President Trump Announces VN Deal, How Will Crypto React?

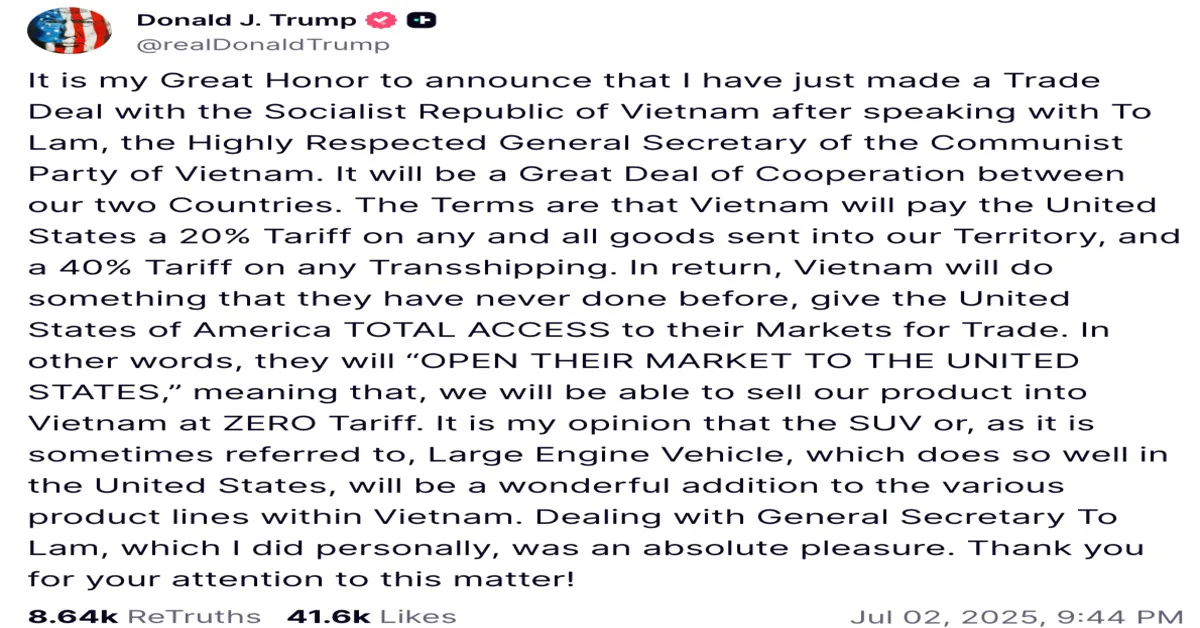

U.S. President Donald Trump shocked global markets today by announcing he had directly reached a new trade agreement with Vietnam following a conversation with Tô Lâm, General Secretary of the Communist Party of Vietnam. The announcement, made via social media, marks one of the most drastic and unexpected trade policy shifts under his administration.

In his official statement, President Trump detailed the terms of the agreement. According to the announcement, Vietnam will apply a 20% tariff on any and all goods entering the United States, and a 40% tariff on any transshipping activities. In return, the U.S. will receive an unprecedented concession: Vietnam will "completely open its market," allowing American products to be sold in Vietnam with a zero-percent tariff. The President was particularly optimistic about the potential for American SUVs in the Vietnamese market.

This agreement, if implemented as stated, would create a seismic shift in the U.S.-Vietnam bilateral trade relationship and could impact global supply chains. It clearly reflects the "America First" philosophy that President Trump has pursued, prioritizing benefits for U.S. exporters.

Financial markets immediately began to analyze the potential impacts. For the crypto market, a sudden macro event of this magnitude could trigger mixed reactions.

Increased Uncertainty and Volatility: Any abrupt change in the trade policy of a major economy like the U.S. increases global uncertainty. In this environment, investors may seek to de-risk their portfolios.

A "Risk-Off" Scenario: A trade shock could trigger "risk-off" sentiment, causing investors to sell highly volatile assets like tech stocks, Bitcoin, and major altcoins to flee to traditional safe havens.

A "Safe Haven" Scenario: Conversely, some analysts argue that instability caused by unpredictable policies could drive a segment of investors towards Bitcoin as a non-sovereign 'safe haven' asset, one that operates on a decentralized blockchain outside the control of singular political decisions.

Currently, analysts are still dissecting the details of the agreement and awaiting more specific information on the implementation timeline. However, it is clear that President Trump's decision has introduced a new element of uncertainty, and investors across all markets, including crypto, will be closely monitoring the fallout from this landmark agreement to adjust their strategies.