Mantle (MNT) Surges Amid Crypto Downtrend

Mantle (MNT) – “Against The Current” Thanks To Ethereum

On August 6, 2025, the cryptocurrency market saw a slight correction, with total market capitalization dropping 1.38% to $3.7 trillion. However, Mantle (MNT) – an Ethereum layer-2 token – stood out by gaining over 8% on the day and nearly 25% over the week.

Listed on Coinbase since May, Mantle is not just a DeFi platform but is also positioning itself as a “Web3 Ethereum Treasury,” holding an ETH reserve worth $364 million – the largest among blockchain-native projects.

Mantle (MNT) – Uptrend Maintained

MNT is showing a clear upward trend, with an ADX of 33 confirming strong buying pressure in the market. The RSI is at 69, close to the overbought zone but still with room to rise. The Squeeze Momentum Indicator signals price compression ahead of a potential breakout, while the narrowing gap between short- and long-term moving averages hints at a possible Golden Cross formation.

Key levels: support at $0.82 and $0.75; resistance at $1.00 and $1.30.

Mantle (MNT) price data. Image: TradingView

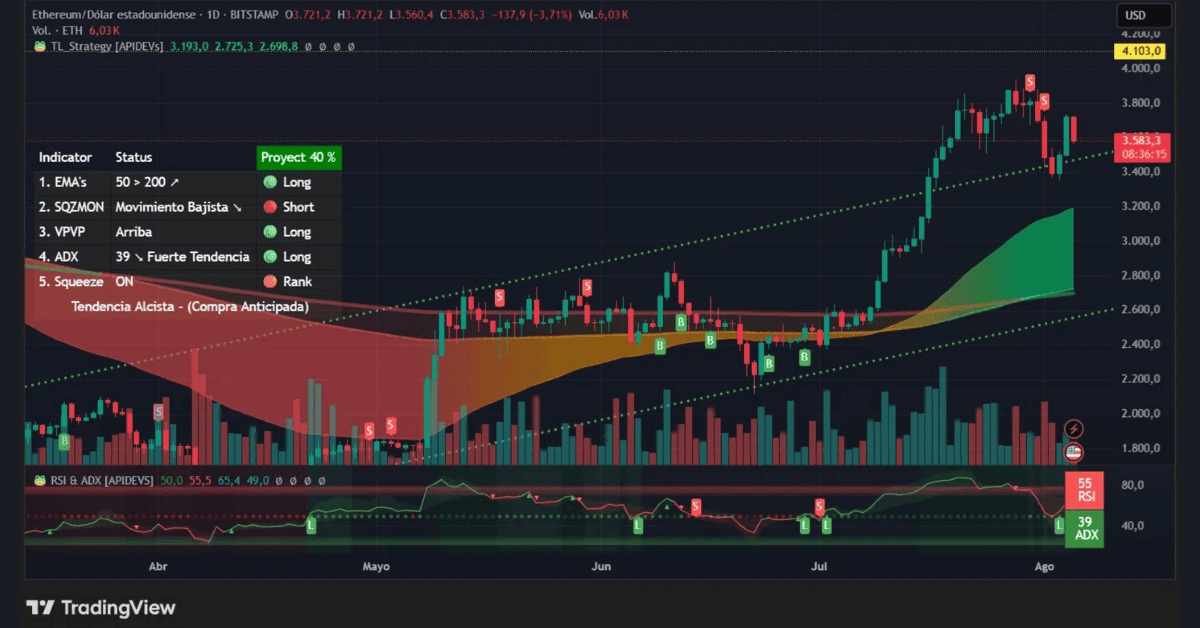

Ethereum (ETH) – The Foundation For MNT

ETH is trading at $3,583.3, with an ADX of 39 indicating strong trend momentum. RSI stands at 55, in neutral territory. The EMA 50 is above the EMA 200, and the Squeeze Momentum Indicator is “On,” suggesting significant volatility may be ahead.

Key levels: support at $3,400 and $3,200; resistance at $3,800 and $4,000.

Ethereum price data. Image: TradingView

Factors Driving MNT

Mantle holds the largest ETH reserve among Web3 projects, providing a solid value foundation. Its listing on Coinbase has boosted credibility and attracted investors. The upcoming launch of UR Neobank, integrating fiat and crypto financial services, is expected after August 8.

Conclusion

Mantle (MNT) is emerging as a “star” in a declining market, backed by Ethereum, strong technical indicators, and positive news flow. With key supports holding and a potential Golden Cross ahead, MNT could have more upside in the near term—especially if Ethereum maintains its bullish trend.