Investors Question U.S. CPI Over Estimated Data

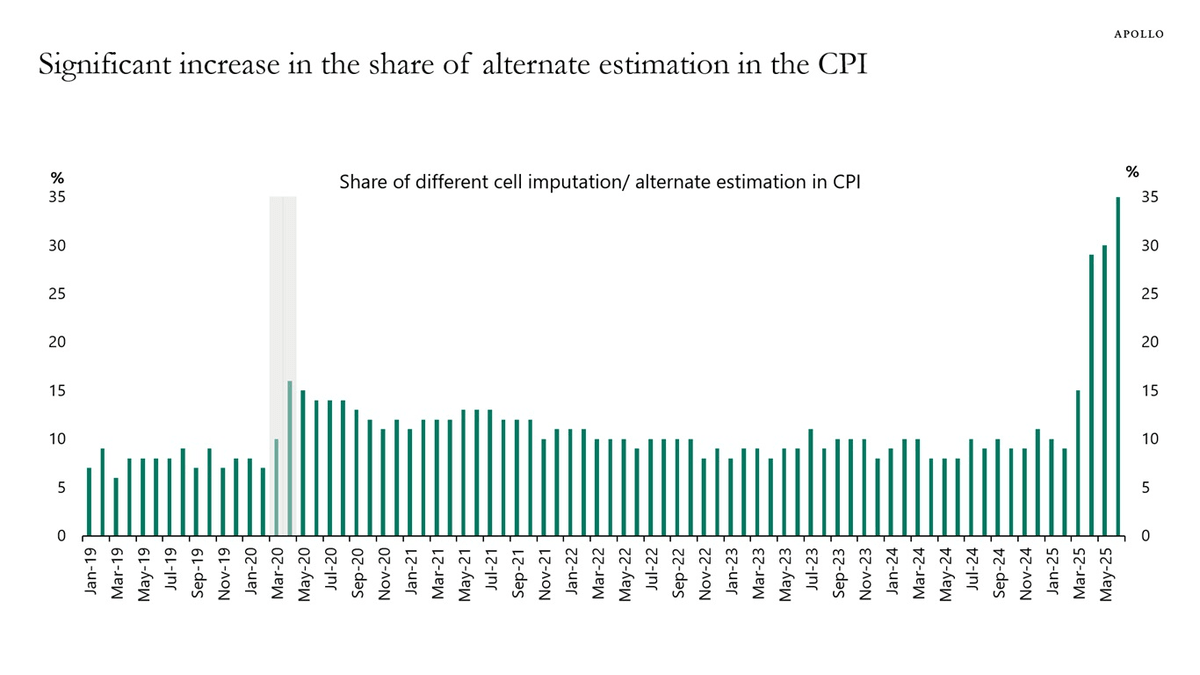

The reliability of the U.S. CPI (Consumer Price Index) is under heightened scrutiny after reports revealed that 36% of the August 2025 CPI was based on estimated data, not direct observations. This marks an increase from 32% in July and represents the highest level since the Bureau of Labor Statistics (BLS) began tracking the measure.

Traditionally, the Consumer Price Index is compiled from about 90,000 monthly price quotes across 200 categories of goods and services, collected by field agents in 75 metropolitan areas. When price data is missing, the BLS uses a statistical technique known as “cell imputation”, substituting data from related categories or similar items. Historically, only about 10% of the index relied on such estimated data.

Since the second half of 2024, however, the share of imputed or estimated data in the U.S. CPI has surged, staying above 30% throughout 2025. Analysts attribute the trend to challenges in data collection post-pandemic, shifting consumer patterns, and difficulties obtaining timely prices for volatile sectors such as housing and healthcare.

Sources: BLS, Apollo Chief Economist

Sources: BLS, Apollo Chief Economist

As the Fed’s key inflation gauge, the U.S. CPI plays a crucial role in shaping monetary policy and interest rate decisions. The growing reliance on estimated data risks widening the gap between official inflation reports and the price pressures households actually face, undermining the Fed’s credibility.

“Markets depend on the CPI for a clear view of inflation,” said one independent economist. “If over a third of the index is based on estimated data, it introduces noise and raises questions about whether it truly reflects consumer costs.”

Such doubts could heighten volatility, especially in the bond market, where investors may react sharply to U.S. CPI releases if they suspect the headline numbers understate real inflation.

Economists and investors are urging the BLS to provide greater transparency by disclosing which CPI components rely on estimated data and how those estimates are derived. While the BLS insists its methodology meets statistical standards, the unprecedented scale of estimated data has intensified calls for stronger disclosure to maintain trust in the Consumer Price Index, one of the world’s most closely watched inflation indicators.

Disclaimer: The content above reflects the author’s personal views and does not represent any official position of Cobic News. The information provided is for informational purposes only and should not be considered as investment advice from Cobic News.