MicroStrategy Risks Dilution As Bitcoin Buys Grow

MicroStrategy Faces Rising Shareholder Dilution Risks As Bitcoin Purchases Continue

MicroStrategy announced today that it has purchased an additional $22 million worth of Bitcoin, reigniting concerns about growing shareholder dilution as the company increasingly relies on stock issuance to fund its BTC acquisitions.

The company is caught between two negative scenarios: if it stops buying Bitcoin, market confidence may collapse; but if it continues diluting shareholders to finance purchases, its stock may underperform the very asset it is accumulating.

Growing Concerns Over Shareholder Dilution

Compared to previous purchases, the $22 million buy is relatively small. However, recent reports highlight MicroStrategy’s urgent dilemma: it is increasingly funding acquisitions through shareholder dilution.

Since adopting its new policy, the company has issued 3,278,660 new shares, raising more than $1.1 billion to acquire Bitcoin. This has diluted shareholder ownership by about 1.2%, directly funding around 94% of its BTC purchases over the past month.

This trend undermines the incentive to invest in MSTR stock versus simply buying Bitcoin directly, raising the risk of a long-term confidence crisis.

Michael Saylor’s Policy Shift

Although Michael Saylor pledged in July not to dilute shareholder exposure to Bitcoin, he reversed course last month. The company now allows stock sales for reasons beyond BTC purchases and removed prior safeguards protecting investors.

Since then, MicroStrategy has acquired around 10,000 BTC since August, yet the company’s performance has significantly lagged behind Bitcoin itself. While it narrowly avoided a class-action lawsuit recently, the developments have been viewed as a major red flag for investor trust.

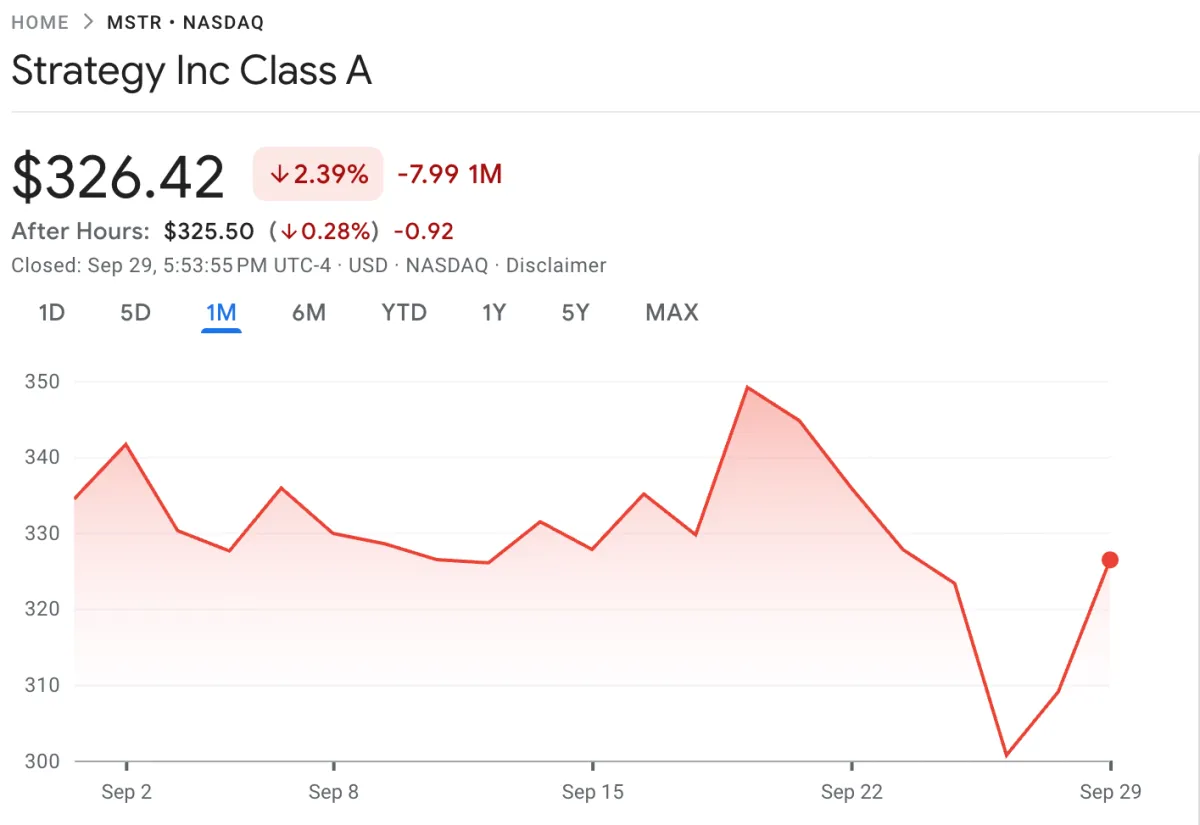

Sources: Google Finance

Sources: Google Finance

A Warning Sign For MicroStrategy

Shareholder dilution not only makes earnings volatile but also risks eroding market confidence. The company has a fiduciary duty to maximize shareholder value, which may conflict with its relentless Bitcoin accumulation strategy.

Like the “Red Queen” in Alice in Wonderland, MicroStrategy must keep running faster just to stay in place. If it stops buying Bitcoin, market sentiment could sour; but if it continues diluting equity to maintain its strategy, it risks triggering an even greater collapse.

There is no easy exit: Michael Saylor must both raise capital and ensure MicroStrategy outperforms Bitcoin itself – a daunting challenge in the current environment.

Disclaimer: The content above reflects the author’s personal views and does not represent any official position of Cobic News. The information provided is for informational purposes only and should not be considered as investment advice from Cobic News.