World Liberty Blacklists Justin Sun After WLFI Move

Unexpected Development

On September 4, 2025, the DeFi project World Liberty Financial (WLFI), where the Trump family serves as advisors, shocked the crypto community by blacklisting Justin Sun’s wallet after a WLFI deposit transaction to an exchange. The news was first revealed by a signal account on X, accompanied by Arkham data showing that Justin Sun transferred $9 million worth of WLFI to a Binance deposit address. This move coincided with a sharp drop of more than 24% in WLFI’s price, sparking heated debate across the market.

Community Backlash Over Centralization

The blacklist has triggered heated debate. Critics argue it exposes how much control developers hold, undermining WLFI’s claims of decentralization. Others support the move, saying it was necessary to stop manipulation by large holders and exchanges connected to Sun.

Adding to the controversy, HTX—an exchange linked to Sun—offered 20% APY for WLFI deposits, raising questions over whether user funds were being sold or used to control market prices.

Why Is This News Important?

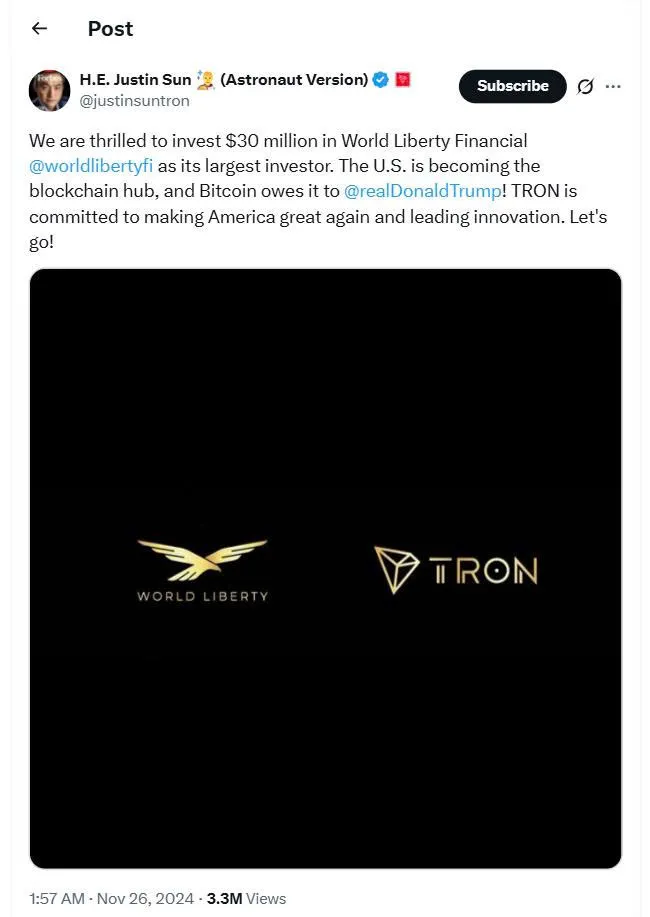

This incident is significant because WLFI only launched on September 1 and was almost immediately listed on major exchanges. The token quickly reached a market capitalization of $9.5 billion, generating massive profits for early investors. Justin Sun is not just an early backer but also a strategic whale investor, having poured $75 million into two funding rounds in 2024. What makes the situation unusual is that World Liberty decided to blacklist the wallet of one of its major investors, rather than limiting such actions to hackers as is typically the case in DeFi. As a result, many observers question whether this reflects an attempt to control liquidity or signs of internal conflict within the project.

Justin Sun Responds

In response to the allegations, Justin Sun quickly denied any wrongdoing on his X account. He explained that his wallet only conducted a few small test deposits, which were later dispersed across multiple addresses. According to him, no buying or selling took place, making it impossible for these transactions to affect the market price. Arkham data further confirmed that Sun still holds 545 million unlocked WLFI tokens, valued at over $102 million. Previously, he had publicly emphasized his long-term commitment to the project and declared that he had no plans to sell his tokens in the near future.

