SharpLink Boosts ETH Treasury To $1.9B

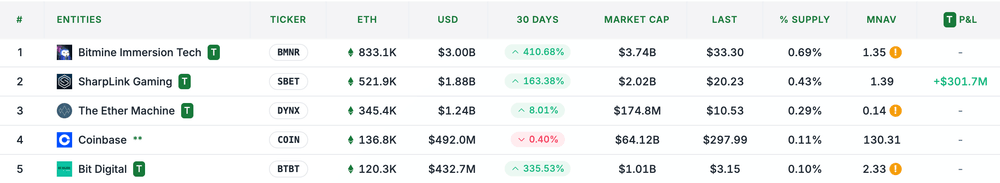

SharpLink Gaming, Inc. (Nasdaq: SBET) has significantly grown its Ethereum (ETH) reserves, now holding 521,939 ETH as of August 3, 2025 — making it the world’s second-largest corporate holder of ETH, according to SER data. The company is committed to building one of the most substantial and trusted ETH treasuries in the market.

SharpLink ranks second on the leaderboard (Source: StrategicETHReserve)

Between July 28 and August 3, SharpLink purchased an additional 83,561 ETH worth approximately $303.7 million at an average price of $3,634 per ETH. This acquisition was funded through its ongoing At-the-Market (ATM) equity program, which generated $264.5 million last week from the sale of 13.6 million common shares, adding to $279.2 million raised the previous week.

SharpLink’s expanding crypto portfolio puts it at the forefront of corporate digital asset strategies, echoing moves made by companies such as Strategy with its sizable Bitcoin holdings. However, SharpLink differentiates itself by focusing exclusively on Ethereum — reflecting its confidence in ETH’s foundational role in decentralized finance (DeFi).

Since launching its ETH treasury strategy on June 2, 2025, SharpLink has also earned 929 ETH in staking rewards, creating an additional revenue stream beyond price appreciation. This approach allows the company to generate yield while holding assets long-term.

Co-CEO Joseph Chalom reaffirmed SharpLink’s mission: “Our goal is to deliver lasting shareholder value by building the largest and most trusted ETH treasury in the world.” He also noted that the firm is exploring further capital-raising opportunities to expand its ETH reserves in alignment with Ethereum’s position in the future of global finance.

The company has also introduced a transparency-focused metric, “ETH Concentration,” now at 3.66 — representing ETH held per 1,000 diluted shares.

SharpLink Chairman Joe Lubin, who is also the CEO and co-founder of Consensys, assumed his role after Consensys led a $425 million private placement in May.

As of Tuesday, SharpLink’s stock (SBET) was trading 3% lower at $18.59, according to The Block.