Whale Pulls $1.7B From Aave, DeFi in Turmoil

1. Ethereum Whale Pulls $1.7B from Aave, stETH Price Plummets

Over the past week, the DeFi community was shaken by a massive $1.7 billion ETH withdrawal from Aave. Many speculate that Tron founder Justin Sun was behind at least $600 million of that amount, triggering a cascade of market effects.

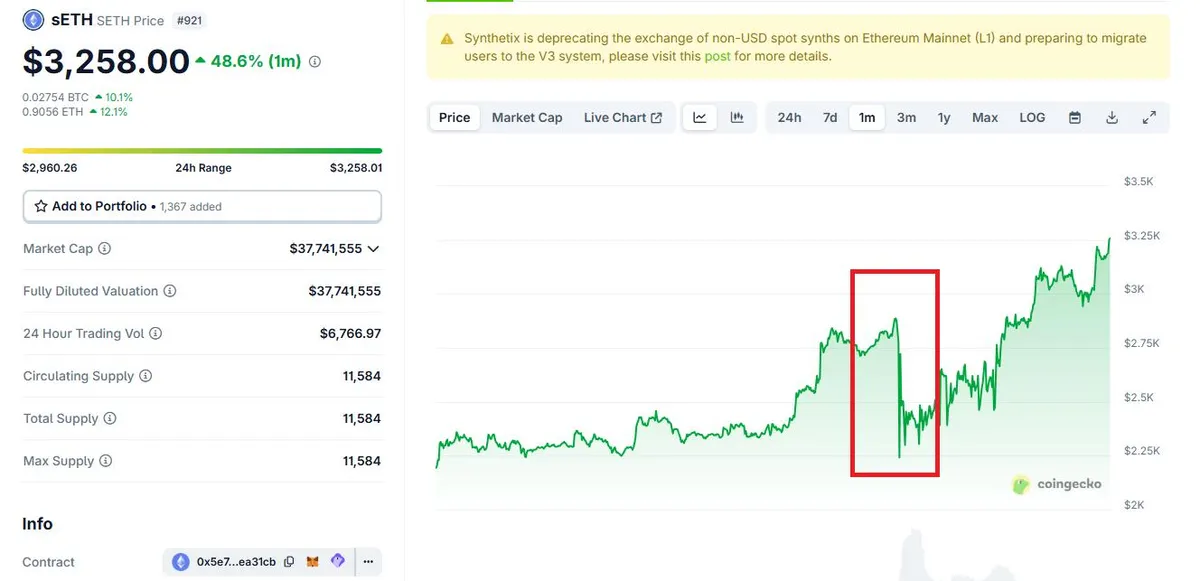

sETH Price Decline on July 14. Source: CoinGecko

2. Soaring Interest Rates Crash Leveraged stETH/ETH Strategy

The large-scale ETH exit drained Aave’s ETH liquidity, driving up utilization rates and causing borrowing interest rates to spike.

This surge in borrowing costs crippled DeFi strategies—especially the popular leveraged stETH/ETH staking loop, where users borrow ETH, buy stETH, and repeat to maximize staking yields. Rising costs and a weakening stETH-to-ETH ratio made this strategy unprofitable, prompting users to unwind their positions.

3. stETH Depegs, Panic Selling Hits the Market

On July 14, stETH's price sharply dropped from $2,800 to $2,200, creating a significant depeg from ETH.

Because stETH unstaking takes around 18 days, many users rushed to sell on secondary markets, accepting up to a 0.3% price discount. For traders using 10x leverage, even this small slippage can result in 3% losses, triggering liquidations and deepening losses.

4. DeFi Faces Major Liquidity Stress Test

While ETH surged over 8% this past week, sETH (Synthetic ETH by Synthetix) jumped 30.5%, reflecting growing interest in alternatives amid market volatility.

This incident highlights how fragile DeFi systems remain. A single large withdrawal disrupted lending rates, broke popular strategies, and exposed dependency on oracles and delayed redemption mechanisms.

Many stETH price feeds still rely on redemption-based oracles instead of real-time market rates—causing mispricing and locking up lenders when stETH drifts away from ETH.

5. Conclusion

The $1.7 billion ETH exodus from Aave wasn't just a whale move—it was a wake-up call for the entire DeFi ecosystem. It revealed liquidity weaknesses, leverage risks, and oracle reliance that could trigger more severe disruptions in the future.