Huatai: Fed Will Still Cut Rates, A Bullish Sign for Crypto

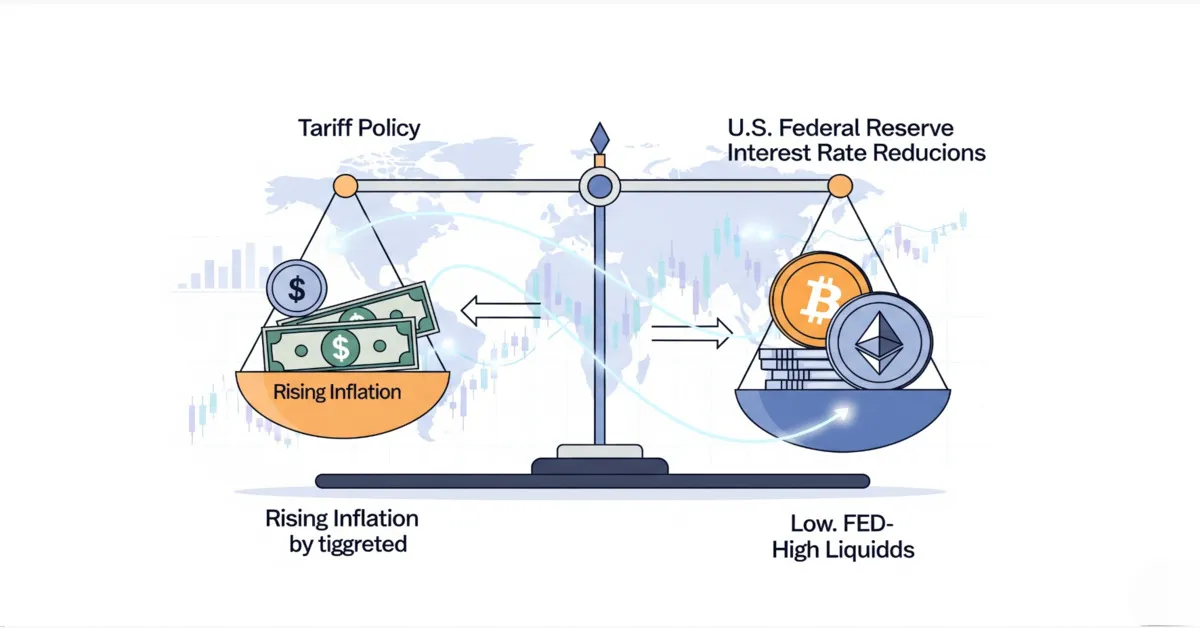

The impact of tariff policy on inflation and the policy path of the U.S. Federal Reserve (Fed) is the most contentious topic in the financial markets. In a new research report, Huatai Securities has provided a detailed perspective and maintained its optimistic view on monetary easing this year.

1. Tariff-Driven Inflation is Real, But...

The Huatai Securities report acknowledges that the implementation of tariff policy will have an upward effect on inflation in the short term. June data has already shown a rebound in inflation for goods with a high import dependency. This refutes the argument that foreign exporters would simply absorb the costs by lowering their prices.

A survey by the New York Federal Reserve also reinforces this view, indicating that up to 88% of manufacturing firms and 82% of service firms would choose to pass on tariff costs to consumers within three months. Huatai predicts that this impact will become even more apparent in the near future as businesses use up their existing low-cost inventory.

2. Why Will the Fed Still Cut Rates?

Despite facing the risk of rising short-term inflation, Huatai maintains its forecast for two Fed rate cuts in September and December. Their argument is based on two key factors:

a) The Labor Market Will Slow Down: The most important factor is the forecast of a future slowdown in the labor market. For the Fed, a weakening labor market is a much stronger signal to cut rates than a temporary, policy-induced inflation spike.

b) The Fed Has Already Anticipated This: At the June FOMC press conference, Chair Powell stated that the Fed would need to observe the impact of tariffs over the summer. This implies that the rebound in inflation from tariffs may already be within the Fed's expectations and will not surprise them into abruptly changing their policy path.

3. Positive Impact on the Crypto Market

For crypto investors, the idea that the Fed might "ignore" short-term inflation to focus on longer-term economic growth is an extremely important signal. It shows that the path to an easing cycle remains open.

A low-interest-rate, high-liquidity environment is the primary fuel for bull cycles in risk assets, including crypto. A more dovish stance from the Fed also typically leads to a weaker U.S. dollar, increasing the appeal of alternative and scarce assets like Bitcoin. Therefore, the analysis from Huatai Securities, while focused on macroeconomics, reinforces a positive outlook for the future of the entire digital asset market.