Dogecoin Builds Higher Lows, $0.221 Key Resistance

Current market structure

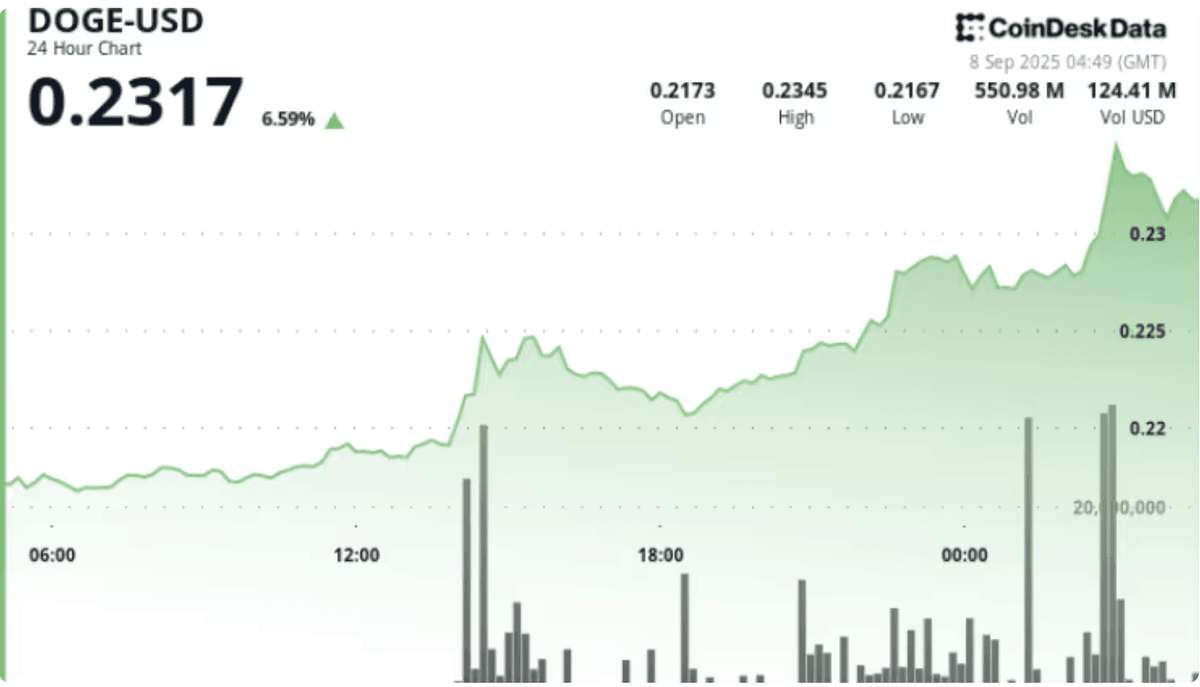

Source: data.coindesk.com

Dogecoin Crypto is consolidating within the $0.213–$0.221 range, reflecting a tug-of-war between bulls and bears. Buyers consistently defend the lows, forming higher troughs, while sellers are firmly capping price advances at resistance. This price action signals a bullish accumulation phase.

Strong support zone at $0.213–$0.214

The $0.213–$0.214 area has repeatedly acted as a cushion, attracting buyers whenever price dips.

• Holding above this zone keeps the bullish bias intact.

• A sustained break below could trigger a slide toward $0.210–$0.212, and in an extended move, $0.205.

Key resistance at $0.220–$0.221

The $0.221 mark is the major barrier bulls must overcome. Several attempts have failed, highlighting sellers’ strength.

• A breakout with strong volume above $0.221 would confirm bullish continuation, opening targets at $0.224–$0.226 and potentially $0.230.

• Failure to breach keeps DOGE locked in its narrow range, leaving traders in a wait-and-see mode.

Technical indicators

• RSI holds around 52–55, neutral but leaning bullish.

• MACD convergence suggests weakening bearish momentum, setting the stage for an upside push.

• Volume remains muted, implying traders are awaiting a catalyst before committing heavily.

Investor scenarios

• Bullish case: Break above $0.221 → target $0.224–$0.226 → extension toward $0.230.

• Bearish case: Rejection at $0.221 + breakdown of $0.213 → fall to $0.210–$0.212 → deeper decline to $0.205 possible.

• Range-bound: Continued sideways trading in $0.213–$0.221 until a breakout decides direction.

Conclusion

Dogecoin Crypto remains in a constructive short-term trend, with higher lows shaping a bullish bias. Yet the $0.221 resistance is the critical pivot. A confirmed breakout would propel DOGE higher, while failure may send it back to retest support. Monitoring volume near this level is essential for traders.

Disclaimer: This article is intended solely to provide information and market insights at the time of publication. We make no promises or guarantees regarding performance, returns, or the absolute accuracy of the data. All investment decisions are the sole responsibility of the reader.