Fed Rate Cut, But Crypto Barely Reacts

The U.S. Federal Reserve has cut its policy rate by 25 basis points, in line with market expectations. Policymakers argue that three more reductions will stimulate the economy and revive the labor market, but financial markets remain cautious.

On the surface, the data looks strong: Q2 GDP grew over 3%, unemployment held at 4.3%, and U.S. stocks hit record highs. Yet the cut still happened, which Chair Jerome Powell described as a “risk management measure” aimed at addressing underlying vulnerabilities.

Fed officials believe that additional cuts are needed to prevent a slowdown and support jobs. However, market reactions reflect skepticism. U.S. Treasury yields steepened — a signal that investors expect higher inflation or stronger growth, running counter to the Fed’s goal of stimulating a slowing economy. The 10-year yield, after dipping below 4%, quickly surged back up, showing sentiment is far from aligned with the Fed’s narrative.

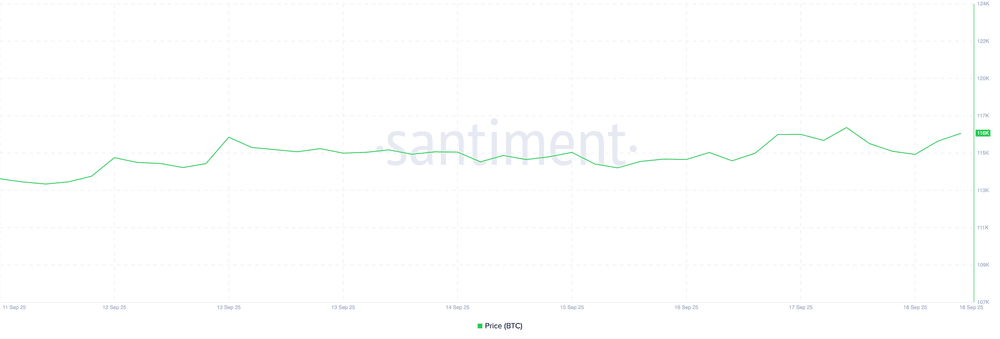

The dollar edged higher as the Fed reiterated its policy path would be data-dependent and decided meeting by meeting. U.S. stocks fell, erasing expectations of gains from the rate cut. Gold — which had climbed more than 40% this year, outperforming the S&P 500 — slipped slightly after the announcement, suggesting the Fed’s easing was already priced in. Bitcoin traded around $116,902, up 2.6% on the week, but showed little reaction to the news.

Sources: Santiment

Sources: Santiment

Politics also played a role as newly appointed member Stephen Miran, backed by Trump, cast the lone dissenting vote. While just one objection, it raises questions about the Fed’s political independence. Conversely, the unity of other members was seen as a show of support around Powell’s leadership.

In short, the Fed has sent a strong signal of continued monetary easing, but both crypto and traditional markets responded with muted moves. This highlights skepticism about the effectiveness of rate cuts in an environment marked by trade uncertainty, inflationary pressures, and political complexity.

Disclaimer: The content above reflects the author’s personal views and does not represent any official position of Cobic News. The information provided is for informational purposes only and should not be considered as investment advice from Cobic News.