CryptoQuant Warns: BTC Treasury Demand Weakening

Introduction

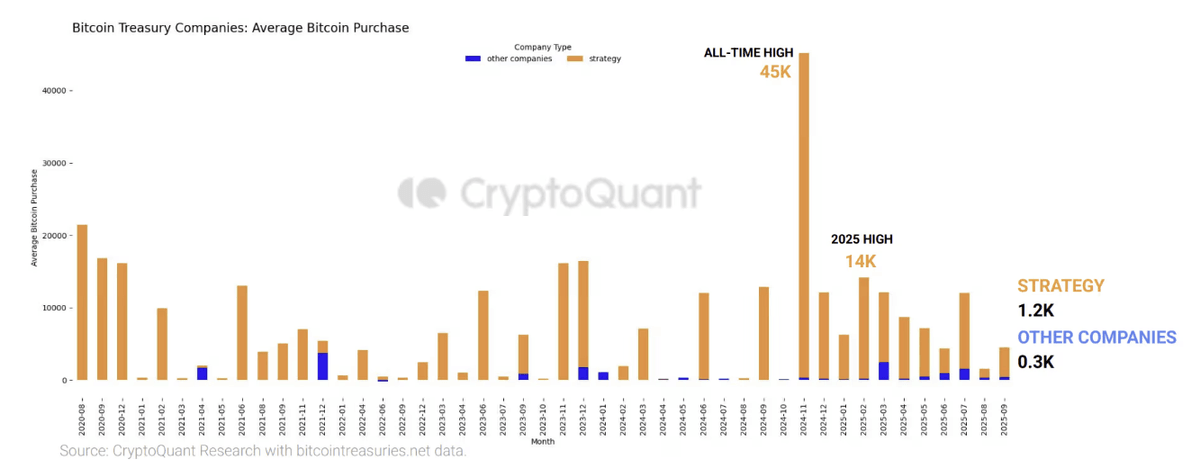

Fresh data from CryptoQuant is raising red flags in the crypto market. While Bitcoin treasury holdings have surged to record highs, actual demand from institutional buyers appears to be weakening, sparking concerns over BTC’s long-term momentum.

Record holdings but shrinking purchases

Source: cryptoquant.com

Bitcoin treasury holdings now exceed 840,000 BTC, the highest on record. Yet the average purchase size has collapsed. In August, Strategy averaged just 1,200 BTC per transaction, while other firms managed only 343 BTC—an 86% decline compared to early 2025 peaks.

This suggests growing caution or liquidity constraints among treasury institutions.

Treasury activity remains robust

Despite smaller transactions, treasury activity remains vibrant. In July and August alone, 28 new treasury firms were established, collectively adding more than 140,000 BTC. This shows institutional belief in Bitcoin persists, though capital deployment strategies are shifting.

Asia emerges as a key player

Asia is stepping up its role in treasury growth. Taiwan-based Sora Ventures recently launched a $1 billion BTC treasury fund, starting with an initial $200 million commitment. This highlights the region’s ambition to expand institutional participation despite global caution.

Implications for Bitcoin’s price

Source: cryptoquant.com

At present, Bitcoin is trading in the $110,000–$113,000 range, supported by expectations of Federal Reserve rate cuts and continued institutional inflows. However, if treasury demand keeps softening, BTC’s price momentum may not be sustainable over the longer term.

Conclusion

CryptoQuant’s findings deliver a mixed signal: while treasury networks are expanding, weaker purchase sizes reveal greater institutional caution. Retail and institutional investors alike should closely monitor these trends, as they may shape BTC’s price trajectory in the coming months.

Disclaimer: This article is intended solely to provide information and market insights at the time of publication. We make no promises or guarantees regarding performance, returns, or the absolute accuracy of the data. All investment decisions are the sole responsibility of the reader.