XRP Crypto jumps 5% On SBI Lending, ETF Countdown

Market context and ETF anticipation

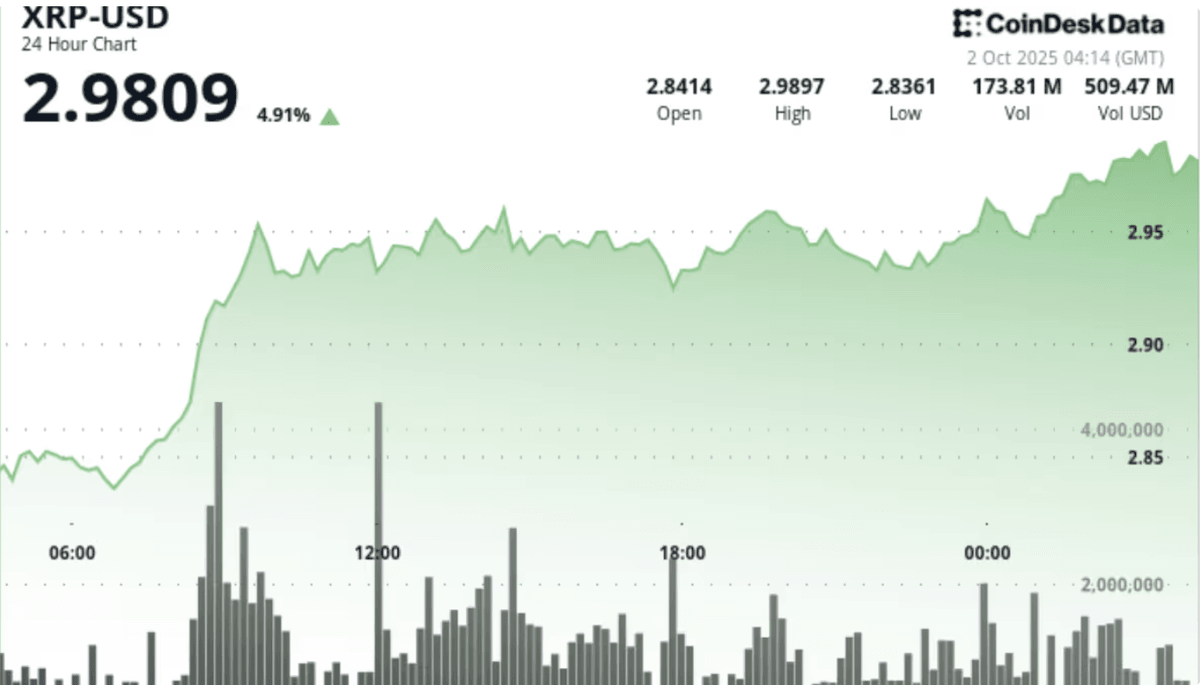

Source: data.coindesk.com

The cryptocurrency market currently reacts sharply to signs of institutional capital and regulatory moves. SBI’s announcement of a lending program linked to XRP is seen as a structural step that may help institutional players access the asset. At the same time, the ticking clock toward a potential ETF decision injects urgency, encouraging investors to position ahead of that event.

XRP’s price action in the session

During the latest trading session, XRP climbed approximately 5%, overcoming resistance barriers that had capped prior moves. Trade volume spiked significantly, signaling elevated buying momentum. While there were minor pullbacks intraday, key support levels held firm, bolstering confidence in further upside potential.

Supporting catalysts for the rally

Two synergistic factors underlie XRP’s recent surge: SBI’s lending program and the ETF countdown. The lending program adds real financial utilization for XRP and improves liquidity. Simultaneously, ETF anticipation sparks short-term positioning ahead of the approval decision. Technical analysts also point to positive chart patterns and moving averages that favor the bullish trend.

Key technical zones and watch points

Given the current rally, XRP is trading above newly reinforced support levels. Crucial resistance lies ahead, and a successful break above it could unlock further gains. Market participants should monitor trading volume in upcoming sessions to gauge the strength of the move. If momentum sustains, XRP could attempt to challenge higher price levels.

Outlook going forward

Should SBI’s lending mechanism function effectively and ETF approval materialize or come closer, XRP may attract strong institutional inflows. In that scenario, the price could break higher from existing resistance zones. However, if broader market pressure intensifies or ETF expectations disappoint, XRP might retreat to support zones to consolidate before attempting another leg upward.

Disclaimer: This article is intended solely to provide information and market insights at the time of publication. We make no promises or guarantees regarding performance, returns, or the absolute accuracy of the data. All investment decisions are the sole responsibility of the reader.