Crypto Faces Pressure From Fed Policy Shift

The cryptocurrency market faces growing uncertainty as the Federal Reserve approaches a potential interest rate cut amid a new 4% baseline for 10-year Treasury yields. Investors currently see an 80% chance of a 25-basis-point cut this September.

Political developments are adding fuel to the fire. Federal Reserve Governor Adriana Kugler has announced her early resignation, effective August 8, leaving a vacancy that former President Donald Trump may seek to fill. A new appointee with a more dovish outlook could shift the Fed’s policy stance ahead of Chair Jerome Powell’s term ending in May 2026.

As crypto markets reel from a weak U.S. jobs report, many analysts fear stagflation—sluggish growth paired with persistent inflation—poses a bigger risk to digital assets than a full-blown recession.

Wall Street is sounding the alarm. Morgan Stanley, Deutsche Bank, and Evercore have all forecast potential corrections of 10–15% in equities, citing economic slowdown, weak consumer spending, and lingering effects of tariffs.

Liquidity is drying up as governments accumulate debt to fund tax cuts, military budgets, and AI infrastructure. Meanwhile, savers are increasingly cautious, wary of politically driven central bank policy that could devalue long-term holdings.

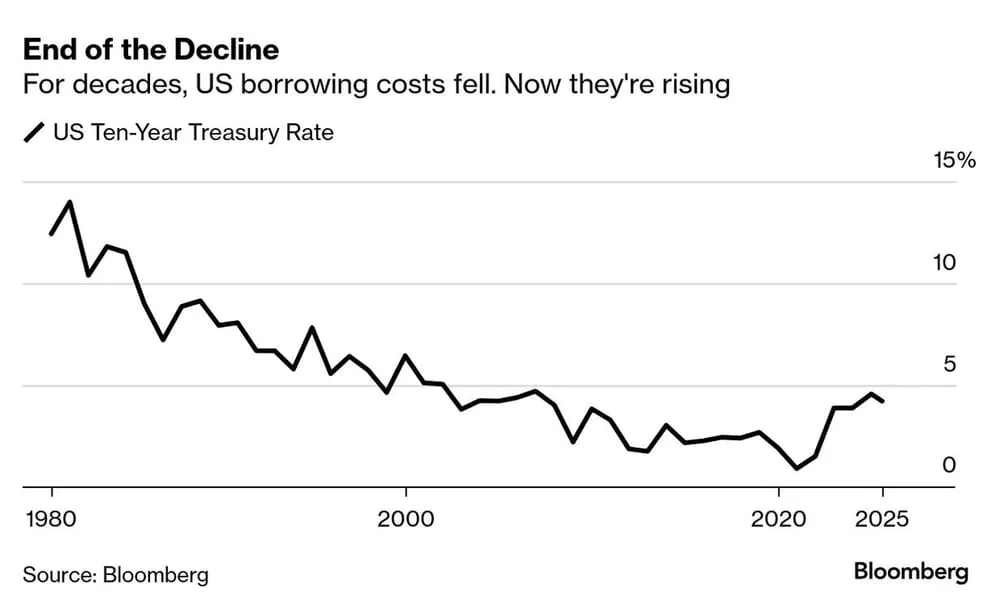

Crypto investors now question whether a Fed rate cut will be enough to revive momentum. While digital assets like Bitcoin and Ethereum surged with lower borrowing costs last year, long-term rates may trend higher even as short-term cuts are priced in.

The natural rate of interest—the balance between saving and investment demand—has reversed its decades-long decline. For more than three decades — from the early 1980s through the mid-2010s — the trend was downward. Now, however, that trajectory has reversed, and rates are clearly moving higher, presenting structural headwinds for all risk assets, including cryptocurrencies.

August and September have historically been poor-performing months for stocks, and this seasonal weakness could spill over into crypto. Analysts warn of a difficult road ahead, with crypto’s hedge appeal being tested by macroeconomic and political risks.