TeraWulf, Google In $3.7B AI Infra Deal

TeraWulf’s Strategic Shift To AI

Bitcoin mining company TeraWulf has announced a landmark AI infrastructure agreement backed by Google, signaling one of the largest transitions from cryptocurrency mining to artificial intelligence services.

The deal involves 10-year colocation agreements with AI platform Fluidstack worth $3.7 billion, with an option to extend leases pushing the value to $8.7 billion. As part of the agreement, Google will guarantee $1.8 billion of Fluidstack’s obligations and will receive warrants for approximately 41 million TeraWulf shares, representing an 8% equity stake.

Stock Rally And Market Impact

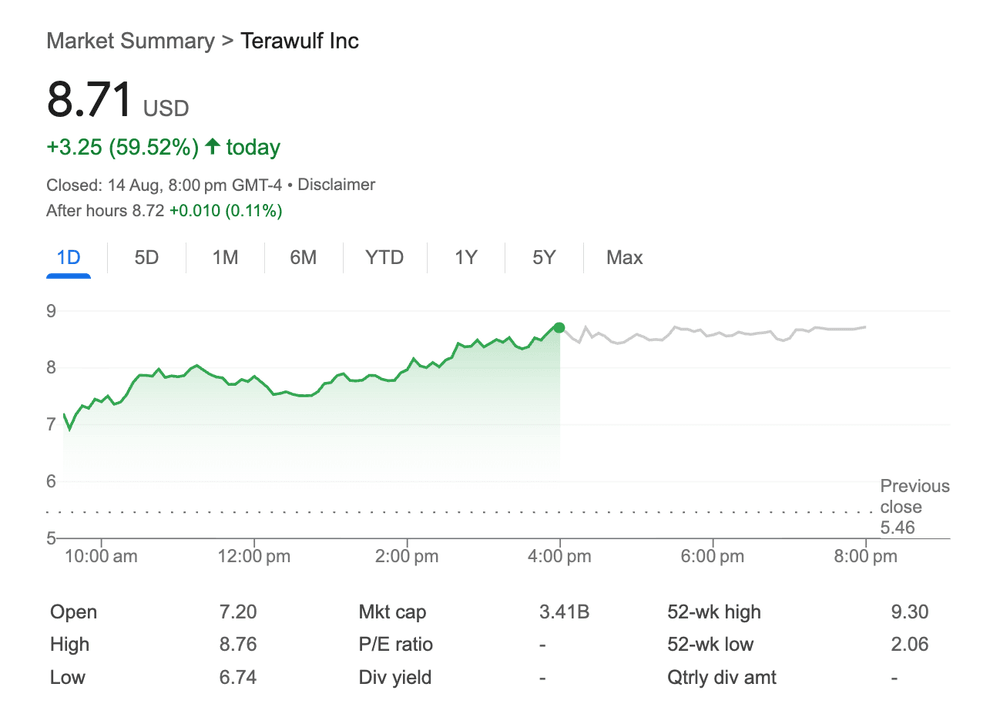

Following the announcement, WULF shares surged by 59.52%, closing at $8.71 and boosting the company’s market capitalization to $3.41 billion. The surge brought TeraWulf’s 2025 performance back into positive territory.

The move underscores a growing trend among Bitcoin miners to diversify into high-performance computing (HPC) and AI hosting, especially as mining profitability declines post-halving.

Operational Transition

TeraWulf’s Bitcoin output fell from 699 BTC in Q2 2024 to 485 BTC in Q2 2025. While the company posted a $61.4 million net loss in Q1, it returned to profitability in Q2.

Under the deal, TeraWulf will deliver over 200 MW of computing capacity at its Lake Mariner facility in New York, specifically designed for liquid-cooled AI workloads. The initial 40 MW is set to go live by mid-2026, with full deployment expected by year-end.

Financial And Strategic Outlook

The Google partnership provides vital capital support as TeraWulf invests $8–10 million per MW in infrastructure. The AI hosting business is projected to generate 85% net operating income margins, equivalent to around $315 million annually.

For miners navigating volatile Bitcoin prices and rising energy costs, the agreement highlights how leveraging existing infrastructure and renewable energy expertise can secure entry into the rapidly expanding AI sector. TeraWulf’s commitment to zero-carbon energy ensures the company’s environmental focus remains intact while achieving more stable, long-term revenues.

Disclaimer: The content above reflects the author’s personal views and does not represent any official position of Cobic News. The information provided is for informational purposes only and should not be considered as investment advice from Cobic News.