Gemini Space Station Q3 2025: Stock Falls 6%

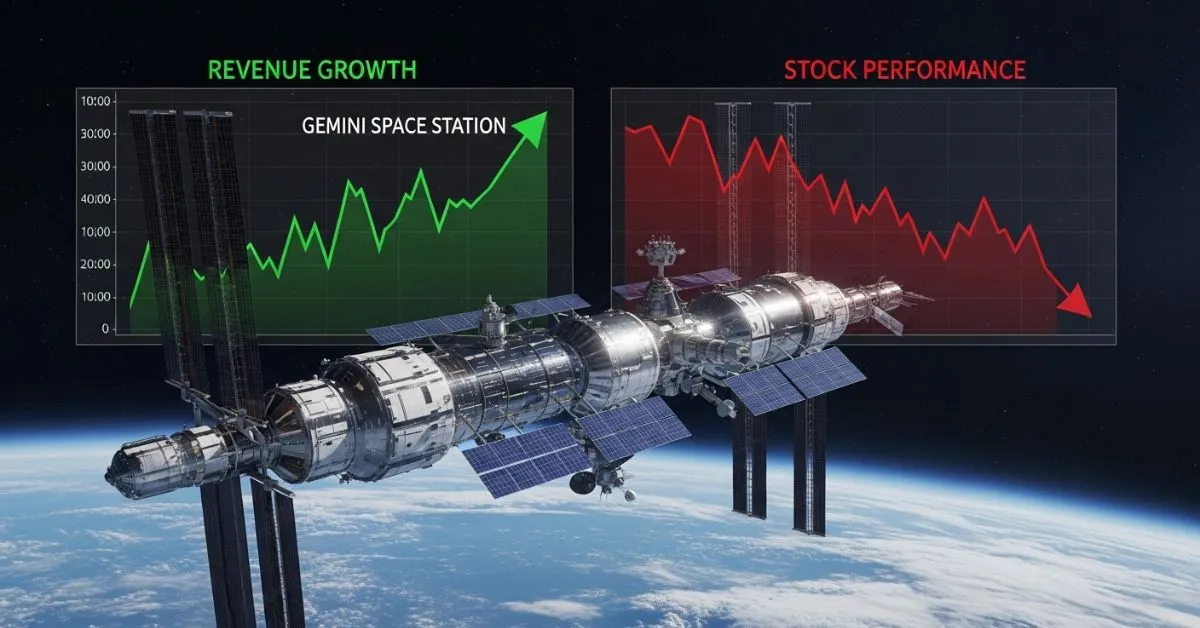

Gemini Space Station, a prominent player in the burgeoning commercial space sector, has released its highly anticipated Q3 2025 financial report. While the report highlighted robust revenue growth, it also revealed persistent losses, leading to a 6% decline in its stock price as investors voiced concerns over long-term profitability.

Q3 2025 Financial Highlights: Growth Despite Losses

For the third quarter of 2025, Gemini Space Station reported impressive revenue figures, reaching $150 million. This represents a significant year-over-year increase of 45%, underscoring the company's expanding market presence and successful service adoption within the commercial space industry. The growth was primarily driven by increased demand for its in-orbit research facilities, space tourism packages, and satellite deployment services.

Despite this strong top-line performance, the company continued to grapple with profitability challenges, posting a net loss of $25 million for the quarter. This figure, though within the company's projections for its high-growth phase, fueled investor apprehension regarding the path to sustainable earnings.

Stock Market Reaction And Profitability Concerns

Following the release of the Q3 report, Gemini Space Station's stock experienced a sharp downturn, falling by 6% in early trading. Analysts attributed this decline directly to the ongoing profitability concerns. Investors, while acknowledging the substantial revenue growth, appear to be prioritizing a clear timeline and strategy for achieving net positive income.

Key factors contributing to the losses include substantial investments in research and development for next-generation space technologies, the high operational costs associated with maintaining and expanding its orbital infrastructure, and aggressive market penetration strategies. The company has been pouring resources into developing new modules for its station and exploring new commercial applications, all of which incur significant upfront expenditures.

Strategic Outlook: Balancing Growth And Financial Health

During the earnings call, Gemini Space Station's CEO, Dr. Anya Sharma, reiterated the company's commitment to long-term value creation. "Our Q3 performance clearly demonstrates the immense demand for our unique offerings and the effectiveness of our expansion initiatives," Dr. Sharma stated. "We are keenly aware of our investors' desire for profitability, and we are actively implementing strategies to optimize our operational efficiency and diversify our revenue streams, including new partnerships and cost-reduction measures set to take effect in Q4 and early 2026."

The company outlined plans to enhance its modular design for more cost-effective expansion, explore more lucrative government contracts, and streamline its supply chain. Furthermore, Gemini Space Station is looking into commercializing some of its proprietary technologies to generate additional licensing revenue.

The Future Of Commercial Space: A High-Stakes Game

The financial results of Gemini Space Station reflect a broader trend within the commercial space industry: a period of intense investment and expansion, often at the expense of immediate profitability. While the market holds immense long-term potential, companies like Gemini must navigate the delicate balance between aggressive growth and demonstrating a clear path to financial sustainability. The next few quarters will be crucial in demonstrating the efficacy of their strategic adjustments and reassuring investors of their capacity to transition from a growth-focused startup to a profitable, established entity in the final frontier.

This report serves as a critical barometer for the health of the commercial space sector, indicating that while innovation and expansion are paramount, the market is increasingly demanding tangible returns and a clear trajectory towards profitability.

The content above reflects the author's personal views only and does not represent any official stance of Cobic News. The information provided is for reference purposes only and should not be considered investment advice from Cobic News.