FalconX Acquires 21Shares: Unifying Crypto ETP Power

FalconX Acquires 21Shares: A Major Shift In Digital Asset Markets

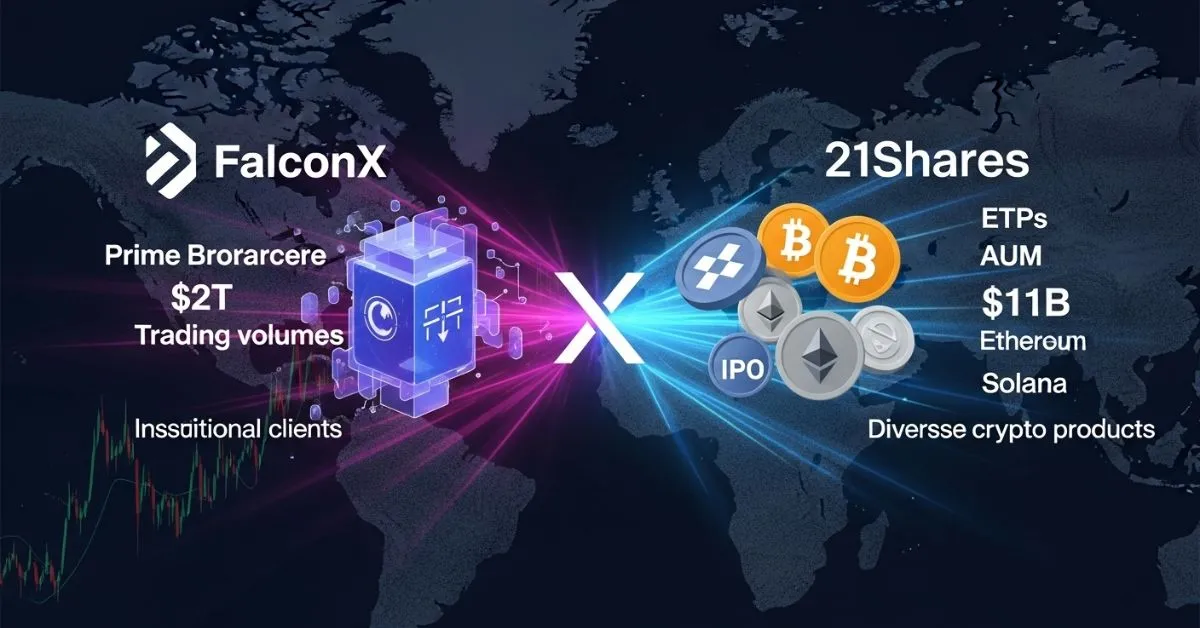

On October 22, 2025, FalconX, a leading institutional digital asset prime brokerage, announced a landmark acquisition: the takeover of 21Shares, the world's largest provider of cryptocurrency exchange-traded products (ETPs). This agreement signals a significant consolidation within the digital asset sector, aiming for deeper integration of listed markets with digital asset infrastructure, while strengthening FalconX's position in the global financial landscape.

Key Details Of The Transaction

The acquisition of 21Shares by FalconX marks one of the most significant transactions in the crypto ETP sector in recent years. While specific financial terms were not disclosed, the deal was financed through a combination of cash and equity. The merger is expected to close by the end of the year.

About 21Shares: A Crypto ETP Pioneer

Founded in 2018 by Hany Rashwan and Ophelia Snyder, 21Shares has established itself as a dominant issuer of physically backed crypto ETPs. As of September 30, 2025, the company manages over $11 billion in assets across approximately 55 listed products globally. Notable 21Shares products include:

- ARK 21Shares Bitcoin ETF (ARKB): With around $5 billion in assets, it was one of the first U.S. spot Bitcoin ETFs to launch in January 2024, marking a watershed moment for institutional crypto adoption.

- 21Shares Ethereum ETF (TETH): The firm's only other U.S.-listed product currently, holding approximately $40 million in assets.

- A broad lineup of crypto ETPs in Europe, offering exposure to tokens such as Solana, Cardano, and Chainlink.

21Shares has also filed to launch additional U.S. ETFs, including a proposed spot Solana ETF and a pair of crypto index funds.

About FalconX: A Digital Asset Prime Brokerage Powerhouse

FalconX, co-founded by Raghu Yarlagadda in 2018, has built a leading institutional digital asset prime brokerage, facilitating over $2 trillion in crypto transaction volume for more than 2,000 institutional clients. The company was valued at $8 billion in a 2022 venture funding round where it raised $150 million.

Strategic Rationale And Future Vision

This acquisition is part of FalconX's broader strategy to expand its operational scope beyond market-making services and liquidity provision, moving into asset management and market infrastructure. The primary goal of the merged entity is to develop sophisticated crypto funds, particularly those centered on derivatives and structured products, targeting a broader range of institutional investors seeking regulated and structured investment vehicles for crypto assets.

Crucially, 21Shares will remain independently managed under the FalconX umbrella, with Russell Barlow continuing as CEO of 21Shares. No changes are planned to the construction or investment objectives of existing 21Shares ETPs in Europe or U.S. ETFs.

Consolidation Trend In Crypto

The deal reinforces an accelerating trend of consolidation within the digital asset sector, where traditional finance institutions are increasingly acquiring or merging with digital asset firms. This convergence is driven by the need for scale, technological integration, and regulatory expertise, signaling a robust endorsement of crypto's long-term viability.

This is FalconX's third strategic transaction in 2025. Previously, FalconX acquired crypto derivatives platform Arbelos Markets in January 2025 and took a majority stake in Monarq Asset Management's parent company in June 2025. These moves demonstrate FalconX's ambition to evolve from a trading desk into a fully integrated financial institution for digital assets.

Notably, FalconX is also reportedly exploring an initial public offering (IPO) as early as 2025, reflecting a broader trend of crypto firms seeking public market access and enhanced legitimacy.

Conclusion

FalconX's acquisition of 21Shares is a pivotal development, reshaping the digital asset investment landscape. It combines 21Shares' robust expertise in ETP products with FalconX's powerful trading and liquidity infrastructure, paving the way for a new generation of regulated and sophisticated digital asset products. With this integration, both entities are well-positioned to drive the growth of the institutional crypto market and accelerate the convergence of traditional finance and digital assets.

The content above reflects the author's personal views only and does not represent any official stance of Cobic News. The information provided is for reference purposes only and should not be considered investment advice from Cobic News.