DOGE Holds Above 200DMA, Needs Daily Close Over $0.24

Market background for DOGE

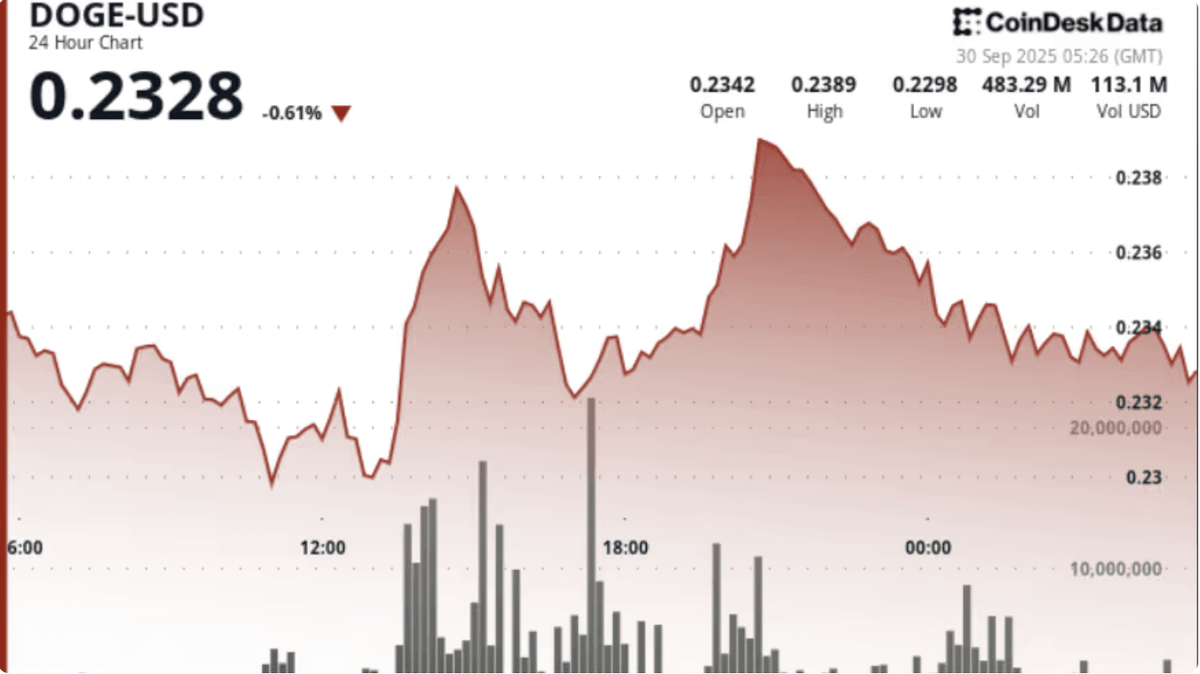

The altcoin sector has been attempting a rebound after a period of corrections. Within this landscape, Dogecoin — the leading meme coin — has managed to maintain strength. In the latest session, DOGE held above its 200-day moving average (200DMA), a key technical indicator separating long-term bullish and bearish phases.

Source: data.coindesk.com

Importance of the 200DMA for DOGE

The 200DMA serves as a barometer for medium-term trends. Staying above it signals that buyers still maintain control. For DOGE, defending the $0.22 level is evidence that structural demand remains intact, providing a foundation for further gains.

Selling pressure at $0.24

DOGE made an attempt to break through the $0.24 resistance but failed to sustain momentum. Heavy profit-taking pushed the price back to $0.23, proving $0.24 to be both a psychological and technical barrier.

Whale activity weighs on price

On-chain data revealed that whale addresses sold roughly 40 million DOGE during the session. This influx of supply amplified selling pressure and blocked DOGE’s breakout attempts, consolidating $0.24 as a hardened resistance zone.

Price action and trading volume

DOGE traded mostly between $0.23–$0.24. A mid-session spike brought over 780 million DOGE in trading volume, showing strong buying interest. However, sellers quickly absorbed the move, dragging the price back to $0.23 by session close.

Key support and resistance levels

• Immediate support: $0.23 — losing this level could expose DOGE to a retest of the 200DMA at $0.22.

• Critical resistance: $0.24 — the breakout level.

• Upside targets: If DOGE secures a daily close above $0.24, the next objectives lie at $0.245–$0.25, followed by $0.255.

Potential scenarios for DOGE

• Bullish case: A daily close above $0.24 with strong volume would validate a breakout, opening further gains toward $0.25.

• Bearish case: Failure to hold $0.23 could push DOGE down to the 200DMA. Breaking below $0.22 would increase risks of a long-term bearish reversal.

Conclusion for traders

DOGE is currently in a “wait-and-see” zone. Traders should closely monitor price behavior around $0.24. A confirmed breakout would strengthen the bullish outlook, while persistent selling pressure could shift DOGE into sideways consolidation or deeper correction.

Disclaimer: This article is intended solely to provide information and market insights at the time of publication. We make no promises or guarantees regarding performance, returns, or the absolute accuracy of the data. All investment decisions are the sole responsibility of the reader.