Secrets to Profiting from USD in 2025

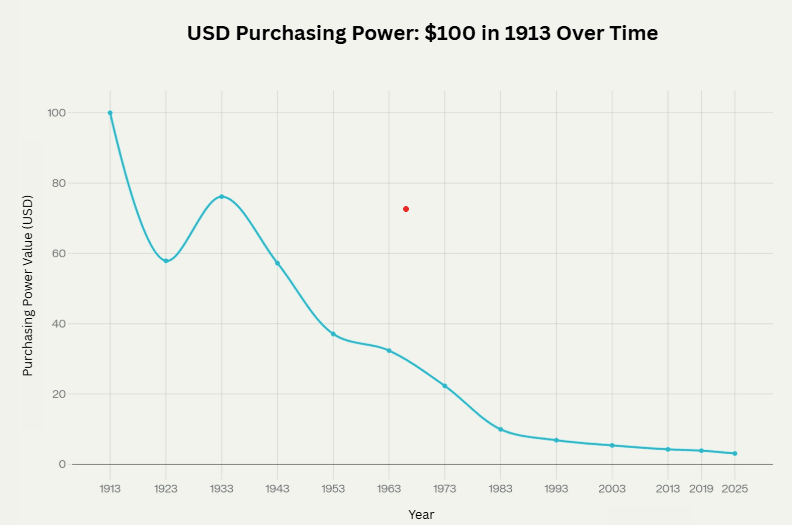

1. Decline in USD Purchasing Power

Over the past century, the purchasing power of the USD has dropped significantly, losing nearly 96% of its original value. This reflects the impact of inflation and economic shifts across decades.

The purchasing power of the USD has decreased by 96% over the past 100 years. Source: Minneapolis Fed

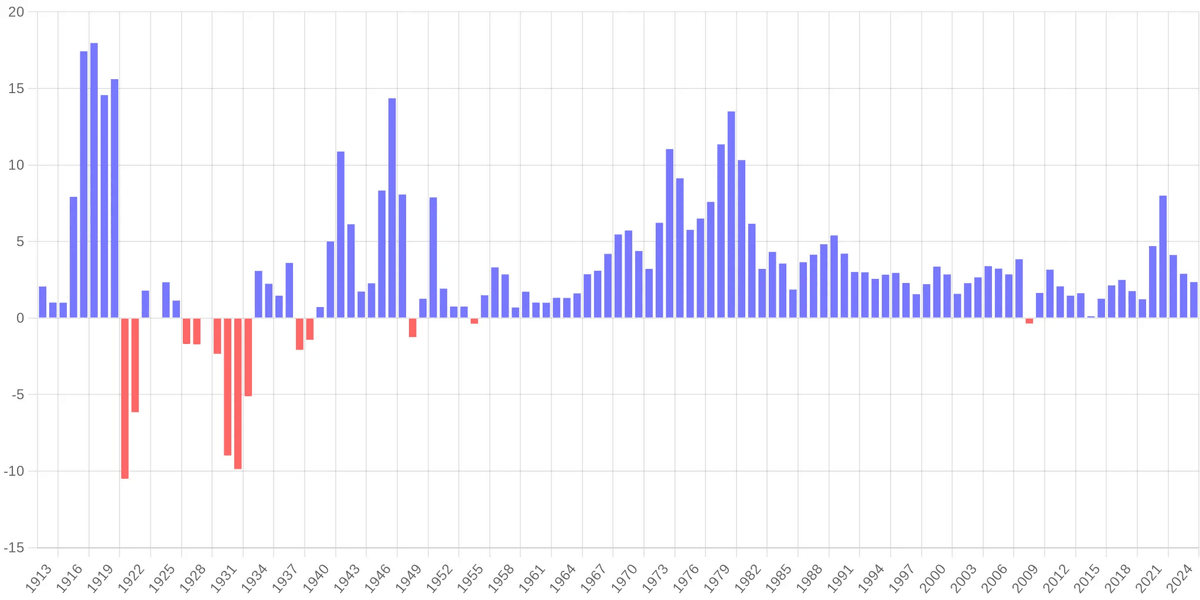

2. Annual Inflation Trends

The inflation rate of the USD has experienced notable fluctuations since 1913. Early years saw sharp rises and falls, but the overall trend indicates a steady decline in value over time.

The annual inflation rate of the USD from 1913 to the present. Source: In2013dollars.

