Crypto Shock: AI Qubic Claims 51% Control Of Monero

Qubic’s Statement Shakes The Monero Community

On August 13, 2025, AI protocol Qubic stirred the cryptocurrency market by claiming it had taken control of 51% of the hashrate of the privacy-focused Monero (XMR) blockchain. According to Qubic, this was merely an “experiment” aimed at helping Monero defend against future attacks.

On social platform X, Qubic asserted: “Qubic has achieved more than 51% of Monero’s hashrate, enough to control the network. We have not activated the takeover, but the theory has been proven.”

What Is A 51% Attack and Why is it Dangerous?

A 51% attack occurs when a single entity controls more than half of the computational power of a proof-of-work network. This allows them to: Manipulate transactions, Double-spend coins, Block valid transactions from others

Major blockchains like Bitcoin and Dogecoin also use PoW, but Monero is particularly vulnerable due to its smaller hashrate and high anonymity.

Experts Skeptical: No Conclusive Proof Yet

Although Qubic is confident in its claims, AMLBot and Horizen Labs say there is no independent confirmation of a successful attack.

AMLBot: No signs of large-scale blockchain rewrites. Horizen Labs: Data only showed a few orphan blocks and minor reorgs over a four-hour period.

However, Nikita Zhavoronkov (CEO of Blockchair) stated that Monero experienced deep reorgs of up to six blocks in the past 24 hours—enough to be considered a “51% attack,” though with low impact.

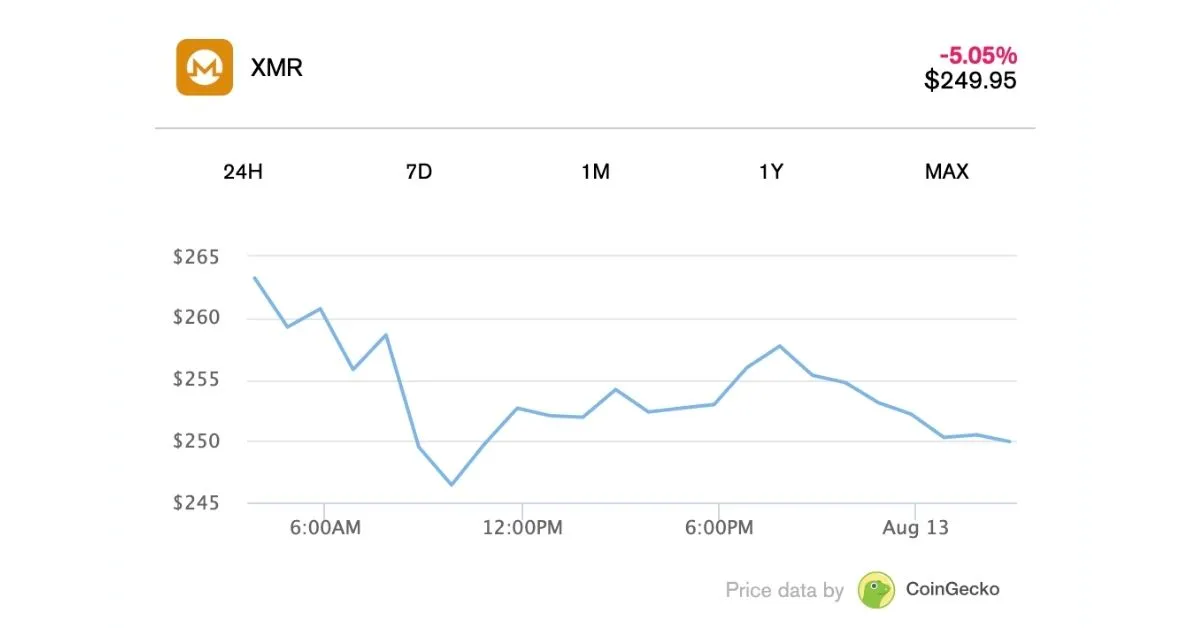

Market Reaction: XMR Plunges

XMR fell 6% in 24 hours, with its market cap dropping to $4.75 billion. Over the past month, XMR has lost nearly 25% of its value, making it the third worst performer in the top 100 coins. Meanwhile, QUBIC token surged 25%, reaching a $342 million market cap.

Comparison: Zcash (ZEC) up 2%, Dash holding steady after a 10% weekly rise, Starknet and ZKSync both up over 4%

Cost And Long-Term Impact

According to Ledger CTO Charles Guillemet, maintaining 51% of Monero’s hashrate costs around $75 million per day—an enormous and unsustainable figure in the long run.

While Qubic claims its intention is to “help Monero defend against government agencies,” analysts warn of a dangerous precedent: any well-funded actor could centralize a PoW network.

Conclusion

The Qubic–Monero incident has reignited old concerns about the vulnerabilities of PoW blockchains. Although the authenticity of the attack remains disputed, the event has heavily impacted XMR’s price and served as a warning to the crypto community about the risks of hashrate centralization.

Disclaimer: The content above reflects the author’s personal views and does not represent any official position of Cobic News. The information provided is for informational purposes only and should not be considered as investment advice from Cobic News.