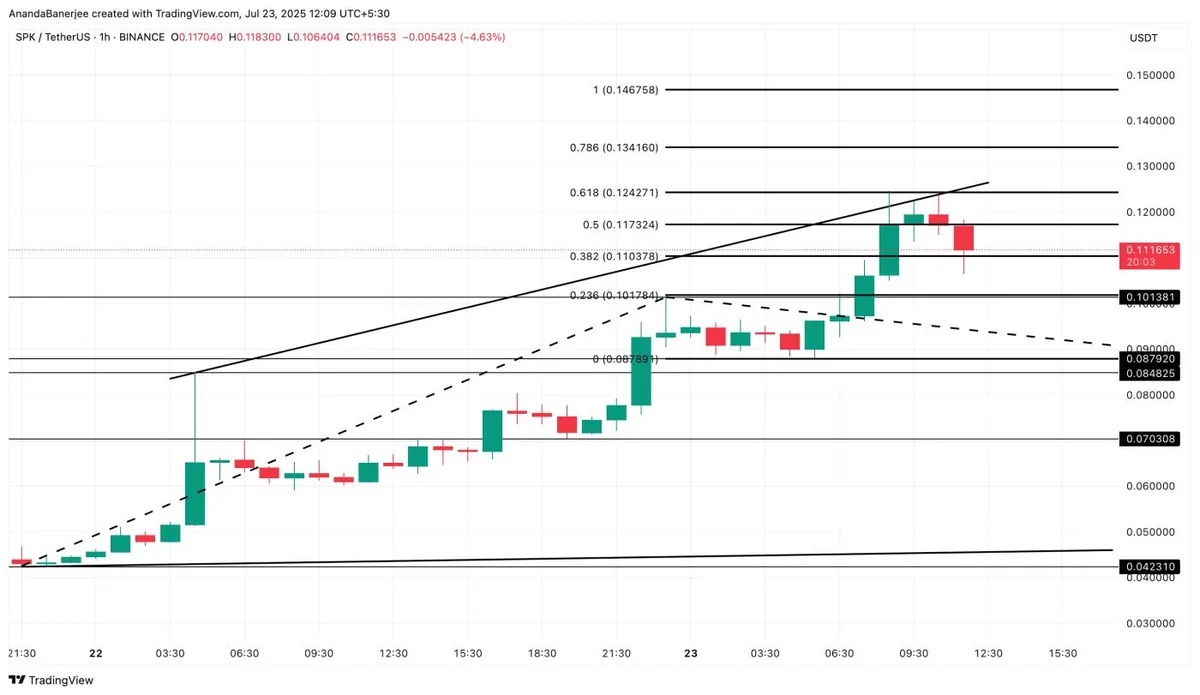

3. $0.124 Resistance: The Key Level To Unlock Further Gains

- The $0.124 level is a critical resistance – it aligns closely with the 0.618 Fibonacci extension, and has already rejected SPK twice.

- A clear hourly close above $0.124, combined with a rising RSI and cooling exchange inflows, would signal a breakout and open the door to a new ATH.

Spark Price Analysis: TradingView

4. Key Support Levels If A Pullback Occurs

If SPK fails to hold its current support zone, here are the key levels to watch:

- $0.110: Immediate support; bulls need to defend this level.

- $0.101: Previous swing high; may act as secondary support.

- $0.087: 0 Fib level – breaching this may trigger a drop to $0.070, weakening the broader uptrend.

5. Conclusion: SPK At A Crossroads

- A breakout above $0.124 could confirm bullish continuation and lead to a new ATH.

- But if RSI stalls and exchange inflows increase, the risk of a short-term correction grows.