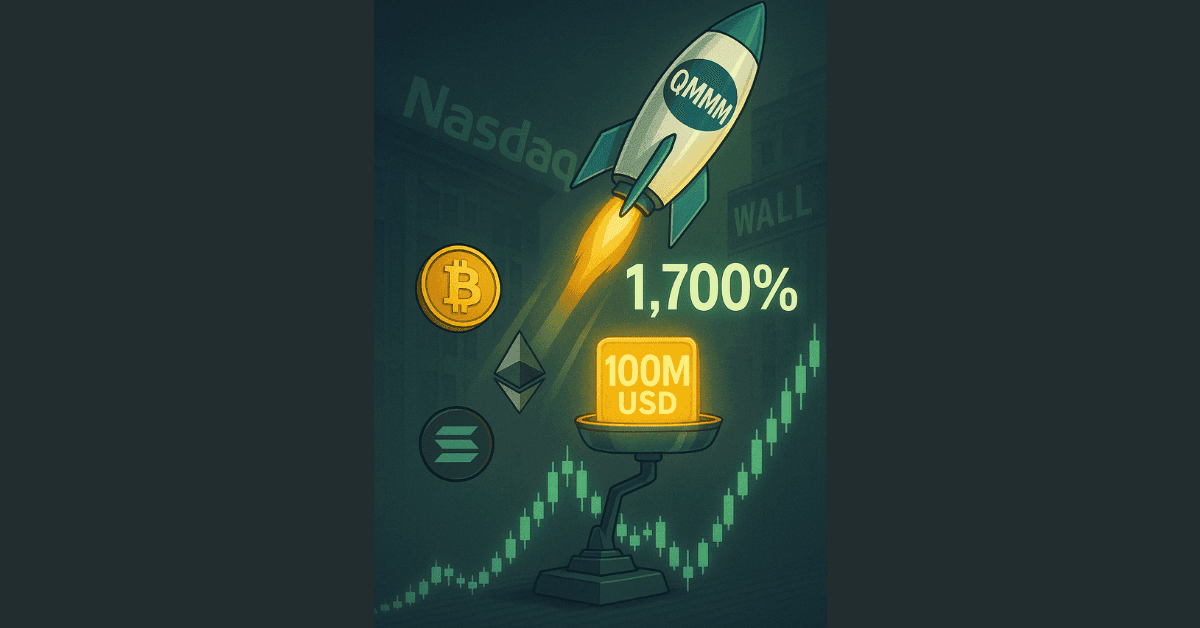

QMMM Surges 1,700% on $100 Million Crypto Treasury Plan

QMMM Stock Shakes Up Wall Street

On September 10, the U.S. stock market witnessed a major shock when shares of QMMM Holdings—a digital advertising firm listed on Nasdaq—skyrocketed nearly 1,750%. At one point, the stock soared as much as 2,300% before cooling down, eventually closing at $207 per share, marking a 1,736% increase from the opening bell. The surge came after QMMM announced plans to establish a $100 million digital assets treasury focused on three leading cryptocurrencies: Bitcoin, Ethereum, and Solana.

Bold Ambitions but Lack of Transparency

According to the announcement, the $100 million fund will serve as a foundation for QMMM’s expansion into Web3, blockchain infrastructure, and other high-potential digital assets. CEO Bun Kwai emphasized that entering the digital asset space reflects QMMM’s commitment to technological innovation and its vision to bridge the digital economy with real-world applications. However, financial reports revealed that as of the end of September 2024, the company held less than $500,000 in cash and posted a net loss of more than $1.58 million. This raised concerns among investors about how QMMM would secure the necessary funding to realize its $100 million plan.

Expansion Into AI, DAO, and the Metaverse

Beyond the crypto treasury, QMMM also unveiled ambitions to develop platforms powered by artificial intelligence, blockchain, and the metaverse. These initiatives aim to support DAO treasury management, enhance virtual world experiences, and help investors make more effective decisions. According to CEO Bun Kwai, the combination of AI and crypto will create sustainable value while reinforcing QMMM’s role as a forward-looking technology company.

Stock Cools Off After Hours

Despite the massive rally during trading hours, QMMM’s stock quickly pulled back in after-hours trading, falling nearly 25% to $156.31. This retracement reflects investor caution, as the ambitious plan remains questionable given the company’s fragile financial position.

Conclusion

The explosive rise of QMMM shares following the $100 million crypto treasury announcement created a short-term frenzy on Wall Street. Yet, the bigger question remains whether a cash-strapped company can truly execute such an ambitious plan. Investors are urged to proceed with caution, as potential rewards come with equally high risks.

Disclaimer: The content above reflects the author’s personal views and does not represent any official position of Cobic News. The information provided is for informational purposes only and should not be considered as investment advice from Cobic News.