Solana May Gain 14% if It Breaks $200

Solana (SOL) has surged over 14% in the past week, currently trading around $190. Despite this strong rally, the token remains nearly 35% below its all-time high (ATH) of $260. The question now: Is SOL gearing up for another major breakout?

1. Solana Approaches Key Psychological Resistance at $200

The $200 level stands as a crucial psychological resistance for SOL. Breaking through this range could open the door to further gains. On-chain and derivative data indicate that this rally may only be getting started, despite the already significant rise.

2. SOPR Suggests Investors Are Holding For Higher Prices

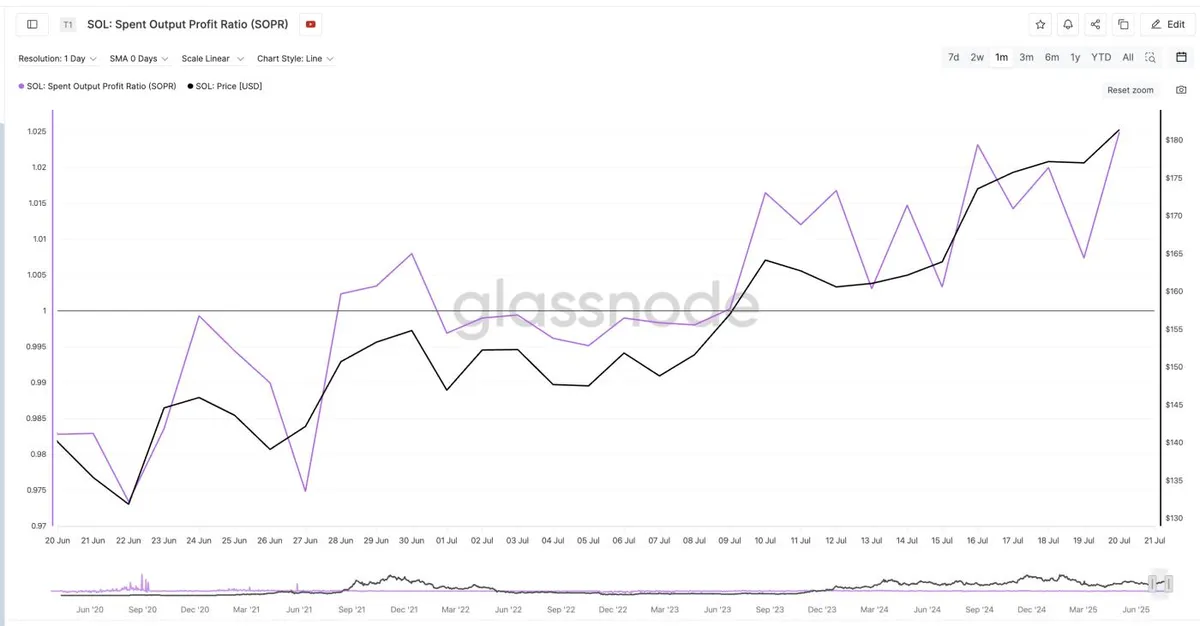

The Spent Output Profit Ratio (SOPR) — a key on-chain indicator — is hovering around 1.02, signaling that most sellers are still in profit and are not panic-selling. This often indicates that holders expect higher prices and are holding back supply.

- On June 27, SOPR dipped to 0.97, and SOL rallied from $142 to $154 in just three days.

- On July 19, SOPR dropped to 1.007, and SOL climbed from $177 to over $190 by July 21.

→ Historically, SOPR resets near 1 have preceded further price increases, confirming bullish sentiment.

Giá Solana and SOPR: Glassnode

3. Derivatives Market Shows Healthy Momentum, No Overheating

- Funding rate for Solana is at a moderate +0.0152%, indicating positive momentum without excessive leverage.

- Open interest (OI) has surged past $9.52 billion, the highest in months, showing new capital entering long positions.

The key insight here is that OI is rising while funding remains steady, suggesting sustainable growth and not short-term speculation or overleveraging.

SOL Price and Funding Rate: Coinglass

4. Technical Structure Points To $218 Price Target

Currently, SOL is:

- Trading near $190

- Flipping previous resistance levels of $183–$184 into support

- Facing strong resistance at $196–$199

If SOL breaks and holds above the $199 zone, the next significant resistance sits at $218 — a potential 14.7% upside from current prices.

Solana Price Analysis: TradingView

5. Key Price Levels To Watch

- Short-term support: $183–$184

- Major resistance zone: $196–$199

- Breakout target: $218

- Downside invalidation (short-term): below $168

- Critical structure failure level: below $161

6. Conclusion: Is Solana Ready For The Next Leg Up?

With supportive SOPR behavior, increasing open interest, and a healthy derivatives market, Solana appears poised for a breakout, possibly pushing toward the $218 level soon.