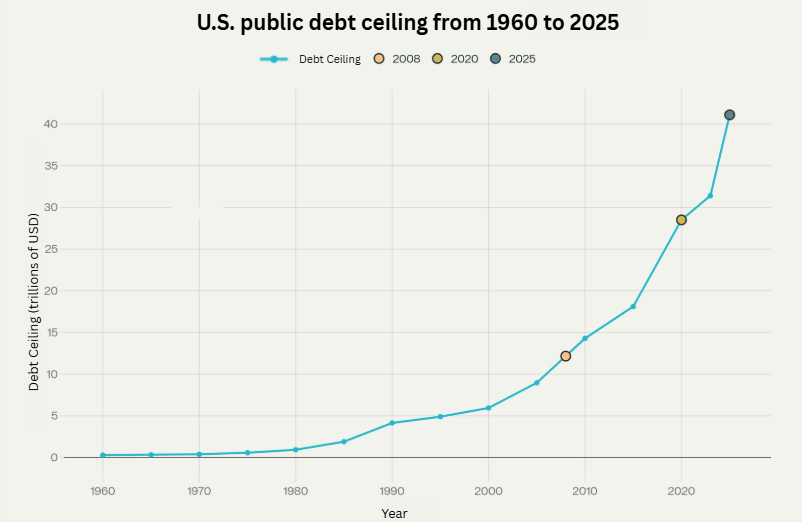

3. Rising US National Debt

The national debt of the USD-issuing country has steadily increased since 1960, with significant jumps in recent years. This upward trend is expected to continue through 2025.

U.S. public debt ceiling from 1960 to 2025 (U.S. Department of the Treasury)

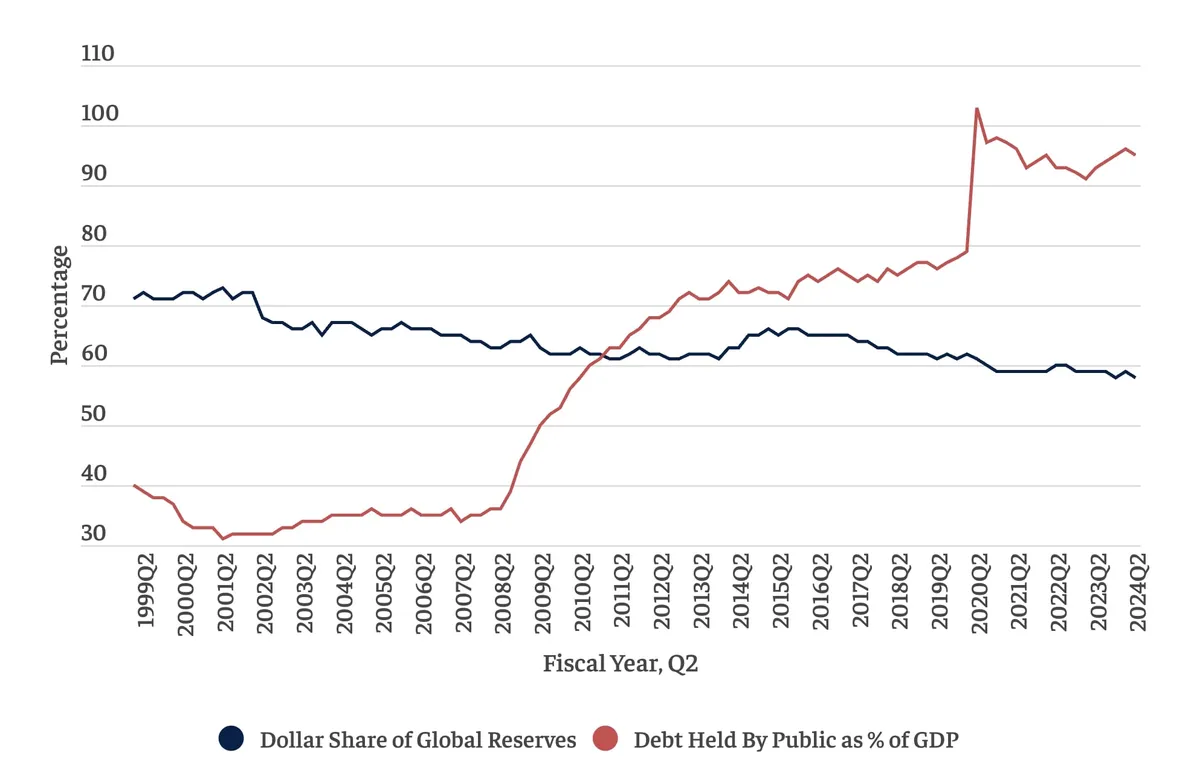

4. Decreasing Share in Global Reserves

The proportion of USD in global foreign exchange reserves has slightly declined over the past two decades, signaling a shift in the international economic landscape.

The USD share in foreign exchange reserves is declining. Source: Bipartisan Policy Center