Crypto Staking: Ethereum and the Hidden Risks

1. The ETH Treasury Model: Profitable But Not Without Risk

Crypto ETH Treasuries: Profit or Peril?

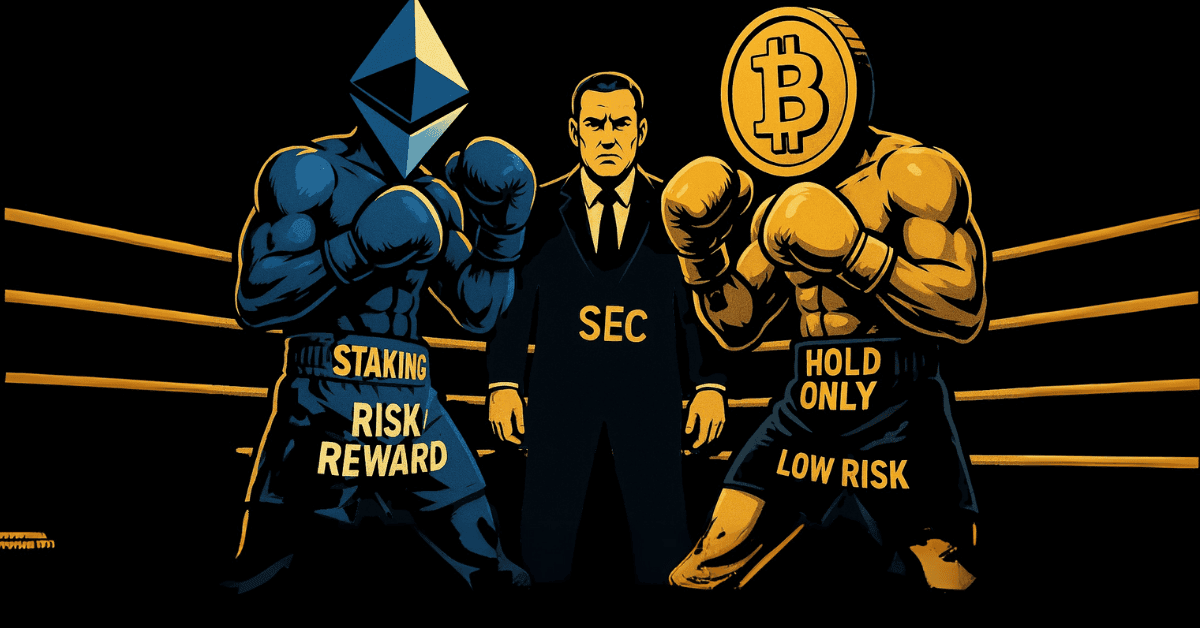

Unlike Bitcoin-focused firms such as Strategy (formerly MicroStrategy)—which simply hold BTC on their balance sheets—companies like BitMine Immersion, SharpLink Gaming, and Bit Digital are actively staking Ethereum to optimize yield.

According to Bernstein, while staking brings real cash flow and contributes to operating income, it also introduces key risks:

-

- Staking generates real yield → supports operational earnings

-

- However, staking contracts are not always liquid—unstaking ETH can take several days

-

- Advanced yield strategies like EigenLayer restaking or DeFi-based farming come with smart contract security risks

2. Comparison With Strategy's Bitcoin Treasury Model

Bernstein points out that Michael Saylor, founder of Strategy, chooses a much more conservative approach:

-

- No BTC staking

-

- No asset lending

-

- Focus on liquidity management and asset-liability balancing (ALM)

In contrast, ETH treasuries benefit from staking-related cash flow but require far more complex risk management strategies.

3. Ethereum Accumulation Is Rapidly Growing

As of July 2025:

-

- BitMine Immersion holds over $2 billion in ETH, aiming to own 5% of total ETH. supply

-

- SharpLink Gaming has surpassed $1.3 billion in ETH holdings

-

- In total, these companies hold 876,000 ETH

Bernstein states:

“The rise of the internet financial economy—driven by the digital dollar and tokenized assets—will. fuel strong demand for Ethereum, especially across Layer 2 networks like Coinbase Base and Robinhood Chain.”

4. ETH Price Outlook: Beyond $3,900?

-

- ETH has surged over 50% in the past month

-

- Arthur Hayes, founder of BitMEX, predicts ETH could hit $10,000 this year

-

- Tom Lee, Chairman of BitMine, even suggested a staggering price target of $60,000 per ETH, based on "replacement value"

However, it's important to note these firms stand to benefit directly from rising ETH prices, so their projections should be viewed with appropriate caution.

Conclusion: High Yield Comes With High Risk

ETH treasuries are ushering in a new era for Web3 companies—where they don’t just “hold,” but actively earn from the assets they own. Still, risks related to liquidity and smart contracts must be carefully managed, especially as more firms explore staking as a core treasury strategy.