Deeper Concerns On Token Distribution

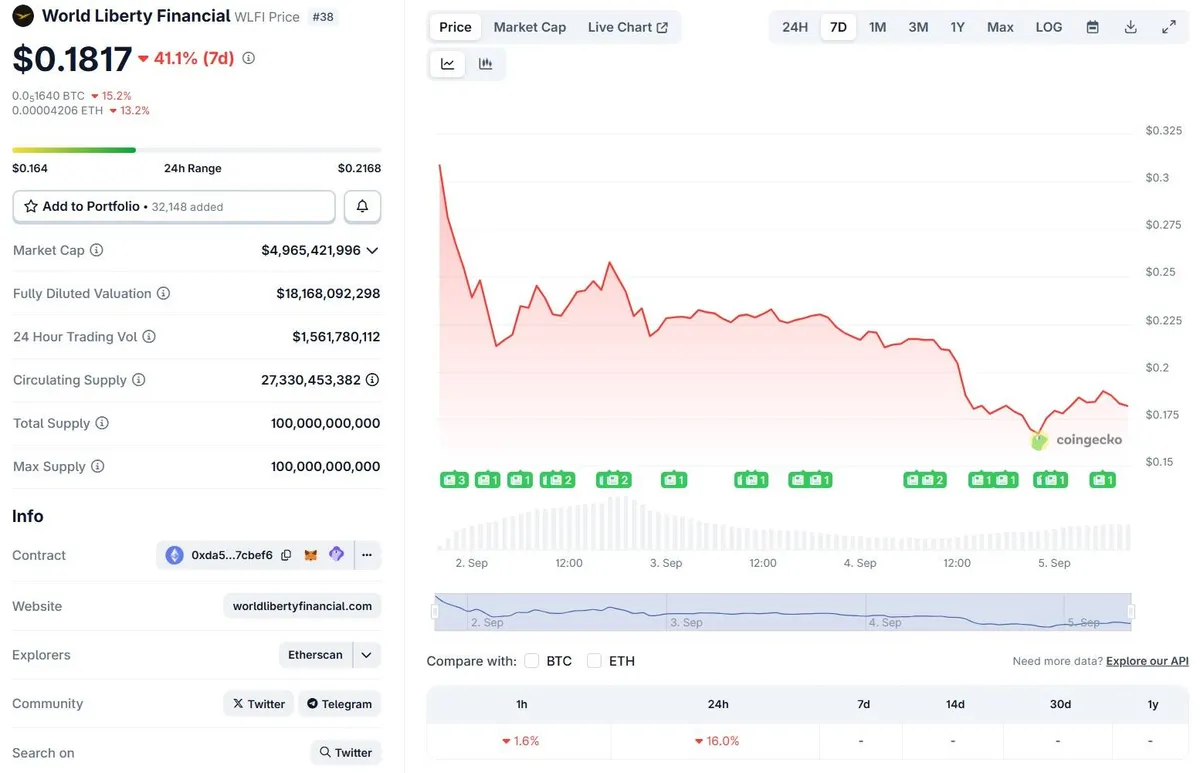

Industry analysts pointed out structural weaknesses in WLFI’s tokenomics. Although only 6.8% of supply was officially unlocked at launch, trading liquidity suggested far more tokens were circulating, likely from insiders. This fueled rapid sell-offs, sending WLFI from $0.40 to below $0.20 within hours.

With Sun still holding 545 million WLFI worth over $100 million, blockchain trackers continue to monitor suspicious transfers. Regulators are also watching closely, as political ties and high-profile launches attract scrutiny.

Impact On WLFI Price

Following the announcement, WLFI experienced a steep decline of more than 24% within a single day. However, it remains unclear whether the price drop was directly caused by the wallet blacklisting or by broader selling pressure. World Liberty has yet to provide an official explanation, and this lack of transparency has fueled growing skepticism among investors, particularly at a time when WLFI was being positioned as one of the most promising DeFi projects of the year.

Long-Term Outlook

Despite the short-term controversy, Justin Sun’s partnership with World Liberty Financial continues to carry strategic significance. He has integrated the project’s stablecoin USD1 into the TRON network, with plans to expand its supply from $50 million to $200 million. Meanwhile, Tron Inc. recently went public on Nasdaq and announced a $1 billion fundraising plan to establish a TRX treasury fund. These developments suggest that WLFI, although currently facing market pressure, is still viewed by major investors and influential figures as a project with strong long-term potential.

Disclaimer: The content above reflects the author’s personal views and does not represent any official position of Cobic News. The information provided is for informational purposes only and should not be considered as investment advice from Cobic News.