DeFi Returns To Golden Era With $170B TVL

DeFi Returns to Its Golden Era With TVL Reaching $170 Billion

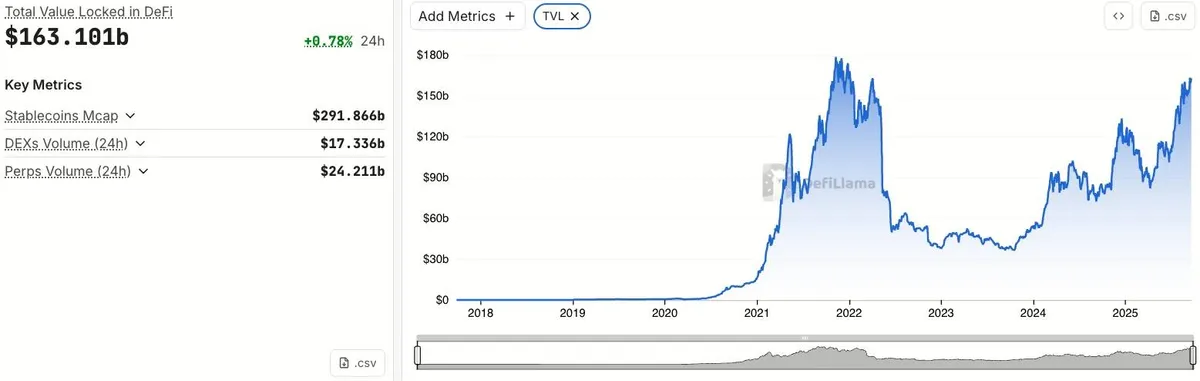

After more than three years of recovery following the historic collapse of Terra, Decentralized Finance (DeFi) has officially returned to its golden age. The Total Value Locked (TVL) in DeFi protocols has now reached $170 billion, nearly equal to the peak before the 2022 disaster, marking a significant turning point for the industry.

TVL of the DeFi sector from 2018 to prese25)nt. Source: Defi Llama (09/19/20

DeFi Reborn After the Terra Crash

In 2022, the collapse of the LUNA/UST ecosystem wiped out over $100 billion in TVL overnight. The incident not only pushed major investment funds like Three Arrows Capital into bankruptcy but also became one of the most devastating events in crypto history. Since then, DeFi has undergone major changes to adapt and grow again.

Interest rates have been adjusted to more sustainable levels. For example, Aave currently pays 5.2% on stablecoins, Ether.fi with its restaking model offers around 11%, while Ethereum staking rewards have dropped to 3.5–4%, compared to nearly 20% in 2021. This shift reflects a healthier and more mature market. Unlike the overheated boom of 2021–2022, when TVL skyrocketed from $16 billion to $202 billion in just over a year, the current cycle has followed a “slow but steady” trajectory, growing from $42 billion in October 2022 to $170 billion in September 2025.

Ethereum Maintains Its DeFi Throne

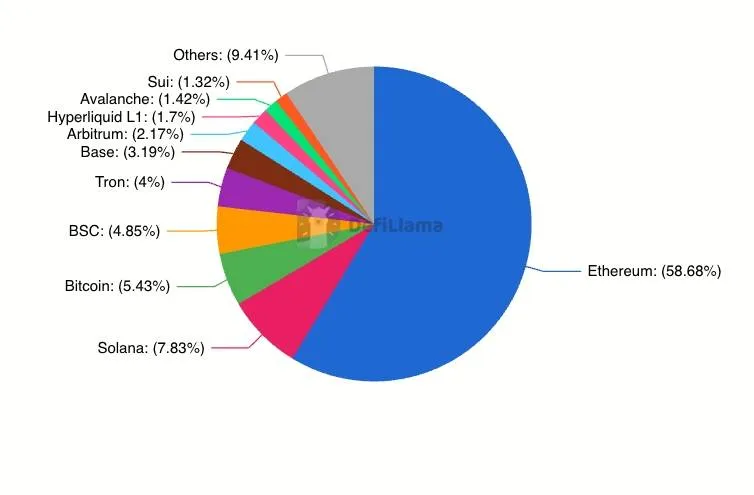

Ethereum continues to dominate the DeFi landscape, accounting for 59% of total TVL. However, new blockchains are gradually asserting their presence. Base, HyperLiquid, and Sui have collectively attracted more than $10.1 billion, or 6% of TVL. Meanwhile, Solana and BNB Chain have risen strongly thanks to the memecoin wave, with TVL reaching $12.8 billion and $7.9 billion, securing the second and third spots respectively.

Another significant change comes from institutional capital. Instead of focusing on popular liquid staking platforms like Lido, many funds are turning to specialized staking solutions such as Figment. At the same time, they are implementing advanced security tools, including MPC wallets (Multi-Party Computation), AI-driven monitoring systems, and decentralized insurance providers like Nexus Mutual. This indicates that institutional money is not only bringing liquidity but also importing risk-management standards from traditional finance into DeFi.

Stablecoins as the New Growth Engine

Stablecoins now account for 40% of DeFi’s total TVL, with the number of active wallets increasing by more than 53% over the past year. Notably, demand is no longer concentrated in the U.S. and Europe but is surging across emerging regions such as Latin America, APAC, and Sub-Saharan Africa.

This shift proves that DeFi’s growth is no longer limited to speculative capital but is expanding into practical applications, from remittances and savings to cross-border payments. Such developments could become long-term growth drivers for the industry, complementing speculative flows that have historically fueled crypto markets.

Security Risks Still Loom Large

Despite the strong recovery, DeFi continues to face severe security threats. In just the first half of 2025, investors lost an estimated $2.5 billion to hacks, scams, and rug pulls. Alarmingly, 80% of these losses came from phishing attacks and compromised wallets—human factors rather than smart contract vulnerabilities.

Unlike traditional finance, crypto has no insurance or bailout mechanisms. Losing a private key, being hacked, or falling victim to phishing almost always means losing everything, with no customer service hotline to call for help. This remains one of the greatest barriers preventing DeFi from reaching mass adoption.

Conditions for Entering a New Era

For DeFi to truly become an alternative to traditional finance, the sector must focus relentlessly on security and attack prevention. At the same time, the establishment of clearer regulatory frameworks—from the U.S. CLARITY Act to EU MiCA and multi-chain security standards—will be crucial in elevating the industry to the next level.

If these conditions are met, DeFi could enter a new era of growth, combining both institutional adoption and mainstream participation. However, just one more large-scale collapse could send the market into another prolonged crypto winter.

Disclaimer: The content above reflects the author’s personal views and does not represent any official position of Cobic News. The information provided is for informational purposes only and should not be considered as investment advice from Cobic News.