MEMEFI Skyrockets 200% After Binance Delisting

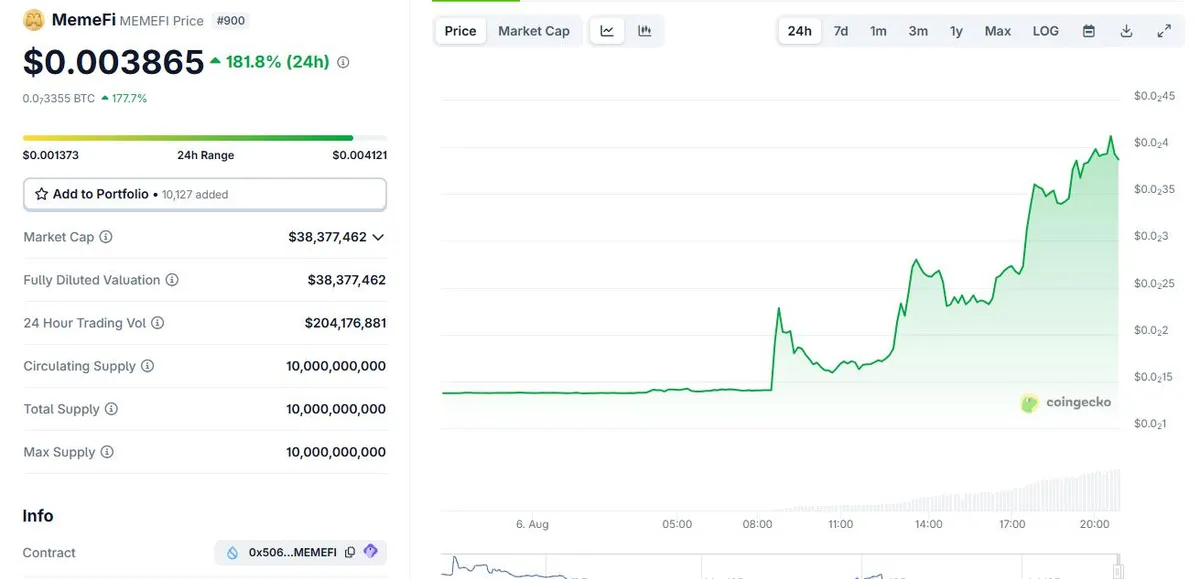

The abrupt removal of MEMEFI futures caused a wave of forced liquidations among short sellers, leading to intense buying pressure and a dramatic spike in price. Within just 24 hours, MEMEFI’s trading volume exploded past $209 million, reflecting a surge in both volatility and market interest.

Memefi : Coingecko

Short squeezes occur when traders who bet against a token are forced to buy it back rapidly, further driving up the price. In this case, MEMEFI’s sudden rally appears to be fueled almost entirely by this liquidation cascade rather than organic investor interest.

What’s concerning is the complete silence from the project’s development team. No official updates have been posted on MEMEFI’s channels since late May, raising serious concerns about transparency and the long-term viability of the token.

Crypto influencers were quick to comment on the situation, with some mocking the artificial nature of the price pump. Many warn that without strong fundamentals or clear communication from the team, MEMEFI’s spike could be short-lived and prone to a steep correction.