Blockchain In 2025: A Global Surge In Multi-Sector Applications Reshaping The Economy

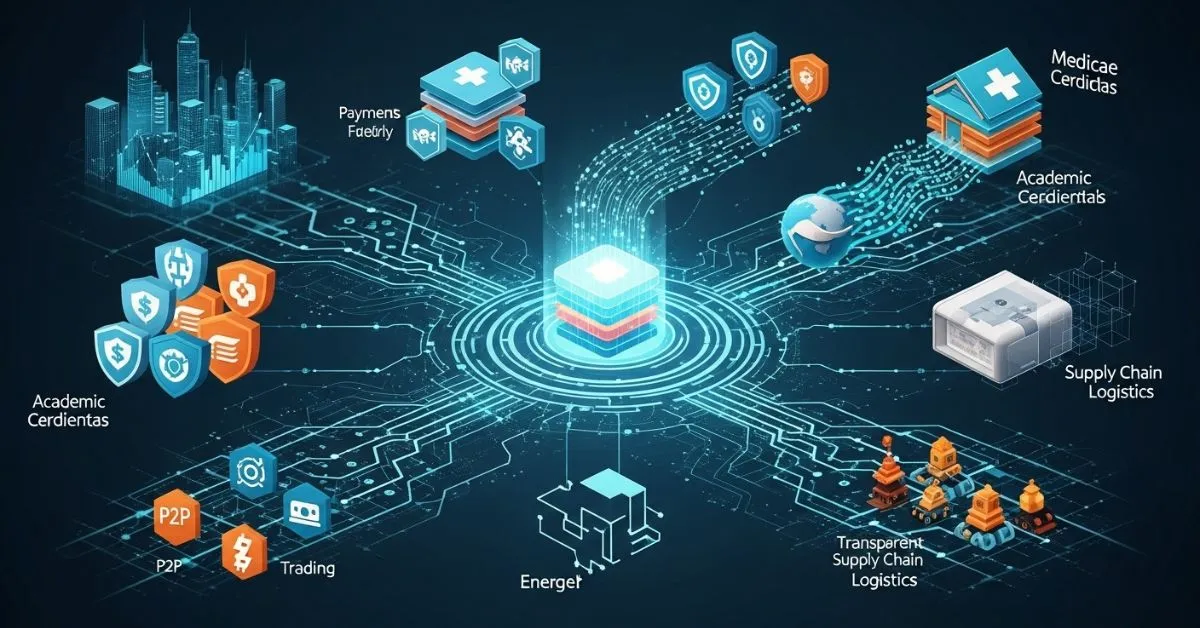

The year 2025 is witnessing a technological revolution driven by Blockchain, which is no longer confined to cryptocurrencies but has boldly expanded into numerous sectors. From finance, real estate, healthcare, and education to energy and supply chains, this distributed ledger technology is reshaping how the world operates, bringing unprecedented efficiency, transparency, and security.

Overview of Blockchain's Expanding Applications

Blockchain has transitioned from a cryptocurrency-supporting technology to a foundational tool for security, transparency, and efficiency across various applications. The business value generated by blockchain is projected to increase to over $360 billion by 2026 and exceed $3.1 trillion by 2030. This growth is fueled by the technology's ability to provide secure, transparent, and efficient solutions, especially in replacing traditional paper-based systems. Further integration with AI and IoT is expected to expand blockchain's applications even more.

The business value generated by blockchain is projected to increase to over $360 billion by 2026 and exceed $3.1 trillion by 2030.

Key Application Areas and Emerging Trends

A. Finance: Cross-Border and Decentralized Revolution

Beyond cryptocurrencies, blockchain is revolutionizing finance and banking by making transactions faster, more secure, and cheaper.

Cross-border Payments: RippleNet, utilizing XRP, helps financial institutions save $550 million annually by 2025 and reduce operating costs by 45%. Transactions via XRP Ledger (XRPL) take only 3-5 seconds with a fee of $0.0002, significantly outperforming SWIFT.

Decentralized Finance (DeFi): DeFi platforms facilitate decentralized lending, borrowing, and trading without intermediaries, enhancing financial accessibility. DeFi 2.0 promises new financial products like programmable derivatives and insurance contracts.

Central Bank Digital Currencies (CBDC): Central banks worldwide are exploring blockchain to issue CBDCs, promising faster and cheaper cross-border payments.

Real-World Asset (RWA) Tokenization: Tokenizing assets like real estate, commodities, and securities is reshaping traditional finance, increasing liquidity, transparency, and market accessibility for various asset types.

B. Real Estate: Digitizing Ownership and Transactions

The global real estate tokenization market is predicted to reach a value of $19.4 billion by 2033.

Digitization of Property Titles and Fractional Ownership: Land/property records on blockchain make ownership transfers faster, cheaper, and more secure. It also allows fractional investment in real estate, attracting more investors.

Smart Contracts: Lease agreements, loan/mortgage transactions are increasingly managed via smart contracts, automating terms execution upon specific conditions, reducing paperwork and manual errors.

