BNB Hits $880 | Price Analysis And Forecast

BNB Hits New All-Time High Above $880: Can The Rally Last?

BNB has just reached a new all-time high, surpassing the $880 mark during Wednesday’s trading session. The surge came shortly after Nasdaq announced the delisting of Windtree Therapeutics (WINT).

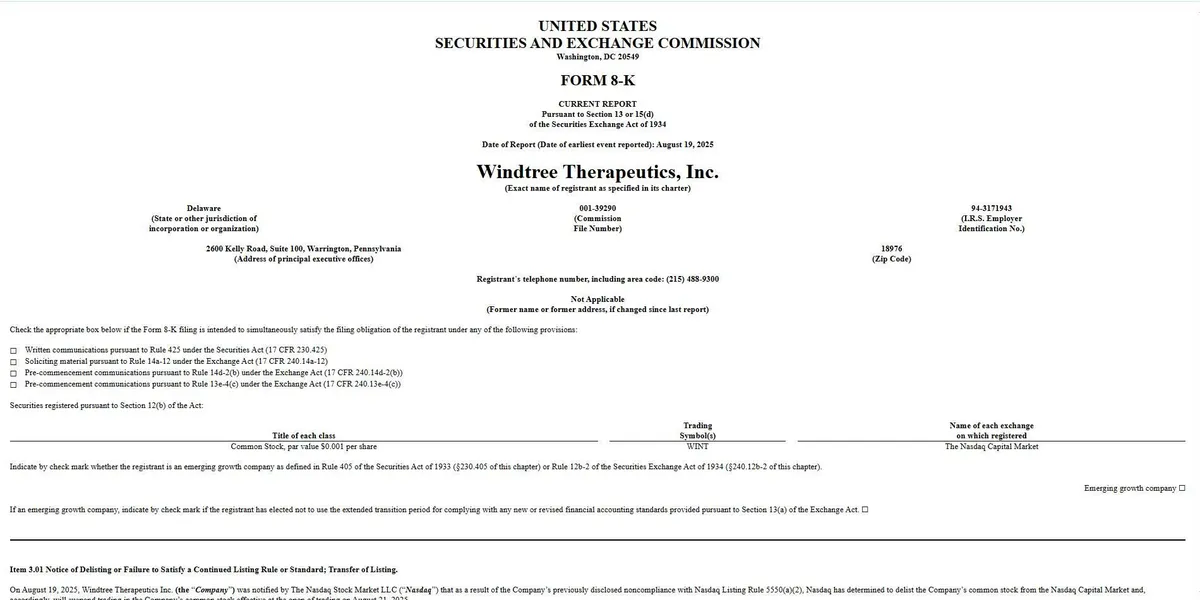

Nasdaq Delists WINT For Listing Rule Violation

In a Form 8-K filed with the U.S. Securities and Exchange Commission (SEC), Windtree Therapeutics confirmed that its stock (WINT) will be officially delisted from the Nasdaq Capital Market, with trading suspension effective Thursday.

The decision came after Nasdaq determined that the company failed to comply with Listing Rule 5550(a)(2), which requires a minimum bid price of $1 per share for at least 30 consecutive trading sessions.

Windtree stated it will move its shares to the over-the-counter (OTC) market under the same ticker symbol, WINT. The company also applied for listing on the OTCID tier of the OTC market, though approval is not guaranteed.

While Windtree emphasized that the delisting will not affect its core operations, trading on OTC markets often faces lower liquidity and less transparency, which may pose challenges for investors. Following the announcement, WINT stock plunged by 76%.

Windtree’s Treasury Strategy With BNB

Less than a month ago, Windtree revealed a treasury management strategy worth $520 million, allocating up to 99% of funds to BNB. This move has drawn strong attention, especially since BNB’s price continued to climb despite negative news regarding its key treasury partner.

According to Binance data, in just 24 hours, BNB surged 5% and hit a fresh all-time high above $880.

BNB Technical Analysis: Potential Breakout Toward $920?

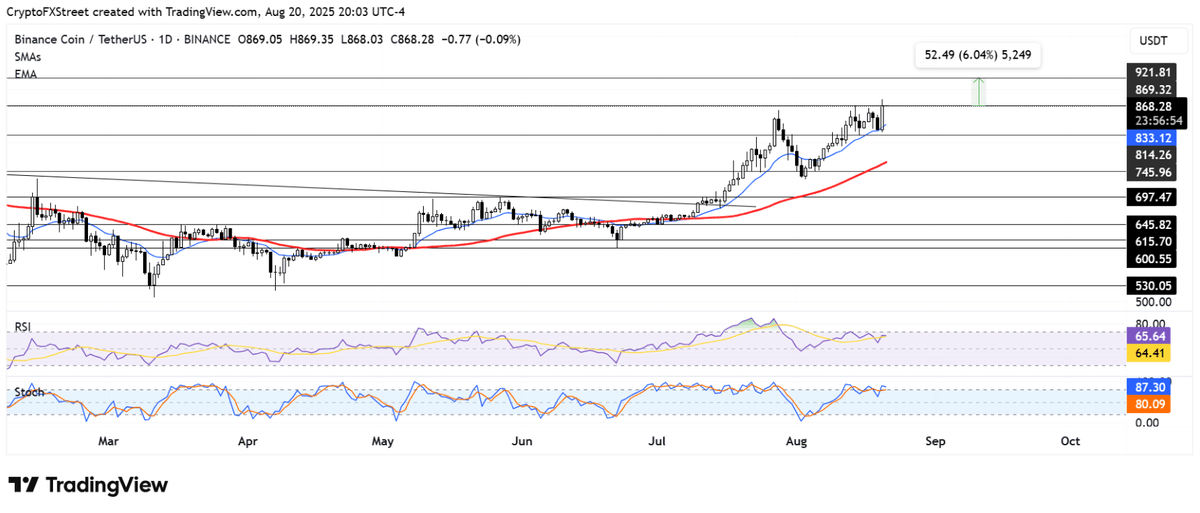

The BNB/USDT chart shows that the coin bounced strongly from the 14-day EMA, holding above the critical support level at $814.

Analysts suggest:

- If the momentum continues, BNB could target the $920 zone, completing the rectangle pattern currently forming.

- Both RSI and Stochastic Oscillator are approaching overbought territory, reflecting strong buying pressure and sustained bullish sentiment.

Conclusion

The Nasdaq delisting of WINT combined with Windtree’s heavy treasury allocation to BNB has created mixed signals, yet BNB continues to show remarkable strength. In the short term, the rally could extend toward $920, but investors should closely monitor market conditions to manage risks effectively.

Disclaimer: The content above reflects the author’s personal views and does not represent any official position of Cobic News. The information provided is for informational purposes only and should not be considered as investment advice from Cobic News.