Over 3,000 Crypto Scams Busted In Australia

Australia Cracks Down On 14,000 Scams, 21% Linked To Crypto Assets

The Australian Securities and Investments Commission (ASIC) has revealed that it has cracked down on over 14,000 online scams since July 2023. Notably, more than 3,000 cases (21%) were directly linked to crypto assets, a sharp rise compared to last year when such scams made up only around 8% of detected cases.

Crypto-Related Scams Surge In Australia

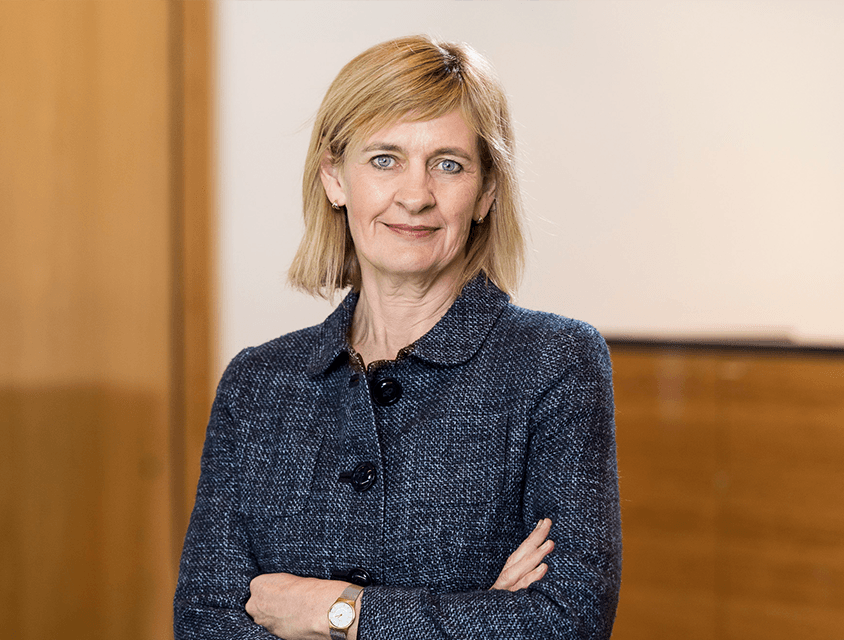

ASIC Deputy Chair Sarah Court emphasized that the regulator is intensifying its monitoring and enforcement efforts, particularly targeting fraudulent ads on social media platforms.

“This crackdown demonstrates that we are closely monitoring emerging trends and taking action to protect Australians,” Court stated.

According to the National Anti-Scam Centre, investment scams remain the most financially damaging. However, losses have significantly decreased, from USD 291 million in 2023 to just USD 73 million so far in 2025.

Ms. Sarah Court.

Scammers Deploy More Sophisticated Tactics

ASIC reports that fraudsters are increasingly using advanced technology, especially AI and deepfake tools, to deceive investors. Popular tactics include:

- Fake AI-powered trading bots.

- Phishing websites mimicking legitimate financial platforms.

- Fabricated news articles featuring deepfake images of celebrities to build trust.

These evolving methods make scams harder to detect for average investors.

Crypto ATMs Become A New Hotspot

Beyond cyberspace, scams are also targeting physical infrastructure. The Australian Transaction Reports and Analysis Centre (AUSTRAC), together with the Australian Federal Police (AFP), has launched a nationwide crackdown on crypto ATMs suspected of facilitating illegal activities, including pig butchering scams.

- Australia currently ranks third globally in crypto ATMs, with nearly 2,000 machines in operation.

- Over the past year, ReportCyber recorded 150 ATM-related scams, causing more than USD 2 million in losses.

- AUSTRAC has introduced tighter operating rules and stricter transaction limits for ATM providers.

Warnings For Investors

Authorities are urging investors to remain skeptical of any unrealistic profit promises, especially those received through messaging apps like WhatsApp or Telegram.

Disclaimer: The content above reflects the author’s personal views and does not represent any official position of Cobic News. The information provided is for informational purposes only and should not be considered as investment advice from Cobic News.