The Trump Effect: What Future Awaits the Crypto Market?

The global digital asset market is facing one of its most significant legal turning points ever, with the focus on political developments in the United States. Recently, a series of events created what is known as "Crypto Week," marking a profound shift in how US lawmakers perceive this industry and opening up a future full of potential.

1. The Turning Point from the Historic "Crypto Week"

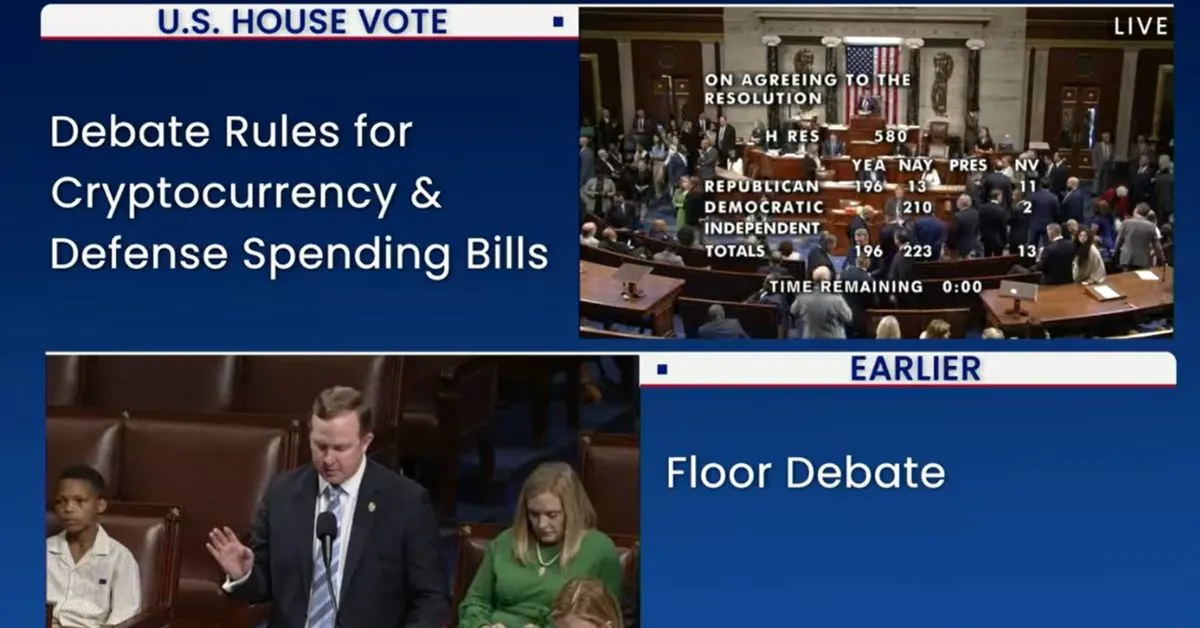

"Crypto Week" is a term used by the industry community to describe the period when the US House of Representatives passed two important bills, creating a clearer framework for the market. The most striking development was not the introduction of the bills, but the unprecedentedly strong support from both parties. This bipartisan consensus broke a years-long stalemate, signaling that the "Wild West" era of the crypto market may soon be over.

The two core documents passed include the Financial Innovation and Technology for the 21st Century Act (FIT21) and a resolution to repeal the SEC's Staff Accounting Bulletin 121 (SAB 121). FIT21 is considered the first comprehensive rulebook, clearly delineating regulatory roles between the SEC (for crypto assets as securities) and the CFTC (for crypto assets as commodities). Meanwhile, the removal of SAB 121 will eliminate a major barrier, allowing large banks and financial institutions to participate in custodying digital assets more safely and efficiently.

2. The Political Shift and the Wave of Support

The success of the above bills would not have been possible without dozens of Democratic lawmakers "breaking ranks." Specifically, as many as 71 Democratic members voted in favor of FIT21, going against the cautious stance of their party leadership and the White House at the time. This move demonstrates a profound shift in perception, reflecting the growing influence of voters interested in crypto and concerns that the US could fall behind in the technology innovation race.

This wave of support was driven by several factors. First, lawmakers realized that the lack of a clear legal framework was stifling development and pushing crypto companies overseas. Second, the SEC's "regulation by enforcement" approach had caused significant controversy and was widely seen as ineffective. This change indicates that Congress wants to reclaim its power to shape policy for one of today's fastest-growing technology sectors.

3. The Trump Effect and the Future of the Crypto Industry

Facing this change, former President (and current President) Donald Trump quickly seized the opportunity, positioning himself as a strong supporter of the crypto industry. He publicly criticized the skeptical stance of the previous administration and declared he would create a more friendly environment for digital assets. These statements are not just empty words, but a shrewd political strategy aimed at attracting a new, dynamic, and influential voter bloc.

With support from the White House, the legal landscape for the crypto industry in the US is predicted to change completely. The FIT21 bill, which was waiting in the Senate, now has a clearer path than ever to become law. Regulatory agencies will also likely receive directives to adopt a more open and cooperative approach. For investors, this signals a new era with clearer rules, the participation of large institutions, and the potential for more sustainable growth for the entire market.