BTC Crypto Steady At $115K Amid Market Debate

Bitcoin steady at $115,000 in Asia session

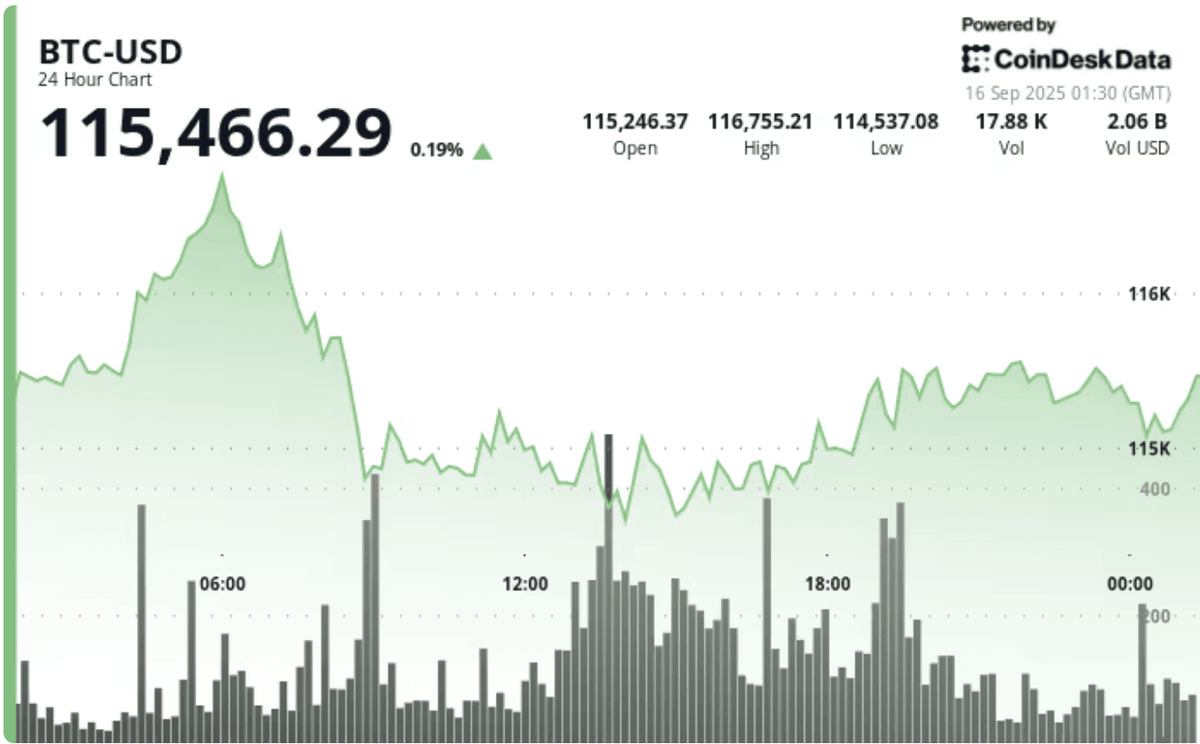

On September 16, Bitcoin held firm near $115,000 during Asian trading hours, marking only a slight pullback after early-week gains. This level is drawing global attention as the market debates whether momentum is building or fragile optimism is fading.

Glassnode: Fragility in the market

According to Glassnode’s weekly insights, several risks are emerging:

• Profit-taking is increasing, with more than 92% of BTC supply in profit, raising the likelihood of selling pressure.

• Spot demand remains weak, suggesting limited conviction from retail buyers.

• Funding rates are softening, signaling lower confidence in leveraged positions.

Glassnode concludes that despite price stability, Bitcoin’s rally rests on shaky ground, and any slowdown in ETF inflows could trigger sharp corrections.

QCP Capital: Signs of renewed strength

In contrast, QCP Capital maintains a bullish view:

• ETF inflows surged nearly 200% last week, highlighting institutional demand.

• Futures open interest has expanded, reflecting deeper liquidity and growing participation.

• Rotation into higher-beta altcoins such as SOL and AVAX indicates improving risk appetite across the crypto space.

QCP argues that if institutional inflows persist, Bitcoin could consolidate above 115K–116K and use this range as a launchpad for the next rally.

115K – 116K: The battleground zone

Source: data.coindesk.com

The price range between $115K and $116K has become a battleground:

• Strong ETF flows could propel BTC beyond $120K.

• Intensified profit-taking may send prices back toward $110K or lower.

This makes the current zone both an opportunity and a high-risk area for traders.

Asian equities provide supportive backdrop

Outside crypto, regional markets strengthened:

• Japan’s Nikkei 225 hit a record high, supported by improved U.S.–China trade outlook.

• A new regulatory framework for TikTok divestment also boosted investor sentiment.

Such developments bolster overall risk appetite, indirectly benefiting the crypto market.

Conclusion

Bitcoin is at a crossroads: institutional inflows through ETFs support prices, but weak spot demand and rising profit-taking pose risks. Whether BTC sustains above $115K will depend on the balance between institutional momentum and retail fragility.

Disclaimer: This article is intended solely to provide information and market insights at the time of publication. We make no promises or guarantees regarding performance, returns, or the absolute accuracy of the data. All investment decisions are the sole responsibility of the reader.