2025: Bitcoin Attracts Dozens of Major Companies

1. 2025 Outlook: Corporate Bitcoin Adoption is Expanding

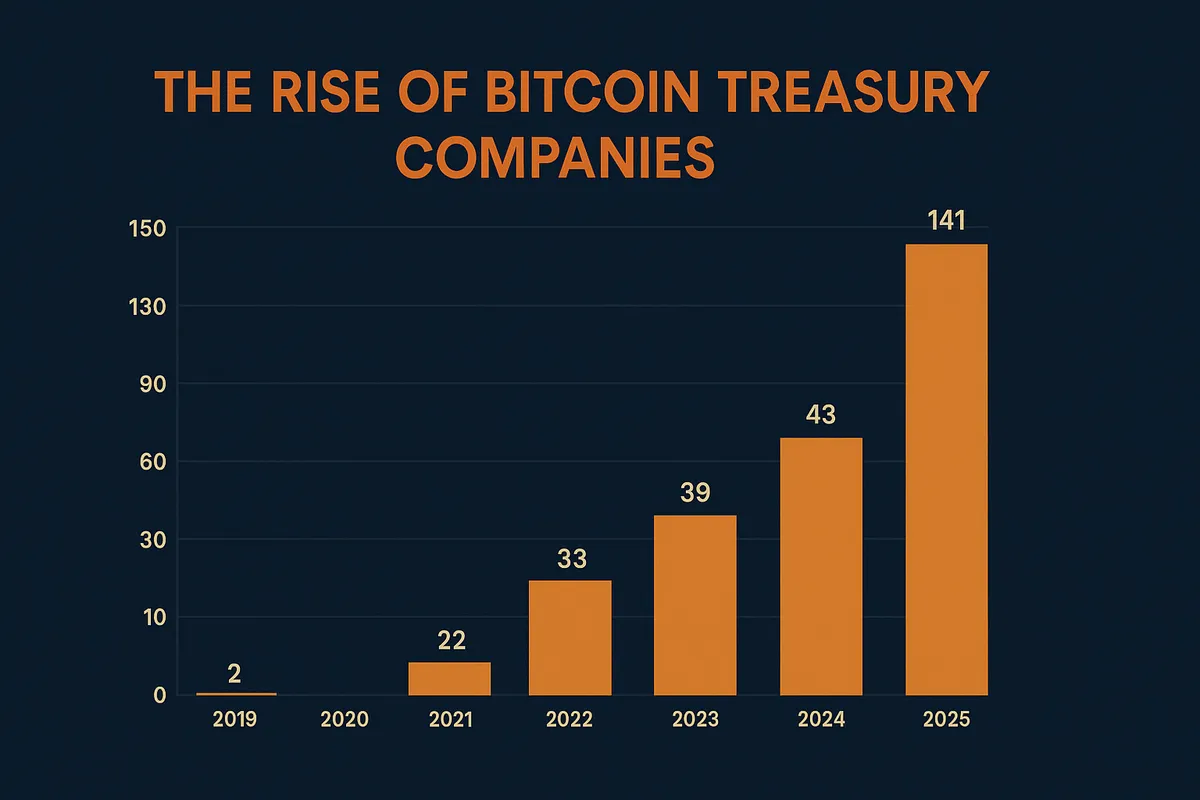

A recent report by Blockware Intelligence projects that at least 36 publicly listed companies will add Bitcoin to their balance sheets in 2025. This marks the next phase of the “Bitcoin treasury” trend, where businesses adopt BTC as part of their long-term financial strategies.

2. Why Are Companies Choosing Bitcoin?

There are three key reasons why companies are adding Bitcoin to their portfolios:

• Inflation hedge and value preservation

• Diversification of investment holdings

• Strong belief in the long-term potential of digital assets

Companies like MicroStrategy, Tesla, Square, and most recently Japan's Metaplanet view Bitcoin as a “digital gold” in an increasingly uncertain financial world.

