XRP Downtrend Deepens After ETF Sell-Off, Next Target $2.75

ETF launch sparks heavy selling

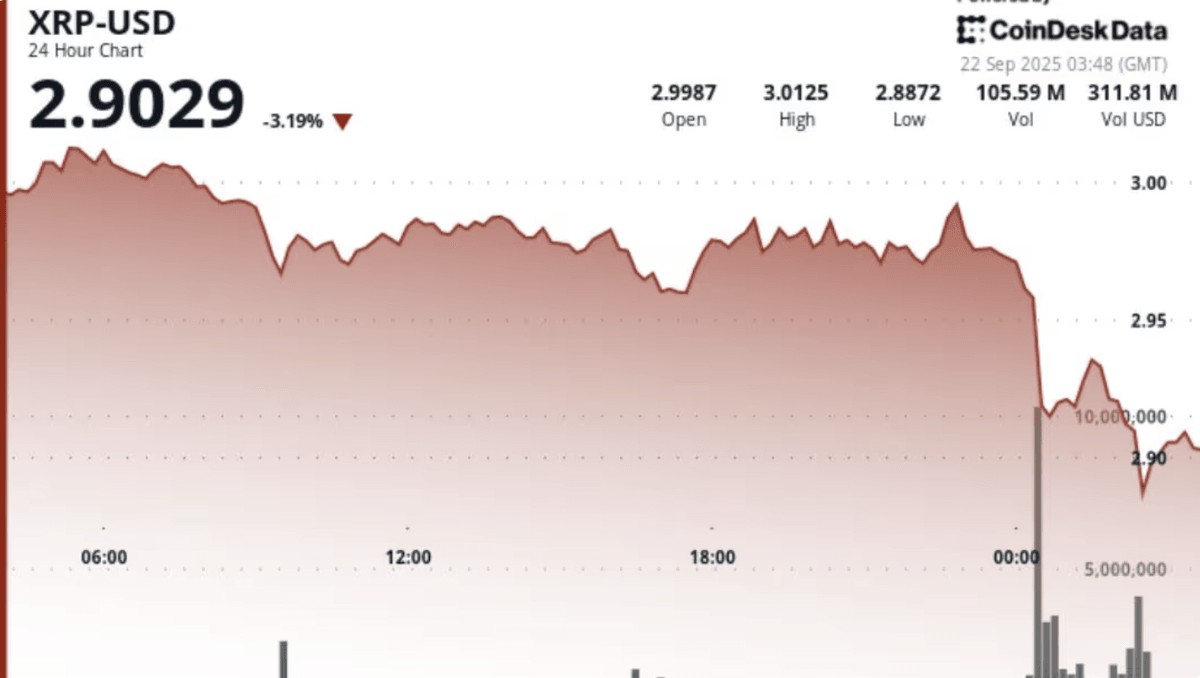

The debut of the REX-Osprey XRP ETF created strong excitement in the market, with first-day trading volume reaching $37.7 million. However, institutional investors quickly sold off, leading to a sharp decline in XRP’s spot price. Instead of fueling a rally, the ETF launch triggered a “sell-the-news” event, erasing nearly 5 percent of XRP’s value within hours.

Technical breakdown: Formation of downtrend channel

Source: data.coindesk.com

Following the ETF sell-off, XRP charts clearly illustrate a descending channel. This pattern is characterized by consistent lower highs and lower lows. Resistance has established itself around $2.87, while the nearest support at $2.77 is repeatedly tested. Strong trading volume during declines confirms that large holders and institutions are offloading positions.

Key levels traders must watch

• Immediate support: $2.77, considered the make-or-break level for short-term stability.

• Short-term pivot: $2.82, may provide temporary bounce but lacks strong conviction.

• Critical downside target: $2.75, followed by $2.70 if bearish pressure intensifies.

• Major resistance: $2.87, a level XRP must reclaim to reverse bearish momentum.

Wider market pressure and Bitcoin dominance

The sell-off in XRP is not an isolated event. Bitcoin dominance has surged to 57.7 percent, reflecting capital rotation out of altcoins into Bitcoin. Crypto derivatives liquidations worth around $1.7 billion amplified downward momentum across the market. Altcoins like XRP faced the brunt of this pressure, while Bitcoin consolidated gains.

Institutional and whale activity

Analysts highlight that whale wallets have been actively moving large volumes of XRP to exchanges, suggesting preparation for further selling. ETF outflows also raise concerns that institutional investors are treating XRP exposure as short-term speculative rather than long-term strategic.

Outlook for XRP in coming weeks

The near-term fate of XRP depends heavily on whether $2.77 support holds. If buyers defend this level, XRP could attempt a relief rally back toward $2.82 or $2.87. However, a breakdown below $2.77 would likely accelerate bearish momentum, making $2.75 the next target, with risk of extending toward $2.70. Traders are advised to monitor ETF inflows and whale wallet activity closely.

Disclaimer: This article is intended solely to provide information and market insights at the time of publication. We make no promises or guarantees regarding performance, returns, or the absolute accuracy of the data. All investment decisions are the sole responsibility of the reader.