Crypto Surges: BTC Hits New Peak; ETH Is 3% From Record

Quick Highlights

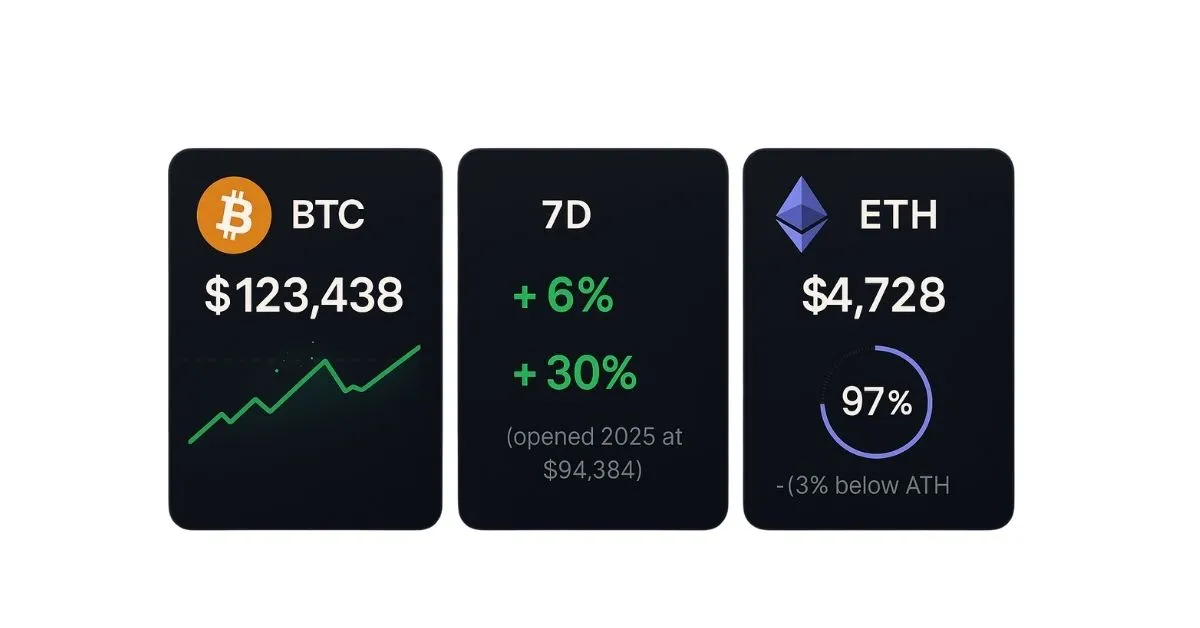

Bitcoin (BTC) set a new all-time high of $122,882 on the afternoon of Aug 14, 2025, surpassing the July record of $122,838.

At the time of writing, BTC was around $123,438 (+4.4%/24h); +6% over 7 days; +30% year-to-date (opened 2025 at $94,384).

Ethereum (ETH) jumped to $4,728, just ~3% away from its $4,878 record (Nov 2021).

U.S. stocks rallied together: the S&P 500 and Nasdaq hit new highs, and the Dow Jones neared its record—hopes of imminent Fed rate cuts continue to “pour fuel” on risk assets.

Why Is Bitcoin Surging?

Rate-cut expectations: Falling yields typically lift valuations of risk assets, including BTC and tech equities.

Flows/ETF narrative: After clearing $100,000 in Dec 2024, BTC has remained supported by institutional flows and growing interest in U.S. Bitcoin ETFs.

“Risk-on” sentiment: BTC maintains a positive correlation with tech stocks as equities set records, reinforcing investors’ risk appetite.

Ethereum: Within Reach And Upgraded Expectations

~3% from its record: The $4,878 (Nov 2021) level is within sight as BTC’s surge spills over to ETH.

Upgraded forecasts: Standard Chartered recently raised ETH targets—$7,500 (end-2025), $12,000 (2026), $18,000 (2027), and $25,000 (2028–2029). While only forecasts, they signal stronger long-term expectations.

Macro & Politics

Pressure on the Fed: Tough rhetoric from the White House toward Fed Chair Jerome Powell further fuels the easing scenario. Although the Fed is independent, markets are still pricing in near-term cuts.

Equities at records: With the S&P 500 and Nasdaq breaking to new highs, BTC—often a “risk-on” asset—benefits.

Risks To Watch

Pre/post-FOMC volatility: Inflation/rate comments could trigger short-term liquidity shocks.

High valuations & profit-taking: After setting an ATH, markets are prone to pullbacks.

Regulatory/macro risks: Policy changes, regulation, or geopolitical shifts can quickly flip sentiment.

Watchlist

Upcoming FOMC schedule & remarks from Fed officials.

Net flows into/out of Bitcoin ETFs and derivatives.

Key technical levels: $120,000 (new psychological support), $125,000–$130,000 (near-term resistance).

For ETH: watch $4,800–$4,900 (prior high) and on-chain/staking activity.

Disclaimer: The content above reflects the author’s personal views and does not represent any official position of Cobic News. The information provided is for informational purposes only and should not be considered as investment advice from Cobic News.