3. Which Companies Are Leading the Trend?

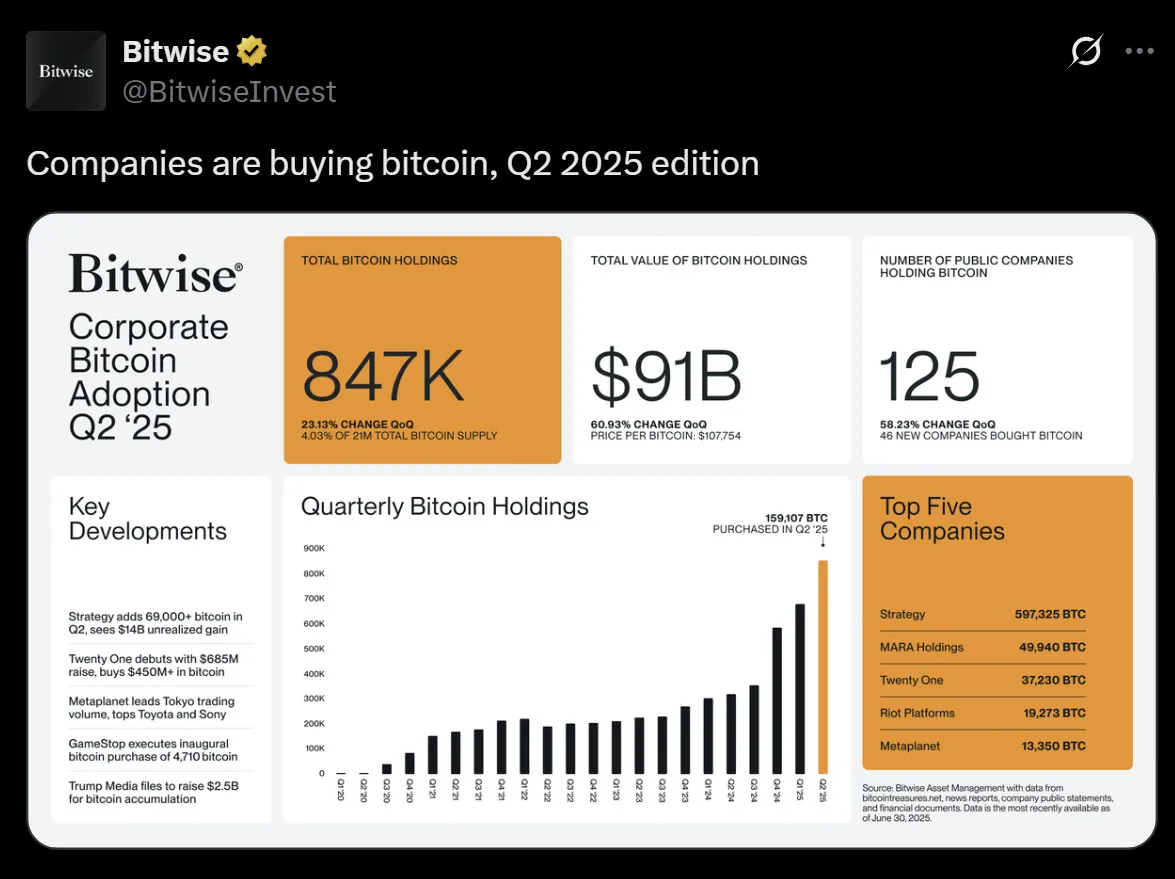

As of mid-2025:

• MicroStrategy holds over 600,000 BTC, remaining the largest corporate Bitcoin holder.

• Metaplanet (Japan) is emerging as Asia’s Bitcoin champion, treating BTC as a “core asset”.

• Tech firms, fintech companies, and even some insurance funds are exploring BTC as part of their financial strategies.

4. Forecast: 36 More Companies to Join in 2025

Blockware forecasts that at least 36 additional companies will announce Bitcoin holdings in 2025. This could push the total BTC held by public institutions to over 1 million BTC, or nearly 5% of total circulating supply.

5. Conclusion: Bitcoin is Becoming a Strategic Corporate Asset

In the face of global economic uncertainty, sustained inflation, and growing confidence in digital assets, corporate Bitcoin adoption is no longer a trend—it’s a shift. Blockware’s forecast signals that the digital asset race is on, and BTC is leading.