Gold Nears Record High On USD Weakness & Geopolitics

Gold Nears Record High Amid U.S. Tariffs & Geopolitical Tensions

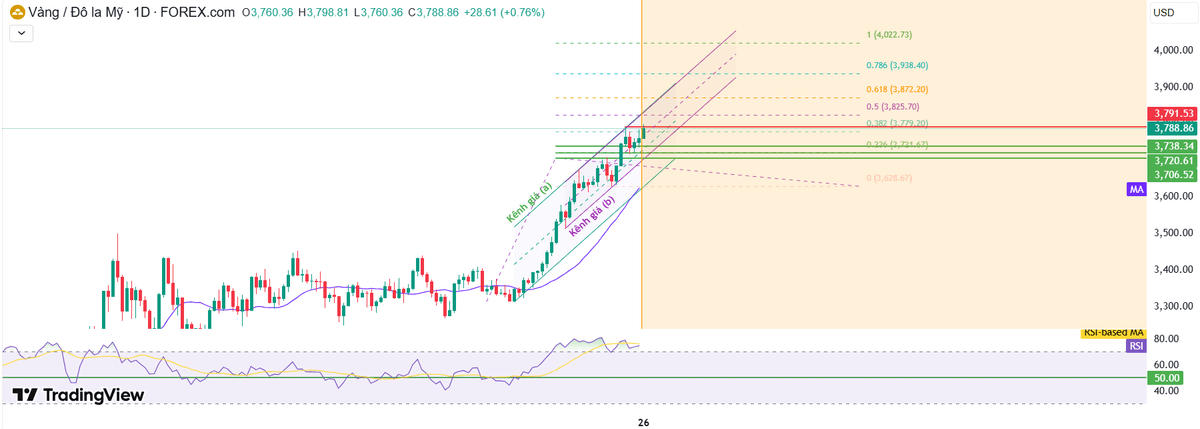

On September 26, spot gold prices broke above $3,760/oz and traded around $3,780, coming within a short distance of the all-time high of $3,791 set earlier in the week. This marked the sixth consecutive weekly gain for the precious metal, driven by safe-haven demand as new U.S. tariffs and escalating geopolitical risks rattled markets.

Sources: TradingView

Sources: TradingView

The August PCE inflation report showed little surprise: core PCE rose 0.2% month-over-month, in line with forecasts and lower than July’s 0.3% (later revised down). Year-over-year, core PCE held steady at 2.9%, still above the Fed’s 2% target. Headline PCE rose 0.3%, lifting the annual rate slightly from 2.6% to 2.7%.

These developments weakened the U.S. dollar, providing additional support for gold. However, the Fed’s monetary policy outlook remains cautious. After cutting rates by 25 basis points last week, several officials stressed that further easing would be premature given persistent price pressures, despite signs of a cooling labor market.

Meanwhile, U.S. data released Thursday – including stronger-than-expected Q2 GDP growth and a drop in jobless claims – has added complexity to the Fed’s decision-making. This could slow the pace of rate cuts, while gold continues to benefit from safe-haven flows amid political and trade risks.

Looking Ahead: Markets Await U.S. Jobs Data & Fed Guidance

From September 29 to October 4, global investors will focus on Fed officials’ remarks following September’s rate cut, with the spotlight on Friday’s Nonfarm Payrolls (NFP) report – a key indicator that could shape the Fed’s October policy decision.

Early in the week, the Eurozone will release data on economic sentiment, consumer confidence, and industrial climate. On Tuesday, Australia will decide its policy rate, Japan will publish a policy summary, China will release its manufacturing PMI, and Germany will announce CPI and retail sales. In the U.S., the Chicago PMI and JOLTs job openings will be released, alongside speeches from several regional Fed presidents.

On Wednesday, attention will turn to the ADP U.S. jobs report and the Eurozone’s harmonized CPI, key inputs for the ECB’s policy stance. Final PMIs for the Eurozone, Germany, France, and the U.K. will also be published. Remarks from the Fed’s Vice Chair are expected to highlight the delicate balance between inflation and employment.

The week’s climax will be Friday’s September NFP report. A weaker-than-expected result could boost expectations for another 25 bps rate cut in October, pushing the USD lower and supporting gold. Conversely, strong data may reinforce the greenback. Japan will also release its unemployment rate, adding further drivers for currency markets.

Overall, the coming week will feature a battle between economic data and policy guidance. NFP will be the decisive gauge for Fed expectations, while European and Japanese data highlight the divergence in global monetary policy. For investors, both gold and the U.S. dollar are set for volatility, while oil prices will react to inventory data and China’s PMI.

Disclaimer: The content above reflects the author’s personal views and does not represent any official position of Cobic News. The information provided is for informational purposes only and should not be considered as investment advice from Cobic News.