XRP Whales, ETFs, And Market Volatility

XRP Whales And ETF Volatility: Navigating Market Shifts

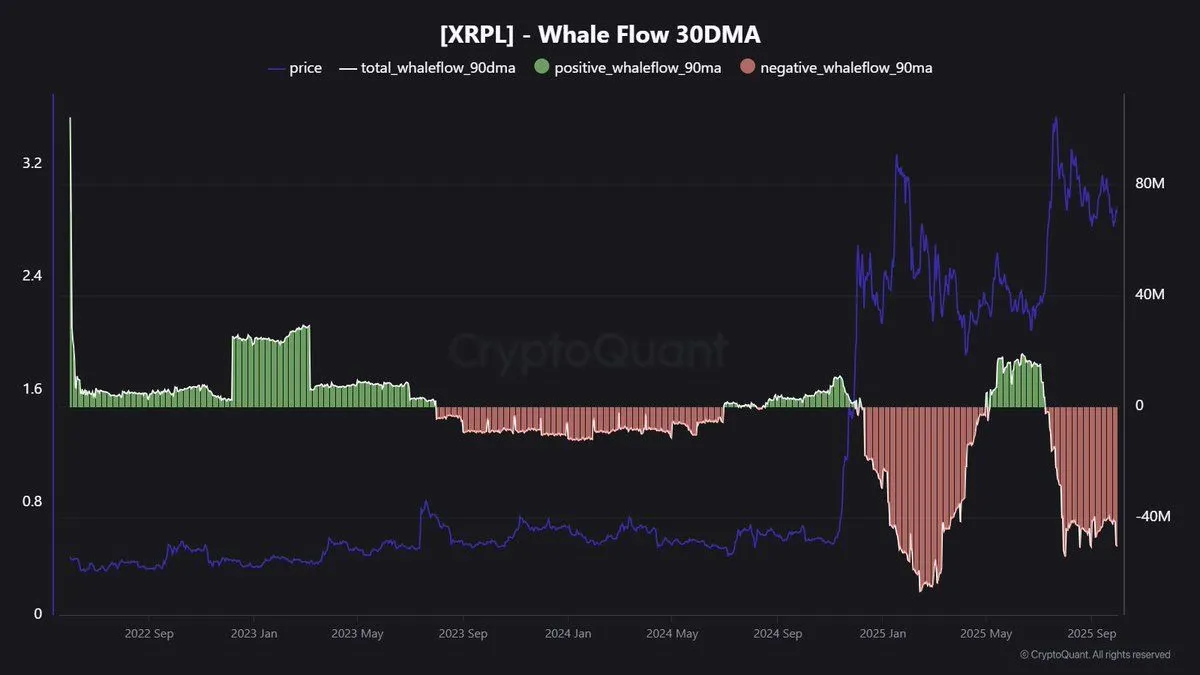

The cryptocurrency market is a dynamic arena, often influenced by significant players and evolving regulatory landscapes. Recently, XRP, the digital asset associated with Ripple, has experienced notable volatility, drawing attention to large-scale transactions by "whales" – addresses holding substantial amounts of the token. This activity unfolds against a backdrop of broader market shifts, including the impact of Bitcoin spot Exchange-Traded Funds (ETFs) and ongoing speculation about similar products for other cryptocurrencies, including XRP.

Sources: JA_Maartun/X

Sources: JA_Maartun/X

XRP Whale Movements Amidst Market Shifts

Recent on-chain data has revealed significant movements of XRP tokens from large holders to exchanges, often interpreted as a precursor to selling. For instance, reports indicate transactions involving hundreds of millions of XRP being transferred, coinciding with periods of price depreciation. This whale activity can exert considerable downward pressure on XRP's price, as large sell-offs increase supply and can trigger panic among smaller investors. Such large transfers suggest either strategic profit-taking, a response to market uncertainty, or a re-evaluation of positions by major holders.

The Ripple Effect: SEC Lawsuit And Market Sentiment

A perpetual cloud hanging over XRP's market performance is the ongoing legal battle between Ripple Labs and the U.S. Securities and Exchange Commission (SEC). While Ripple has secured some favorable rulings, the ultimate resolution remains uncertain. The lawsuit's outcome is widely seen as a pivotal factor that could define XRP's regulatory status in the U.S. and significantly impact investor confidence. Any news, positive or negative, regarding the lawsuit can trigger immediate price reactions, demonstrating its profound influence on market sentiment and whale behavior.

ETF Hopes And Market Reality

The approval and subsequent success of Bitcoin spot ETFs have revolutionized institutional access to cryptocurrency, leading to increased capital inflow and legitimization. This success has fueled speculation about the potential for spot ETFs for other major cryptocurrencies, including Ethereum and, eventually, XRP. An XRP ETF, if approved, could unlock massive institutional investment, providing a more regulated and accessible pathway for traditional finance to engage with XRP. However, regulatory hurdles, particularly concerning XRP's classification, remain significant. The SEC lawsuit's resolution is a prerequisite for any serious consideration of an XRP ETF in the U.S. Until then, the promise of an ETF remains a speculative driver, influencing market psychology without direct impact.

Understanding Market Volatility

XRP's recent price fluctuations are not isolated incidents but rather part of a larger pattern of volatility inherent in the crypto market. Factors contributing to this include:

- Macroeconomic Conditions: Interest rate changes, inflation data, and global economic stability can influence risk appetite for cryptocurrencies.

- Regulatory Developments: News regarding new regulations, bans, or legal outcomes (like the SEC vs. Ripple case) can cause sharp price movements.

- Whale Activity: As seen with XRP, large buy or sell orders from whales can significantly impact market depth and price action.

- Market Sentiment: Fear, uncertainty, and doubt (FUD) or conversely, fear of missing out (FOMO), driven by news or social media, can create self-fulfilling prophecies in price.

Navigating The XRP Landscape

For current and prospective XRP investors, understanding these dynamics is crucial. While whale movements can signal short-term price pressure, the long-term outlook for XRP is tied to its utility, adoption by financial institutions, and the resolution of its regulatory challenges. Investors should:

- Conduct Thorough Research: Understand Ripple's technology, use cases, and market position.

- Monitor Regulatory News: Stay informed about the SEC lawsuit and broader crypto regulations.

- Practice Risk Management: Never invest more than you can afford to lose and consider dollar-cost averaging to mitigate volatility.

- Avoid Emotional Decisions: Resist the urge to panic sell during downturns or FOMO buy during rallies.

Conclusion

The recent surge in XRP whale activity and subsequent market volatility underscore the complex interplay of individual large holders, regulatory uncertainty, and broader market trends. While the promise of an XRP ETF remains distant without a clear regulatory framework, the asset continues to attract attention. Investors must remain vigilant, prioritize informed decision-making, and acknowledge the inherent risks within the volatile cryptocurrency ecosystem.

Disclaimer: The content above reflects the author’s personal views and does not represent any official position of Cobic News. The information provided is for informational purposes only and should not be considered as investment advice from Cobic News.