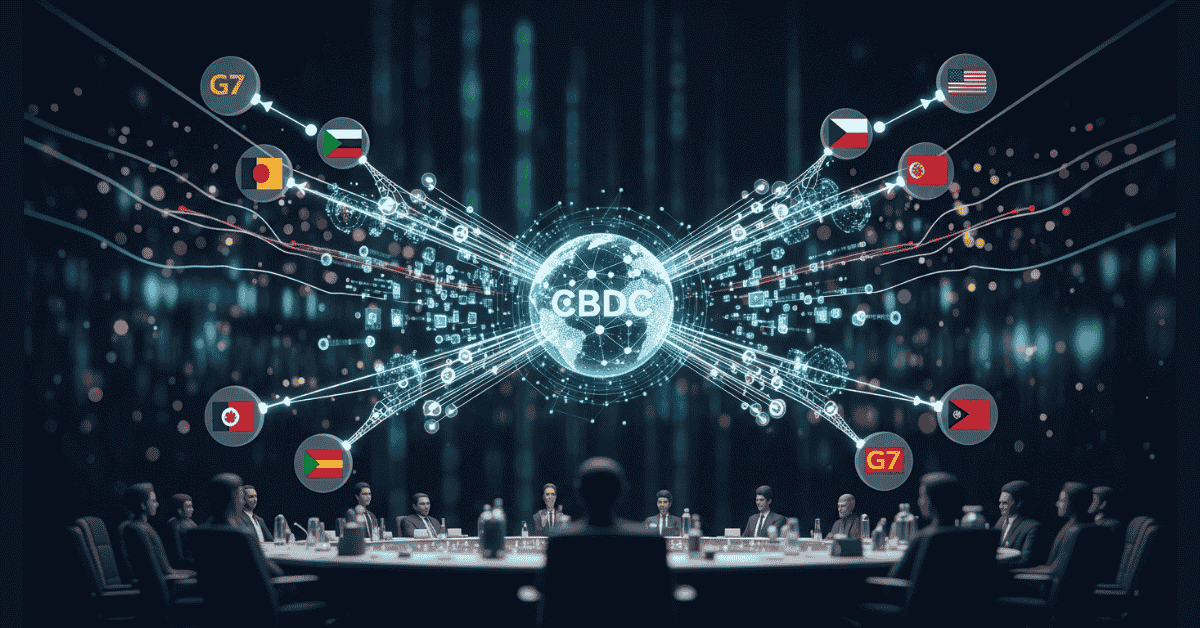

G7 Nations Discuss Crypto CBDC Interoperability

The future of global finance is increasingly digital, and at its forefront are Central Bank Digital Currencies (CBDCs). Recently, representatives from the influential G7 nations convened for high-level discussions, signaling a significant step towards shaping this future. The primary focus of these crucial talks? Establishing a robust interoperability framework for potential CBDCs, emphasizing the imperative for cross-border compatibility and shared standards to facilitate seamless global transactions.

The Dawn of Digital Fiat: Understanding CBDCs

Central Bank Digital Currencies represent a digital form of a country's fiat currency, issued and backed by its central bank. Unlike cryptocurrencies such as Bitcoin, CBDCs are centralized, stable, and aim to offer the benefits of digital payments—speed, efficiency, and potentially lower costs—without the volatility. They hold the promise of revolutionizing payment systems, enhancing financial inclusion, and providing central banks with new tools for monetary policy management.

G7 Takes the Lead: Why Interoperability Matters

The G7's engagement in this dialogue underscores the profound implications of fragmented digital currency ecosystems. Without a unified approach, individual CBDCs could create isolated digital islands, hindering international trade and increasing transaction complexities. Interoperability, therefore, isn't just a technical convenience; it's a strategic necessity for a globally connected economy.

Facilitating Seamless Cross-Border Transactions

One of the most compelling arguments for an interoperable CBDC framework is its potential to streamline cross-border payments. Current international payment systems are often slow, expensive, and opaque. An interoperable CBDC system could offer:

Instantaneous Settlement: Reducing transaction times from days to seconds.

Lower Costs: Cutting out intermediaries and associated fees.

Increased Transparency: Providing clearer audit trails for regulatory compliance.

Enhanced Financial Inclusion: Making global remittances more accessible and affordable.

Preventing Digital Fragmentation

Imagine a world where different nations' CBDCs cannot easily communicate or transact with each other. This scenario, known as digital fragmentation, would lead to inefficiencies, increased operational risks, and potentially undermine the stability of the global financial system. The G7's proactive stance aims to preempt such issues by laying down foundational principles for harmonious integration from the outset.

Key Pillars of an Interoperability Framework

Establishing an effective interoperability framework involves tackling complex technical, legal, and policy challenges. The G7 discussions likely delved into several critical areas:

Shared Technical Standards: Agreeing on common protocols, messaging formats, and application programming interfaces (APIs) to ensure different CBDC systems can 'talk' to each other.

Regulatory Alignment: Harmonizing international regulations concerning anti-money laundering (AML), combating the financing of terrorism (CFT), data privacy, and consumer protection across jurisdictions.

Governance Models: Developing a cooperative governance structure that can evolve with technological advancements and adapt to varying national priorities.

Data Exchange Protocols: Defining secure and efficient methods for exchanging transaction data while respecting privacy and sovereignty.

Global Implications and Future Outlook

While the G7 discussions emphasized the collaborative effort and growing international interest in digital fiat, it is crucial to note that no concrete launch dates for CBDCs were announced. This measured approach reflects the intricate nature of designing, implementing, and integrating national digital currencies into a global framework. The involvement of G7 nations—comprising some of the world's largest economies—lends significant weight to this initiative, suggesting that a unified international approach to CBDCs is not merely aspirational but increasingly becoming a practical imperative.

In conclusion

the G7's focused discussions on CBDC interoperability are a pivotal development in the evolution of digital finance. By prioritizing cross-border compatibility and shared standards, these nations are working towards a future where digital fiat can truly unlock its potential for seamless, efficient, and inclusive global transactions. The journey is complex, but the commitment signals a clear direction towards a more interconnected digital financial world.

Disclaimer: The content above reflects the author’s personal views and does not represent any official position of Cobic News. The information provided is for informational purposes only and should not be considered as investment advice from Cobic News.