Project Crypto – “The Blockchain Revolution” Of The SEC

Tâm•8/1/2025

1. Background and Origins

● On July 31, 2025, SEC Chairman Paul Atkins officially announced Project Crypto – a comprehensive initiative aimed at transforming U.S. financial markets onto blockchain technology.

● This project is the implementation of recommendations from a 160-page report by the Working Group on Digital Asset Markets, overseen by the White House under the Trump administration.

Background and Origins

2. Key Objectives

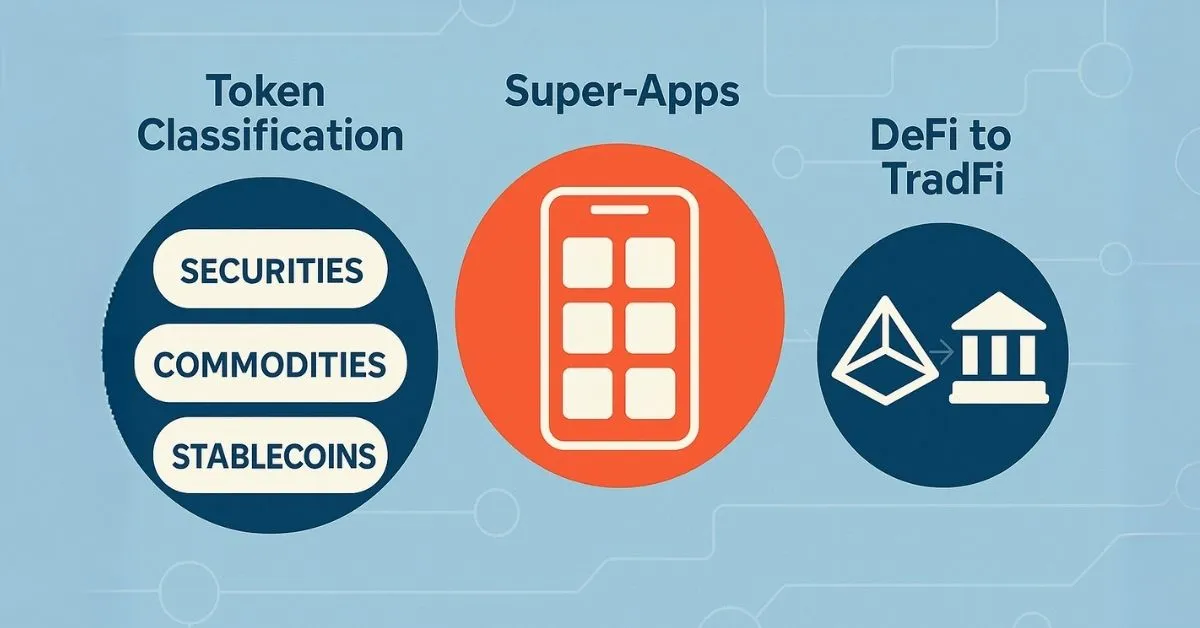

● Clear token classification: Provide guidance on when a token is considered a security, commodity, stablecoin, or collectible.

● Super-app mechanism: Allow brokers to offer multiple services—such as stock trading, crypto trading, staking, and lending—under a single license.

● Integration of DeFi and tokenization: Establish a regulatory framework enabling both centralized and decentralized finance, as well as tokenized securities, to operate on blockchain technology.

● Tailored processes for ICOs and fundraising: Introduce specific disclosure requirements, exemptions, and safe harbors for ICOs, airdrops, and staking rewards to create a safe and transparent environment for innovative fundraising.

Token Classification, Super-apps, DeFi → TradFi

3. Role of the Crypto Task Force

● The Crypto Task Force was launched on January 21, 2025, led by Hester Peirce, with the mission to develop clear regulations, practical registration processes, and an appropriate disclosure framework.

● It hosted a series of four public roundtables from April to June 2025, focusing on tokenization, DeFi, custody, and trading, with participation from the SEC and major institutions such as BlackRock, JPMorgan, and Chainlink Labs.

4. Specific Initiatives

● The SEC developed the DART monitoring system (on-chain & off-chain) for real-time oversight, aimed at increasing transparency in the crypto market and setting technical standards for blockchain-based securities.

● The SEC pledged to create an “innovation exemption” for DeFi, allowing DeFi platforms to operate under existing laws with minimal requirements, emphasizing disclosure and public compliance.

5. Impact Assessment

● This marks a turning point compared to the stricter enforcement era under SEC’s Gensler/Biden leadership, during which lawsuits against platforms like Coinbase and Binance were initiated but are now gradually being suspended.

● Financial experts and blockchain companies (e.g., Securitize, Chainlink) believe that clear regulations will accelerate the tokenization of trillions of dollars of real-world assets, such as stocks and real estate, enhancing liquidity and opening markets to a broader base of smaller investors.