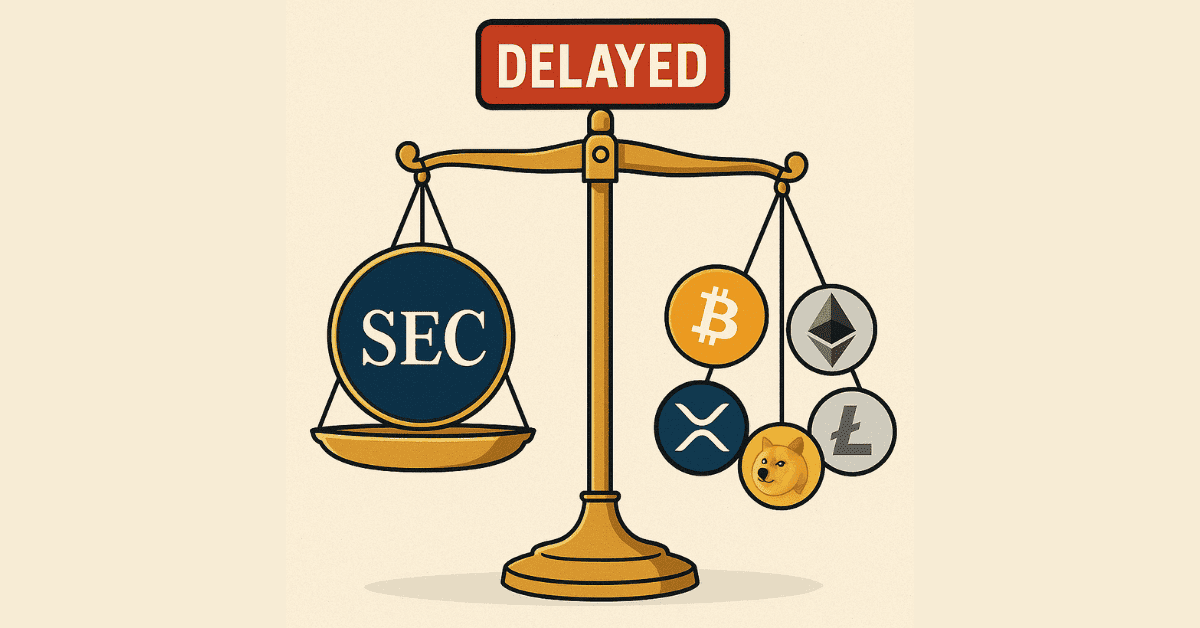

SEC Delays Multiple Crypto ETFs: Bitcoin, Ethereum, XRP

SEC Postpones Decisions On A Series of Cryptocurrency Funds

The U.S. Securities and Exchange Commission (SEC) continues to “stall” in reviewing cryptocurrency-based exchange-traded funds (ETFs). The most notable among them is the Truth Social Bitcoin & Ethereum ETF, backed by Trump Media & Technology Group—the media company founded by former President Donald Trump.

In a filing published on August 18, the SEC said it would extend its decision deadline by 45 days, moving it to October 8, 2025.

In addition, the SEC also delayed proposals for: XRP ETFs from Grayscale, CoinShares, Canary Capital, Bitwise, and 21Shares. Dogecoin ETFs (Grayscale and 21Shares). Litecoin ETF (CoinShares). A proposal to add staking to the 21Shares Core Ethereum ETF

Reasons Behind The Delay

This decision came just days after the SEC also postponed rulings on Solana ETFs. Analysts believe the delays are linked to changes in listing rules proposed by major exchanges such as Cboe BZX and NYSE Arca.

Both exchanges submitted requests to allow crypto ETFs to be listed without requiring individual case-by-case SEC approval. If adopted, the approval process could be shortened significantly compared to the current maximum of 240 days.

Expert Insight

Eric Balchunas, Senior ETF Analyst at Bloomberg, said: “This isn’t bad news. The SEC is simply waiting for the consultation period to end so new listing standards can be approved. Starting in October, a batch of crypto ETFs could get the green light.”

Positive Signals For The Crypto Market

While the delays may disappoint investors, many expect that October 2025 will bring a wave of new ETF approvals, following the earlier success of 11 Bitcoin ETFs and 9 Ethereum ETFs.

Alongside a more crypto-friendly political environment under the Trump administration and increasing participation from major traditional finance firms, crypto ETFs are anticipated to become a legitimized and booming investment channel in the U.S.

Disclaimer: The content above reflects the author’s personal views and does not represent any official position of Cobic News. The information provided is for informational purposes only and should not be considered as investment advice from Cobic News.