PUMP.FUN Likely To Extend Its Drop

Pump.fun (PUMP) — once a fast-rising altcoin — is now under heavy selling pressure as investors pull out. With bearish momentum building, can PUMP hold its ground or is a deeper correction on the way?

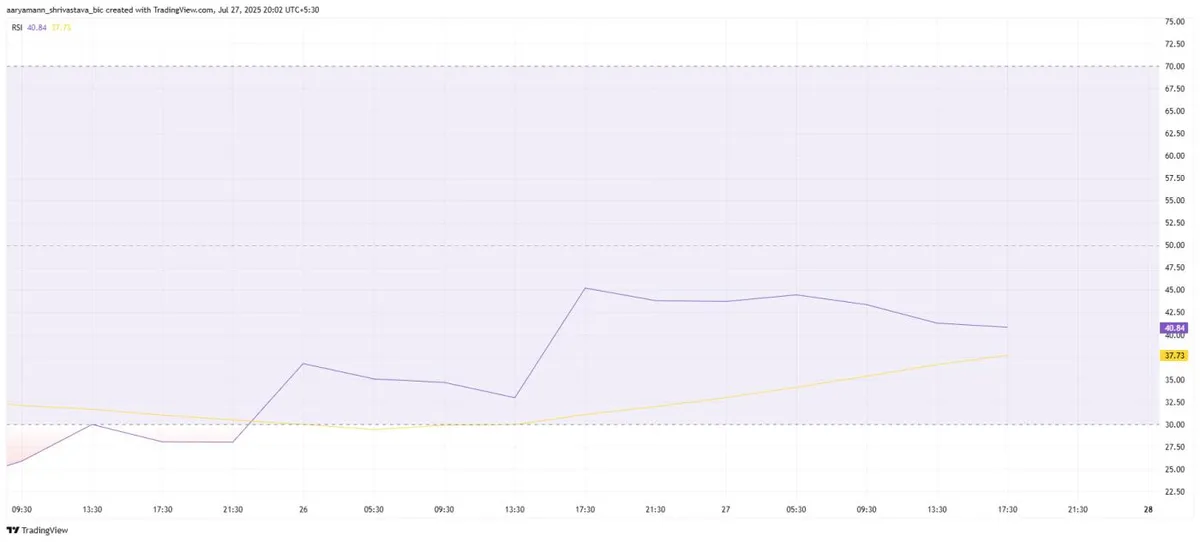

1. PUMP Price Under Pressure – Bearish Signals From Bollinger Bands & RSI

Recent technical analysis shows that Bollinger Bands are narrowing, signaling a major price move is imminent. Given the current downtrend, this is a worrisome indicator for PUMP holders.

- Candles are below the baseline, reinforcing the bearish bias.

- RSI remains under the neutral 50 level, reflecting sustained selling pressure and a lack of bullish momentum.

This setup suggests that unless sentiment shifts, PUMP may face another round of selling in the short term.

PUMP Bollinger Bands. Source: TradingView

2. How Low Can PUMP Go?

PUMP is currently trading around $0.0027, sitting just below resistance at $0.0029 and above support at $0.0024.

- If the support at $0.0024 fails, PUMP could fall further to $0.0021, confirming a deeper downtrend.

- This move would likely increase investor losses and strengthen negative sentiment in the market.

PUMP RSI. Source: TradingView

3. Is There Any Hope For A Recovery?

Despite the bearish setup, there’s still a chance for a rebound if PUMP can break above the $0.0029 resistance and hold it as support.

In that scenario:

- The next target could be $0.0038, signaling a bullish reversal.

- A breakout may trigger FOMO (fear of missing out) and attract fresh capital back into the market.

PUMP Price Analysis. Source: TradingView

4. Conclusion: High Volatility, High Risk – Caution Advised For PUMP Holders

PUMP is at a critical decision point. Technical indicators suggest the path of least resistance is still downward — unless bulls step in soon.

If you're holding PUMP, closely monitor the $0.0024 support and $0.0029 resistance zones to adjust your strategy accordingly.