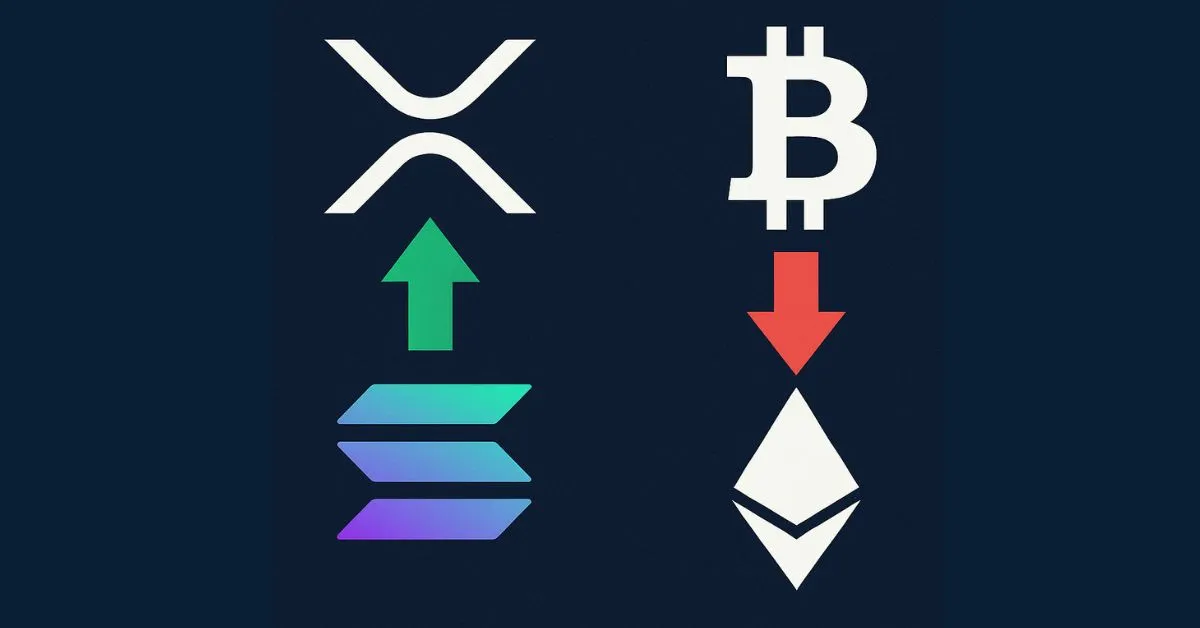

XRP And Solana Gain While BTC, ETH Face Downside Bets

Market context

Options data from Deribit reveals sharp divergence in sentiment across major cryptocurrencies. XRP and Solana display strong bullish positioning with calls outweighing puts, while traders use puts to hedge against potential downturns in Bitcoin and Ethereum.

XRP: Bullish bets rising

XRP call options trade at a premium across multiple expiries, signaling confidence in a year-end rally—possibly tied to ETF approval optimism. Market observers anticipate over $5 billion in inflows if spot ETF greenlights materialize, which could greatly boost demand.

Solana: Technical upgrade spurs optimism

Solana shows even stronger bullish skew, with December calls trading roughly 10 volatility points above puts. The key catalyst is the Alpenglow upgrade, approved by over 98 % of stakers. This drastically cuts transaction finality to 100–150 milliseconds, improving Solana’s infrastructure for high-frequency and institutional use.

Bitcoin and Ether: Hedging sentiment prevails

In contrast, put options dominate for Bitcoin and Ethereum, indicating caution. Traders appear risk-averse amid mixed economic signals — using derivatives to guard against potential downside as both tokens consolidate under macro uncertainty.

Conclusion

The crypto market is bifurcating. XRP and Solana are riding bullish momentum based on prospects like ETF approvals and technical enhancements. Meanwhile, Bitcoin and Ethereum face stronger downside hedging as traders navigate an increasingly uncertain macroeconomic environment.

Disclaimer: This article is intended solely to provide information and market insights at the time of publication. We make no promises or guarantees regarding performance, returns, or the absolute accuracy of the data. All investment decisions are the sole responsibility of the reader.