Property Management and Due Diligence: Reduces real estate transaction costs by up to 30% by eliminating inefficiencies and streamlining settlement and verification processes.

C. Healthcare: Data Security and Supply Chain Transparency

The global blockchain in healthcare market is estimated to grow from $5.5 billion (2025) to $43.37 billion by 2030.

Secure Electronic Health Records (EHR): Blockchain ensures secure and tamper-proof health records, protecting against cyberattacks and enabling safe patient data sharing among hospitals.

Patient Data Control: Projects like PranaChain empower patients to control their health records through decentralized health data wallets and smart consent tools.

Drug Traceability: Used to track medications, prevent counterfeit drugs, and enhance transparency in the pharmaceutical supply chain.

Insurance Claims Management: Smart contracts are explored by insurers to automate reimbursements, with hospitals reporting a 30% reduction in administrative time and costs by 2025 using blockchain for claims management.

D. Education: Credential Verification and Record Management

The global blockchain in education market is projected to reach $9.39 billion by 2033.

Certificate and Degree Verification: Facilitates quick and secure verification of academic credentials, reducing fraud and allowing students control over their records.

Student Record Management: Enables secure, decentralized student record management, creating lifelong learning portfolios, and simplifying transfers between institutions.

Smart Contracts and Automated Learning Platforms: Used for course management and creating personalized learning paths, automating enrollment and course material dissemination.

Intellectual Property (IP) Protection: Blockchain can protect IP by timestamping research papers and monitoring citations.

E. Energy: P2P Trading and Smart Grids

The global blockchain in energy and power market is estimated to reach $162.2 billion by 2035.

Peer-to-Peer (P2P) Energy Trading: Blockchain enables decentralized P2P energy trading, allowing individuals with solar panels to sell surplus electricity directly to others.

Smart Grids and Grid Management: Supports efficient grid management, predictive maintenance, and automated decision-making, ensuring grid stability.

Carbon Credit Tracking: Plays a crucial role in accurately tracking renewable energy production and consumption, as well as transparently tracking carbon credits, preventing double-counting and fraud.

F. Supply Chain: Transparency, Anti-Fraud, and Efficiency

The blockchain-based supply chain finance market is valued at $3.27 billion in 2025 and expected to reach $21.29 billion by 2029.

Transparency and Traceability: Provides a transparent, immutable ledger for every transaction, enhancing trust and accountability throughout the supply chain. It enables real-time tracking of goods from origin to delivery.

Anti-fraud and Counterfeiting: Blockchain's tamper-proof nature makes it nearly impossible to falsify documents or goods. The pharmaceutical industry could save $218 billion annually with blockchain by reducing fraud and counterfeit drugs.

Cost Reduction and Efficiency: By eliminating intermediaries and automating processes, blockchain helps reduce operational and transactional costs. It streamlines processes, reduces paperwork, administrative tasks, and delays.

Prominent Technologies and Projects

Smart Contracts: Central to blockchain's value, offering automation, transparency, cost-efficiency, and scalability. Trends for 2025 include AI-driven smart contracts, cross-chain interoperability, and privacy-preserving technologies (such as ZKPs).

RippleNet: Leading the revolution in cross-border payments, recognized by the G20.

Blockchain-as-a-Service (BaaS): Major tech companies like Microsoft and Amazon offering blockchain services to simplify enterprise deployment.

Real-World Asset (RWA) Tokenization: Enabling digital representation of tangible assets on blockchain, bringing new liquidity and accessibility.

Cross-chain Interoperability: Allowing seamless communication and transactions between different blockchain networks.

Green Blockchain: Energy-efficient blockchain networks like Solana and Avalanche are promoting sustainable and eco-friendly practices.

Key Benefits of Blockchain

Blockchain can significantly cut operational and transaction costs, e.g., reducing cross-border payment costs by up to 70% and real estate transaction costs by 30%.

Security and Transparency: Distributed, immutable ledger ensures data is recorded securely and transparently, resistant to tampering.

Automation and Efficiency: Smart contracts automate processes, eliminating the need for intermediaries and significantly reducing manual errors, leading to increased efficiency and reduced costs.

Cost Reduction: By eliminating intermediaries and streamlining processes, blockchain can significantly cut operational and transactional costs.

Traceability and Authenticity: Provides end-to-end product tracking, verifying authenticity, and preventing counterfeits.

Data Control and Privacy: Empowers users with control over their data, especially in healthcare and education, with privacy-preserving technologies.

Challenges and Future Prospects

Despite its immense potential, blockchain still faces challenges in regulation, interoperability between different blockchain systems, data standardization, and keeping pace with compliance requirements in specific industries. However, with the evolution of pragmatic governance models, interconnectivity between blockchains, integration with adjacent technologies like AI and IoT, and improved data validation tools, blockchain is moving towards a future where it becomes an essential infrastructure for the digital economy, focusing on scalability, security, and cost-efficiency.

Disclaimer: The content above reflects the author’s personal views and does not represent any official position of Cobic News. The information provided is for informational purposes only and should not be considered as investment advice from Cobic News.