BTC & ETH Hold Key Levels As Powell Sets The Tone

Crypto Markets Brace For Powell’s Jackson Hole Speech

The crypto market enters the new week on edge as traders await Fed Chair Jerome Powell’s remarks at the Jackson Hole symposium. Bitcoin (BTC) is holding between $115K and $117K, with $115K as a vital support zone and $120K–$123K marking near-term resistance. Ethereum (ETH) remains stuck below $4.7K, struggling to confirm a breakout despite record institutional inflows.

Macro Pressures Collide with ETF Optimism

Markets are pricing in an 85% chance of a September Fed rate cut, yet tariff-driven inflation and weaker job data muddy the outlook. BTC dropped 2% and ETH 5% in early Asian trading, underscoring volatility tied to policy expectations. If Powell signals a hawkish bias, risk assets could face renewed pressure. A neutral stance may leave BTC and ETH consolidating until further macro data provides clarity.

Still, equities near all-time highs and relentless crypto ETF inflows offer some cushion. Bitcoin ETFs saw $547 million in net inflows last week, while Ethereum ETFs recorded $2.85 billion, including a $1 billion single-day inflow — a historic milestone.

BTC Holds Key Support, ETH Faces Historic Resistance

BTC continues to defend $115K, a zone of strong on-chain support. Breaking above $123K could pave the way to $127K, while falling below $115K risks a drop to $112K. Short-term holder cost-basis remains firm, providing resilience.

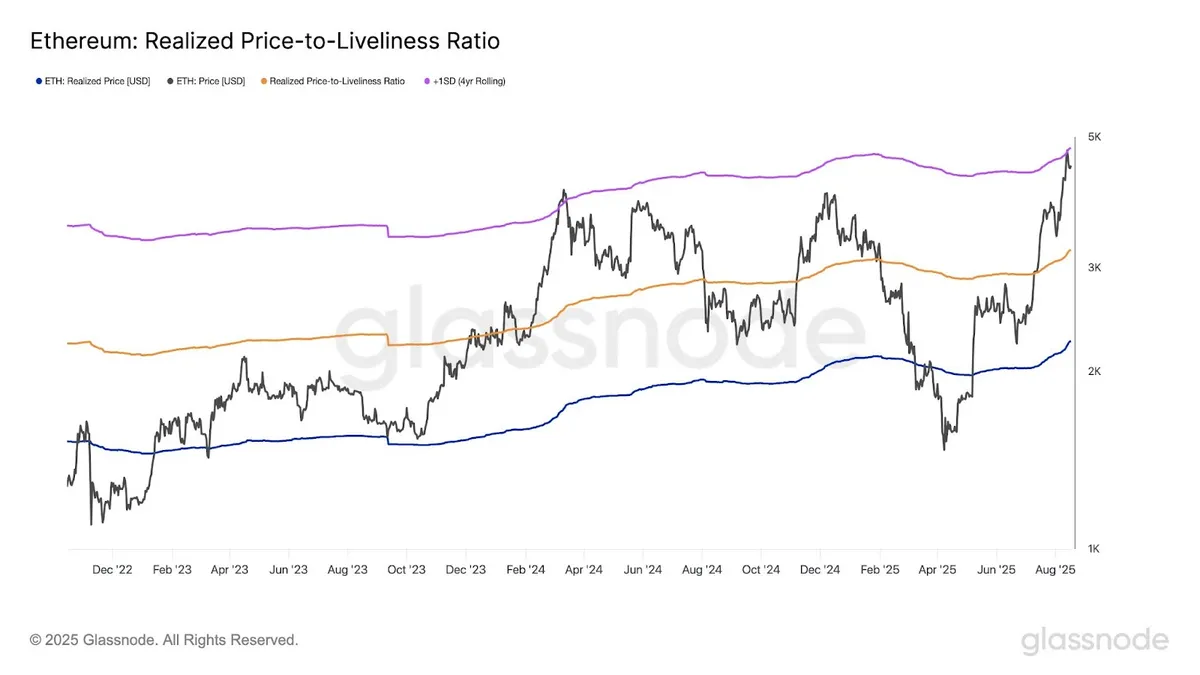

ETH, meanwhile, faces repeated rejection at $4.7K — its +1σ Active Realized Price, a known historical resistance. Although treasury and ETF demand remain strong, a clean acceptance above $4.7K is required to confirm bullish continuation.

Derivatives and Volatility Warning Signs

The 6M/1M implied volatility ratio for BTC sits at extreme levels, higher than 96.8% of historical observations. Combined with $39B in BTC open interest and $35.5B in ETH, markets face the potential for an explosive volatility breakout if current ranges give way.

Positioning And Outlook

Institutional demand continues to support the market, with ETH increasingly positioned as the speculative leader. Traders, however, remain cautious with tight risk management.

- Cash: 10% held ahead of Powell’s speech, anticipating volatility.

- BTC: 35%, support at $115K but sticky resistance at $120K–$123K.

- ETH: 40%, overweight exposure given ETF flows but tactical caution at $4.7K.

- SOL: 10% for high-beta altcoin exposure.

- BNB/XRP: 5% each as stable allocations.

As the week begins, the stage is set: crypto markets are pinned between strong inflows and macro uncertainty, with Powell’s words at Jackson Hole likely determining the next major breakout.

Disclaimer: The content above reflects the author’s personal views and does not represent any official position of Cobic News. The information provided is for informational purposes only and should not be considered as investment advice from Cobic News.