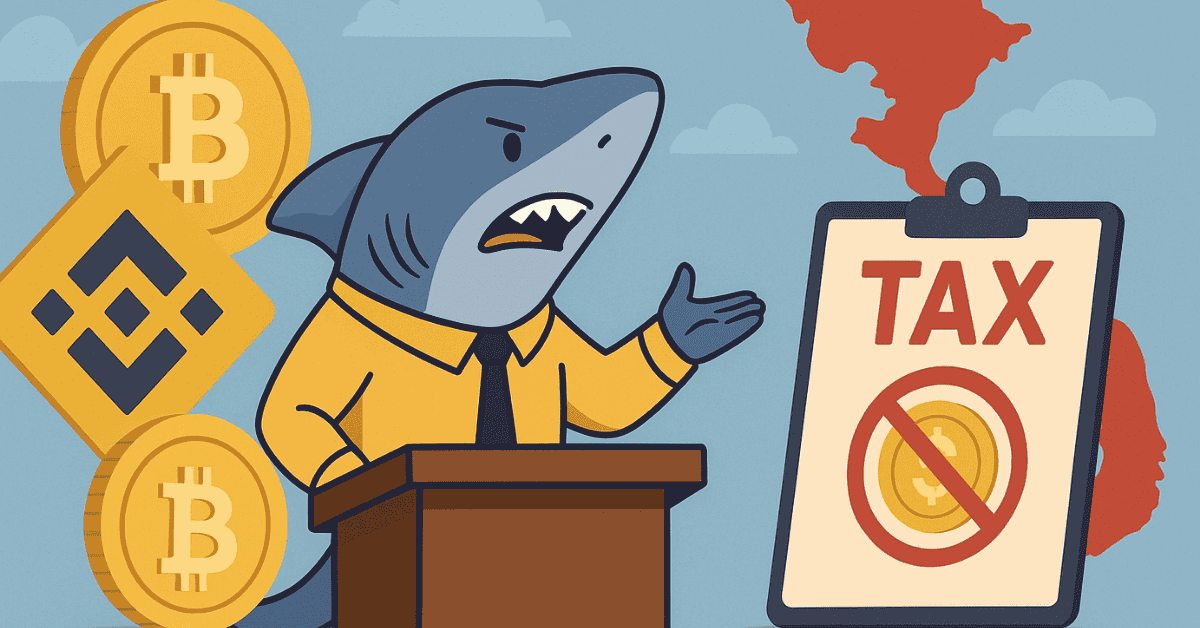

Binance Pushes Vietnam To Ease Crypto Tax Burden

Binance Proposes Vietnam Exempt Digital Asset ‘Whales’ From Income Tax

As the Ministry of Finance is gathering feedback on the draft Personal Income Tax Law (amended), one of the most controversial issues is how to tax digital asset transactions — a sector that is booming but still carries significant risks.

Recently, Binance, the world’s largest cryptocurrency exchange, submitted its recommendations, stressing that tax should not be applied on the total transaction value, but rather on net profit. According to Binance, taxing gross transaction value would directly disadvantage market makers (MMs) — also known as “whales” in the market — who provide liquidity with extremely thin margins.

Risks of taxing gross transaction value

- Tax obligations could exceed actual profits, discouraging organizations from providing liquidity.

- Reduced liquidity could lead to sharp price volatility, negatively impacting retail investors.

- The withdrawal of “whales” would make Vietnam’s digital asset market less attractive compared to other countries, reducing its global competitiveness.

Binance’s proposal for a fairer tax model

Binance suggests that income from digital asset transfers should be treated similarly to capital gains, with a tax rate of 20% on net profit instead of the gross transaction value.

In cases where profits are difficult to determine, Binance proposes a 0.1% tax on transaction value, ensuring both fairness and feasibility in tax administration.

Global perspective and implications for Vietnam

In the U.S., taxation and regulation of digital assets have also become hot topics. The Trump administration previously pledged to reduce tax burdens and establish clear legal frameworks to help the U.S. become a global hub for digital assets.

If Vietnam adopts an overly heavy tax policy, capital and skilled talent could migrate to more open markets such as the U.S., Singapore, or Dubai. This not only weakens Vietnam’s domestic blockchain ecosystem but also causes the country to miss out on deeper participation in the global fintech race.

Disclaimer: The content above reflects the author’s personal views and does not represent any official position of Cobic News. The information provided is for informational purposes only and should not be considered as investment advice from Cobic News.