PayPal Launches Crypto Checkout for U.S. Merchants

On July 28, PayPal officially launched a new feature allowing small businesses in the U.S. to accept payments in over 100 cryptocurrencies. This includes not only major tokens like Bitcoin (BTC) and Ethereum (ETH), but also memecoins such as TRUMP and Fartcoin. The move marks another major step in PayPal’s ongoing push into the digital asset space.

1. PayPal Supports Crypto Payments: Flexible – Fast – Secure

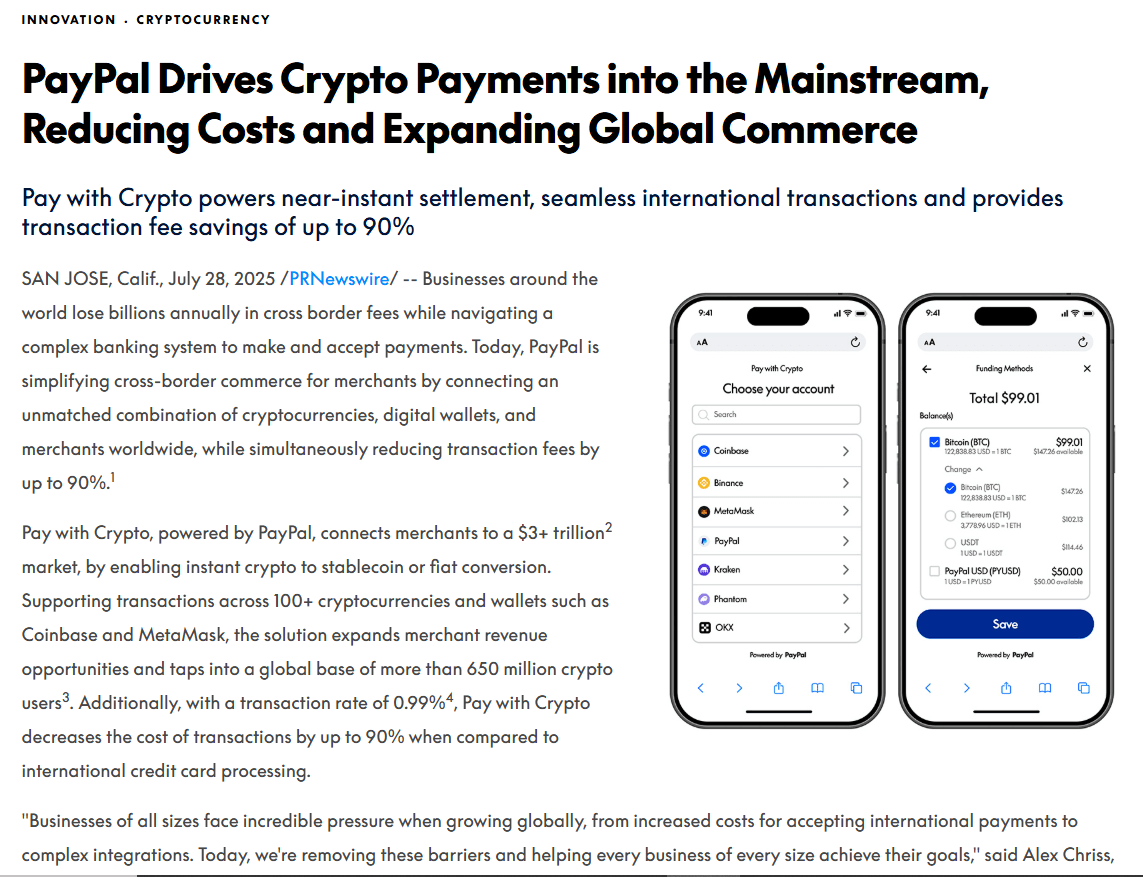

With this new feature, buyers can pay using a wide range of cryptocurrencies. PayPal will then sell the digital assets via major exchanges like Coinbase or Uniswap, convert the funds into its stablecoin PYUSD, and finally settle the transaction in USD for the business. This process helps minimize price volatility risks for merchants.

Paypal'Innovation:newsroom.paypal-corp

2. Competitive Transaction Fees

For the first year, PayPal will charge a promotional transaction fee of just 0.99%, lower than the 2024 U.S. average credit card fee of 1.57%. Starting in the second year, the fee will increase slightly to 1.5%.

3. Global Expansion on the Horizon

Following its U.S. rollout, PayPal plans to expand this crypto payment feature to larger enterprises and international markets. This builds on PayPal’s previous crypto initiatives, including enabling buy/sell functionality since 2020, integration with Venmo, and the launch of its own stablecoin, PayPal USD (PYUSD), in 2023 — which now has a market cap of nearly $850 million.