JPYC: Japan’s First Yen Stablecoin Nears Approval

Japan’s FSA To Approve First Yen-Pegged Stablecoin – JPYC

The Financial Services Agency of Japan (FSA) is expected to approve JPYC, the country’s first yen-pegged stablecoin, this fall. This marks a significant milestone in Japan’s financial digitalization strategy and could have a major impact on the Japanese government bond (JGB) market.

JPYC – Japan’s First Yen-Pegged Stablecoin

According to The Nihon Keizai Shimbun, Tokyo-based fintech firm JPYC will register as a money transfer business this month to lead the rollout. This will be the first time Japan allows the issuance of a fiat-backed stablecoin, opening a new era for the domestic stablecoin market.

JPYC is designed to maintain a fixed rate of 1 JPYC = 1 JPY, backed by highly liquid assets such as bank deposits and Japanese government bonds (JGBs). When individuals or businesses make deposits via bank transfer, JPYC tokens are issued directly to their digital wallets, ensuring safety and transparency under Japan’s strict regulatory framework.

Global Stablecoin Market Expansion

The global stablecoin market has surpassed $286 billion, largely dominated by USD-pegged assets like USDT and USDC. While USD stablecoins already circulate in Japan, JPYC will be the first stablecoin pegged to the yen, adding diversity and competition to the market.

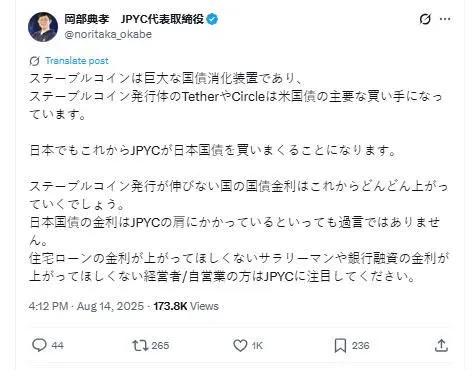

Potential Impact On Japan’s Bond Market

Mr. Okabe, a representative of JPYC, noted that a yen stablecoin could significantly boost demand for JGBs. He pointed out that in the U.S., major stablecoin issuers have become top buyers of U.S. Treasury bonds, using them as collateral for circulating tokens.

He predicted that a similar trend in Japan could increase demand for JGBs if JPYC gains wide adoption. He also warned that countries slow to develop stablecoins may face higher government bond yields, as they risk missing out on this new layer of demand.

USDC’s Entry Into Japan

Earlier this year, Circle launched USDC in Japan on March 26, after receiving FSA approval to list on SBI VC Trade. This was the first time the FSA allowed a foreign-issued stablecoin to be listed under its regulatory framework.

Circle has also announced plans to expand USDC listings to major Japanese exchanges such as Binance Japan, bitbank, and bitFlyer — platforms with a combined $25 million+ in daily trading volume and over 1.85 million monthly visits.