PayPal Expands PYUSD To 9 New Blockchains

PYUSD goes omnichain with LayerZero

PayPal USD (PYUSD), a stablecoin issued by Paxos Trust, has officially expanded to 9 new blockchains through the Stargate Hydra bridge powered by LayerZero.

Initially launched on Ethereum and later deployed on Solana, Arbitrum, and Stellar, PYUSD will now also exist as a permissionless version called PYUSD0 on Abstract, Aptos, Avalanche, Ink, Sei, Stable, and TRON.

PYUSD0 follows the OFT (Omnichain Fungible Token) standard, ensuring 1:1 swaps with the original PYUSD across all supported chains. This reduces liquidity fragmentation, removes reliance on centralized bridges, and makes asset transfers seamless.

Among the new integrations, TRON stands out as a strategic choice with 332 million accounts, over 9 million daily transactions, and one of the top TVLs in the industry.

PYUSD growth remains modest compared to USDT & USDC

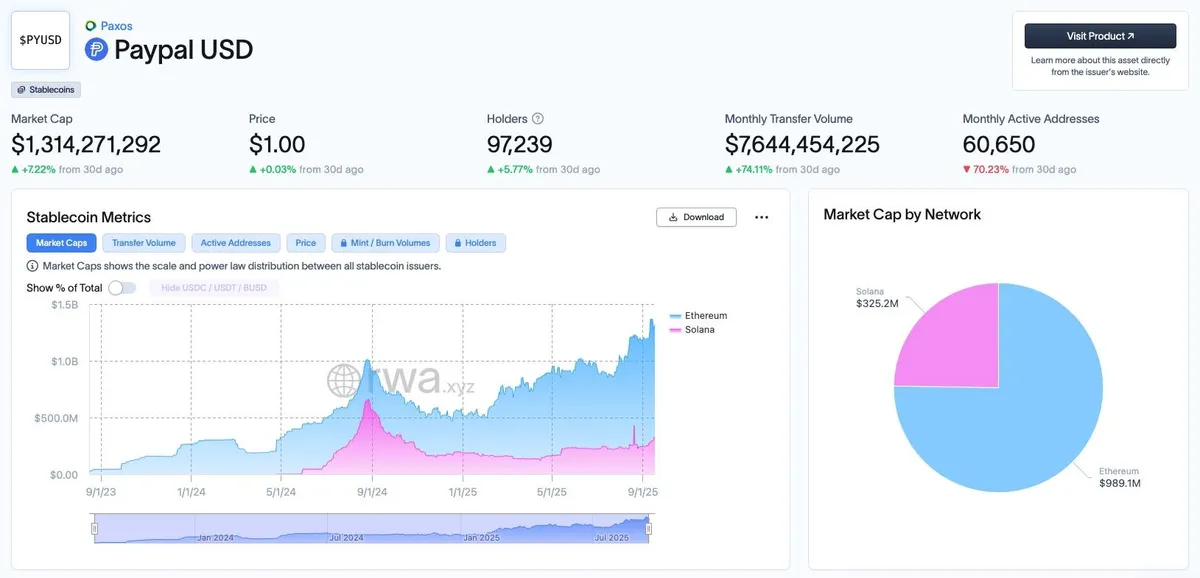

Since launching in 2023, PYUSD has shown strong growth—rising from a supply of $520 million at the start of 2025 to $1.3 billion today.

However, this remains small compared to Tether’s USDT and Circle’s USDC, both of which hold market caps in the tens of billions. Notably, USDT has already launched its own omnichain version, USDT0, on LayerZero, intensifying competition with PayPal.

Source : RWA.xyz

PayPal accelerates P2P and crypto payments

Beyond blockchain expansion, PayPal recently introduced PayPal Links, enabling users to create personalized payment links, even for recipients without a PayPal account. This service fueled nearly 10% YoY growth in Q2 2025 for its P2P business.

Soon, PayPal will integrate crypto directly into PayPal Links, supporting Bitcoin, Ethereum, PYUSD, and more across PayPal, Venmo, and compatible wallets worldwide. Importantly, these P2P payments will not trigger U.S. 1099-K tax reporting, lowering barriers for users.

Additionally, the company launched a “Pay with Crypto” service, allowing U.S. businesses to accept over 100 cryptocurrencies with automatic conversion into PYUSD.

Risks and challenges ahead

Despite promising growth, PYUSD faces two main risks:

- Regulation: Stablecoins are under heavy global scrutiny, and a permissionless version like PYUSD0 raises compliance questions.

- Technical risks: Complex cross-chain systems could be vulnerable to bugs or exploits, impacting user security and trust.

David Weber, Head of PayPal USD Ecosystem, stated:

“By partnering with LayerZero, we can expand PYUSD to new markets faster while maintaining compliance and seamless integration from day one.”

Disclaimer: The content above reflects the author’s personal views and does not represent any official position of Cobic News. The information provided is for informational purposes only and should not be considered as investment advice from Cobic News.